Which of the following is a correct description of the crowding-out effect of deficit spending? The selling of government bonds leads to higher interest rates, thereby reducing private investment. The buying of government bonds leads to lower interest rates, thereby reducing private investment. The selling of government bonds leads to lower interest rates, thereby reducing private investment. The buying of government bonds leads to higher interest rates, thereby reducing private investment. The following graph shows the demand for private investment. Show the crowding-out effect of deficit spending on the demand for investment by moving the dot, dragging the investment demand (ID) Soth. Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back t original position, just drag it a little farther. INTEREST RATE INVESTMENT ID ID Point Along ID

Which of the following is a correct description of the crowding-out effect of deficit spending? The selling of government bonds leads to higher interest rates, thereby reducing private investment. The buying of government bonds leads to lower interest rates, thereby reducing private investment. The selling of government bonds leads to lower interest rates, thereby reducing private investment. The buying of government bonds leads to higher interest rates, thereby reducing private investment. The following graph shows the demand for private investment. Show the crowding-out effect of deficit spending on the demand for investment by moving the dot, dragging the investment demand (ID) Soth. Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back t original position, just drag it a little farther. INTEREST RATE INVESTMENT ID ID Point Along ID

Chapter13: Federal Deficits, Surpluses, And The National Debt

Section: Chapter Questions

Problem 13SQ

Related questions

Question

pls check the first question and do the graph. very confused with the graph part

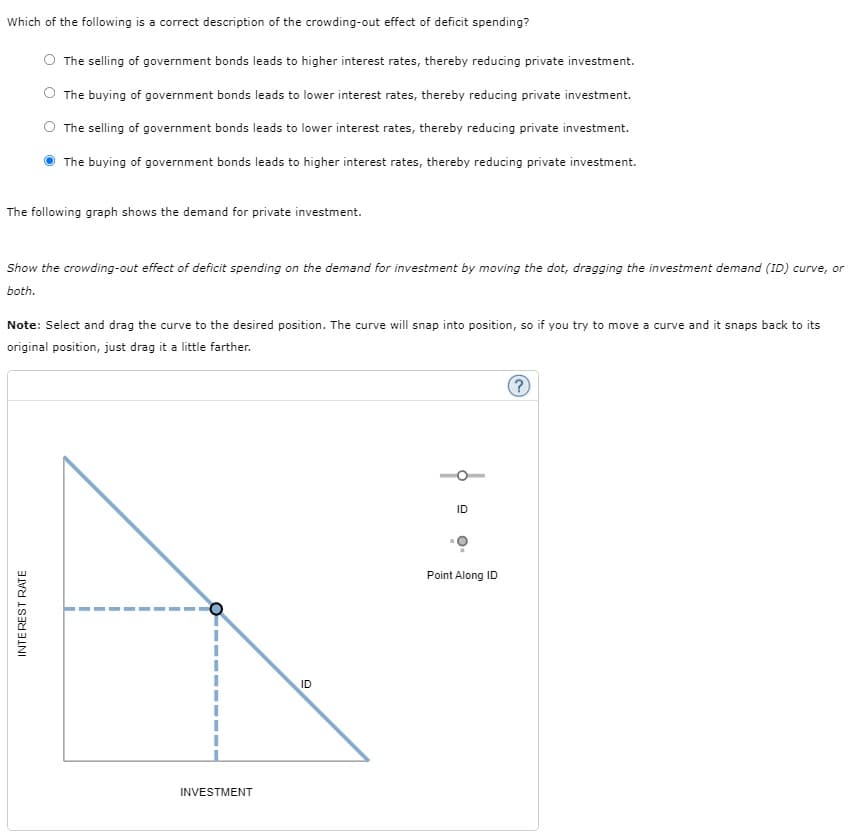

Transcribed Image Text:Which of the following is a correct description of the crowding-out effect of deficit spending?

The selling of government bonds leads to higher interest rates, thereby reducing private investment.

The buying of government bonds leads to lower interest rates, thereby reducing private investment.

The selling of government bonds leads to lower interest rates, thereby reducing private investment.

The buying of government bonds leads to higher interest rates, thereby reducing private investment.

The following graph shows the demand for private investment.

Show the crowding-out effect of deficit spending on the demand for investment by moving the dot, dragging the investment demand (ID) curve, or

both.

Note: Select and drag the curve to the desired position. The curve will snap into position, so if you try to move a curve and it snaps back to its

original position, just drag it a little farther.

INTEREST RATE

INVESTMENT

ID

ID

Point Along ID

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning