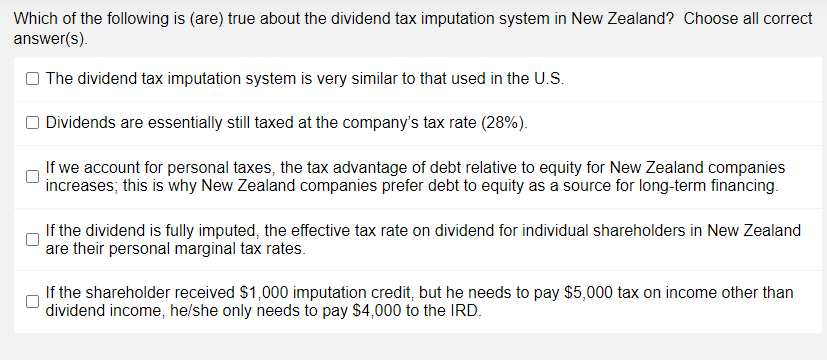

Which of the following is (are) true about the dividend tax imputation system in New Zealand? Choose all correct answer(s). O The dividend tax imputation system is very similar to that used in the U.S. O Dividends are essentially still taxed at the company's tax rate (28%). If we account for personal taxes, the tax advantage of debt relative to equity for New Zealand companies increases; this is why New Zealand companies prefer debt to equity as a source for long-term financing. If the dividend is fully imputed, the effective tax rate on dividend for individual shareholders in New Zealand are their personal marginal tax rates. If the shareholder received $1,000 imputation credit, but he needs to pay $5,000 tax on income other than dividend income, he/she only needs to pay $4,000 to the IRD.

Which of the following is (are) true about the dividend tax imputation system in New Zealand? Choose all correct answer(s). O The dividend tax imputation system is very similar to that used in the U.S. O Dividends are essentially still taxed at the company's tax rate (28%). If we account for personal taxes, the tax advantage of debt relative to equity for New Zealand companies increases; this is why New Zealand companies prefer debt to equity as a source for long-term financing. If the dividend is fully imputed, the effective tax rate on dividend for individual shareholders in New Zealand are their personal marginal tax rates. If the shareholder received $1,000 imputation credit, but he needs to pay $5,000 tax on income other than dividend income, he/she only needs to pay $4,000 to the IRD.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter15: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 2Q: How would each of the following changes tend to affect aggregate payout ratios (that is, the average...

Related questions

Question

Transcribed Image Text:Which of the following is (are) true about the dividend tax imputation system in New Zealand? Choose all correct

answer(s).

The dividend tax imputation system is very similar to that used in the U.Ss.

O Dividends are essentially still taxed at the company's tax rate (28%).

If we account for personal taxes, the tax advantage of debt relative to equity for New Zealand companies

increases; this is why New Zealand companies prefer debt to equity as a source for long-term financing.

If the dividend is fully imputed, the effective tax rate on dividend for individual shareholders in New Zealand

are their personal marginal tax rates.

If the shareholder received $1,000 imputation credit, but he needs to pay $5,000 tax on income other than

dividend income, he/she only needs to pay $4,000 to the IRD.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning