According to OCED , a number of countries are considered "Tax Havens" which contribute to tax revenue lost to other countrie Which one of the following country/region is NOT listed among the top 10 list? O a. Hong Kong O b. United States O c. Switzerland O d. United Kingdom Under the US tax code, when an American company merged with a foreign entity (i.e., Ireland), the global income from this newly merged company is no longer subject to US corporate tax. What is the processed called?

According to OCED , a number of countries are considered "Tax Havens" which contribute to tax revenue lost to other countrie Which one of the following country/region is NOT listed among the top 10 list? O a. Hong Kong O b. United States O c. Switzerland O d. United Kingdom Under the US tax code, when an American company merged with a foreign entity (i.e., Ireland), the global income from this newly merged company is no longer subject to US corporate tax. What is the processed called?

Chapter9: Taxation Of International Transactions

Section: Chapter Questions

Problem 30P

Related questions

Question

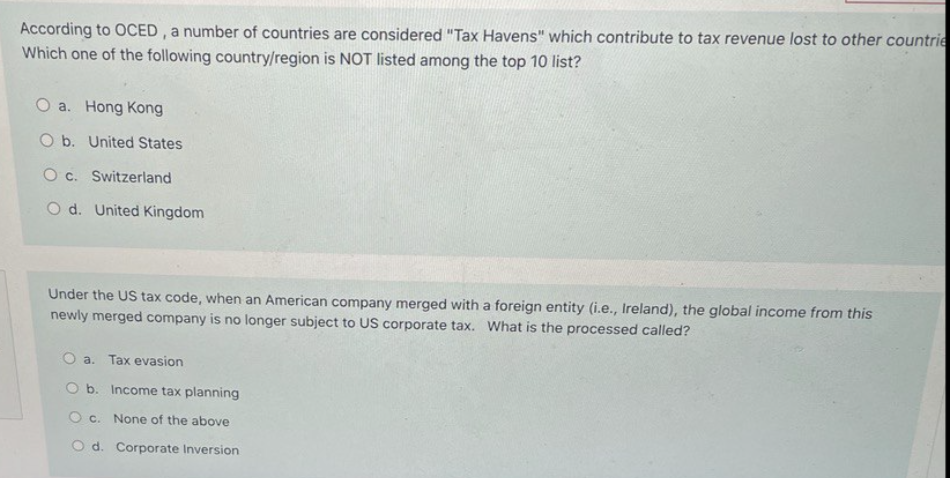

Transcribed Image Text:According to OCED , a number of countries are considered "Tax Havens" which contribute to tax revenue lost to other countrie

Which one of the following country/region is NOT listed among the top 10 list?

O a. Hong Kong

O b. United States

O c. Switzerland

O d. United Kingdom

Under the US tax code, when an American company merged with a foreign entity (i.e., Ireland), the global income from this

newly merged company is no longer subject to US corporate tax. What is the processed called?

a. Tax evasion

O b. Income tax planning

O c. None of the above

O d. Corporate Inversion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you