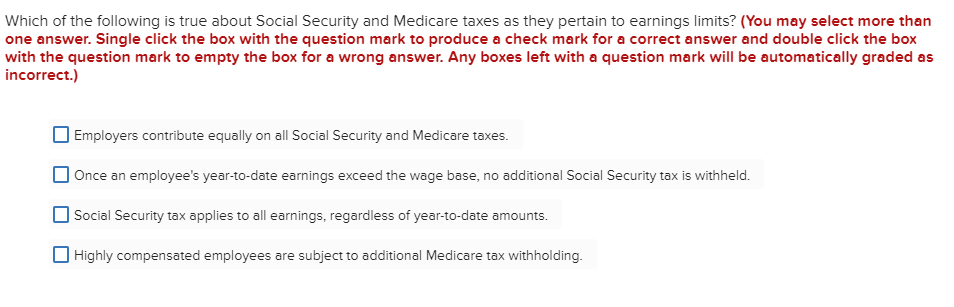

Which of the following is true about Social Security and Medicare taxes as they pertain to earnings limits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Employers contribute equally on all Social Security and Medicare taxes. Once an employee's year-to-date earnings exceed the wage base, no additional Social Security tax is withheld. Social Security tax applies to all earnings, regardless of year-to-date amounts. Highly compensated employees are subject to additional Medicare tax withholding.

Which of the following is true about Social Security and Medicare taxes as they pertain to earnings limits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Employers contribute equally on all Social Security and Medicare taxes. Once an employee's year-to-date earnings exceed the wage base, no additional Social Security tax is withheld. Social Security tax applies to all earnings, regardless of year-to-date amounts. Highly compensated employees are subject to additional Medicare tax withholding.

Chapter9: Payroll, Estimated Payments, And Retirement Plans

Section: Chapter Questions

Problem 9MCQ

Related questions

Question

I humble request plz I need fast answer

Transcribed Image Text:Which of the following is true about Social Security and Medicare taxes as they pertain to earnings limits? (You may select more than

one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box

with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as

incorrect.)

Employers contribute equally on all Social Security and Medicare taxes.

Once an employee's year-to-date earnings exceed the wage base, no additional Social Security tax is withheld.

Social Security tax applies to all earnings, regardless of year-to-date amounts.

Highly compensated employees are subject to additional Medicare tax withholding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you