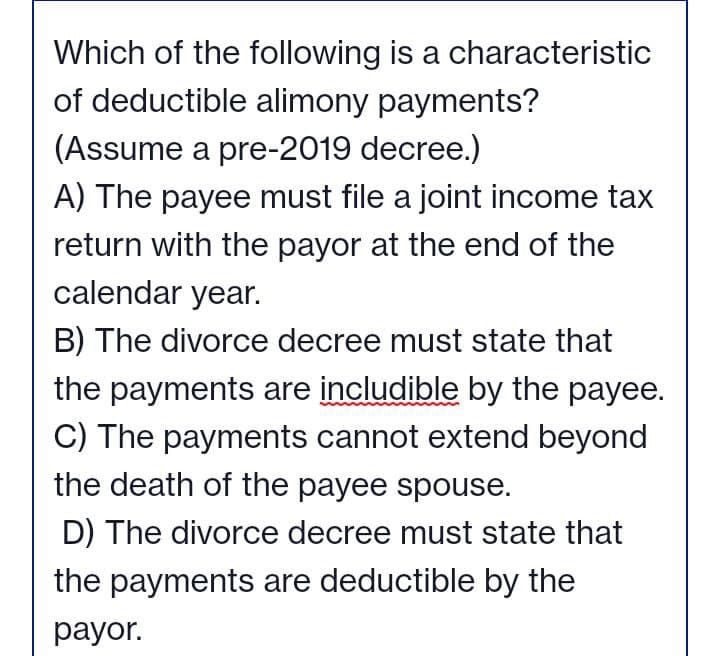

Which of the following is a characteristic of deductible alimony payments? (Assume a pre-2019 decree.) A) The payee must file a joint income tax return with the payor at the end of the calendar year. B) The divorce decree must state that the payments are includible by the payee C) The payments cannot extend beyond the death of the payee spouse. D) The divorce decree must state that the payments are deductible by the payor.

Which of the following is a characteristic of deductible alimony payments? (Assume a pre-2019 decree.) A) The payee must file a joint income tax return with the payor at the end of the calendar year. B) The divorce decree must state that the payments are includible by the payee C) The payments cannot extend beyond the death of the payee spouse. D) The divorce decree must state that the payments are deductible by the payor.

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

Please answer with reason why the option is correct why the other options are incorrect

Transcribed Image Text:Which of the following is a characteristic

of deductible alimony payments?

(Assume a pre-2019 decree.)

A) The payee must file a joint income tax

return with the payor at the end of the

calendar year.

B) The divorce decree must state that

the payments are includible by the payee.

C) The payments cannot extend beyond

the death of the payee spouse.

D) The divorce decree must state that

the payments are deductible by the

payor.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT