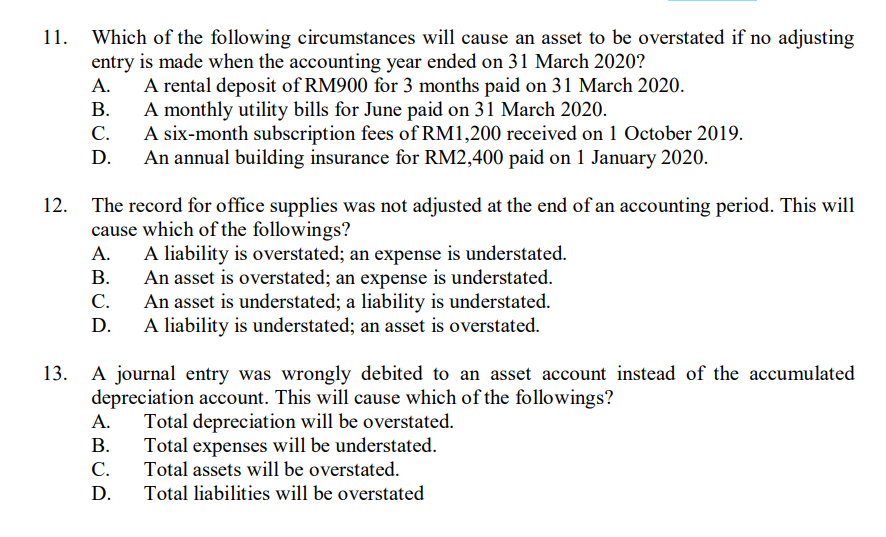

Which of the following circumstances will cause an asset to be overstated if no adjusting entry is made when the accounting year ended on 31 March 2020? А. В. A rental deposit of RM900 for 3 months paid on 31 March 2020. A monthly utility bills for June paid on 31 March 2020. С. A six-month subscription fees of RM1,200 received on 1 October 2019. An annual building insurance for RM2,400 paid on 1 January 2020. D.

Which of the following circumstances will cause an asset to be overstated if no adjusting entry is made when the accounting year ended on 31 March 2020? А. В. A rental deposit of RM900 for 3 months paid on 31 March 2020. A monthly utility bills for June paid on 31 March 2020. С. A six-month subscription fees of RM1,200 received on 1 October 2019. An annual building insurance for RM2,400 paid on 1 January 2020. D.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter3: Review Of A Company's Accounting System

Section: Chapter Questions

Problem 10P: Worksheet Victoria Company has the following account balances on December 31, 2019, prior to any...

Related questions

Question

100%

Transcribed Image Text:Which of the following circumstances will cause an asset to be overstated if no adjusting

entry is made when the accounting year ended on 31 March 2020?

A rental deposit of RM900 for 3 months paid on 31 March 2020.

A monthly utility bills for June paid on 31 March 2020.

A six-month subscription fees of RM1,200 received on 1 October 2019.

An annual building insurance for RM2,400 paid on 1 January 2020.

11.

А.

В.

С.

The record for office supplies was not adjusted at the end of an accounting period. This will

cause which of the followings?

A liability is overstated; an expense is understated.

An asset is overstated; an expense is understated.

An asset is understated; a liability is understated.

A liability is understated; an asset is overstated.

12.

А.

В.

С.

D.

A journal entry was wrongly debited to an asset account instead of the accumulated

depreciation account. This will cause which of the followings?

Total depreciation will be overstated.

Total expenses will be understated.

Total assets will be overstated.

13.

А.

В.

С.

D.

Total liabilities will be overstated

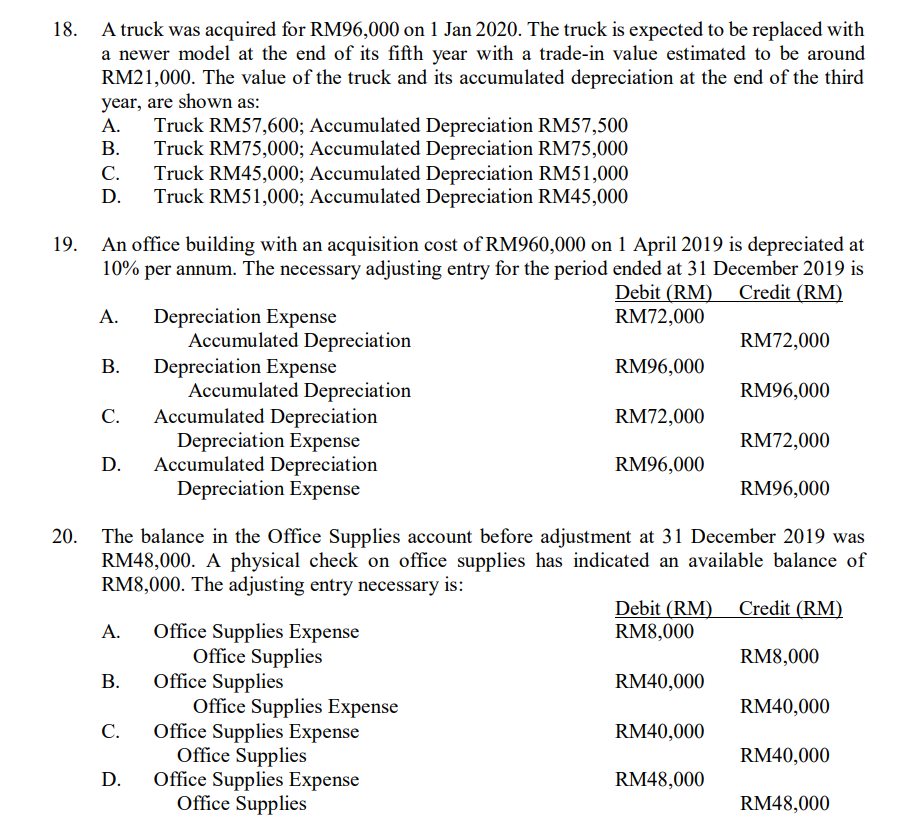

Transcribed Image Text:A truck was acquired for RM96,000 on 1 Jan 2020. The truck is expected to be replaced with

a newer model at the end of its fifth year with a trade-in value estimated to be around

RM21,000. The value of the truck and its accumulated depreciation at the end of the third

year, are shown as:

A.

Truck RM57,600; Accumulated Depreciation RM57,500

Truck RM75,000; Accumulated Depreciation RM75,000

Truck RM45,000; Accumulated Depreciation RM51,000

D.

В.

С.

Truck RM51,000; Accumulated Depreciation RM45,000

An office building with an acquisition cost of RM960,000 on 1 April 2019 is depreciated at

10% per annum. The necessary adjusting entry for the period ended at 31 December 2019 is

Credit (RM)

19.

Debit (RM)

RM72,000

Depreciation Expense

Accumulated Depreciation

Depreciation Expense

Accumulated Depreciation

Accumulated Depreciation

Depreciation Expense

Accumulated Depreciation

Depreciation Expense

А.

RM72,000

В.

RM96,000

RM96,000

C.

RM72,000

RM72,000

D.

RM96,000

RM96,000

The balance in the Office Supplies account before adjustment at 31 December 2019 was

RM48,000. A physical check on office supplies has indicated an available balance of

RM8,000. The adjusting entry necessary is:

Debit (RM)

RM8,000

Credit (RM)

Office Supplies Expense

Office Supplies

Office Supplies

Office Supplies Expense

Office Supplies Expense

Office Supplies

Office Supplies Expense

Office Supplies

A.

RM8,000

В.

RM40,000

RM40,000

С.

RM40,000

RM40,000

D.

RM48,000

RM48,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning