Which of the following is true about the partnership's allocation of loss?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 29P

Related questions

Question

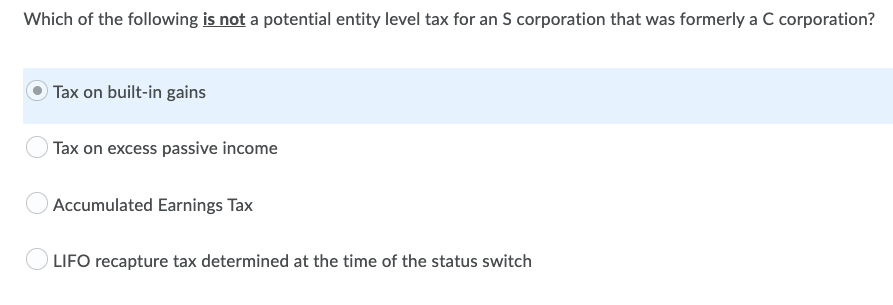

Transcribed Image Text:Which of the following is not a potential entity level tax for an S corporation that was formerly a C corporation?

Tax on built-in gains

Tax on excess passive income

Accumulated Earnings Tax

LIFO recapture tax determined at the time of the status switch

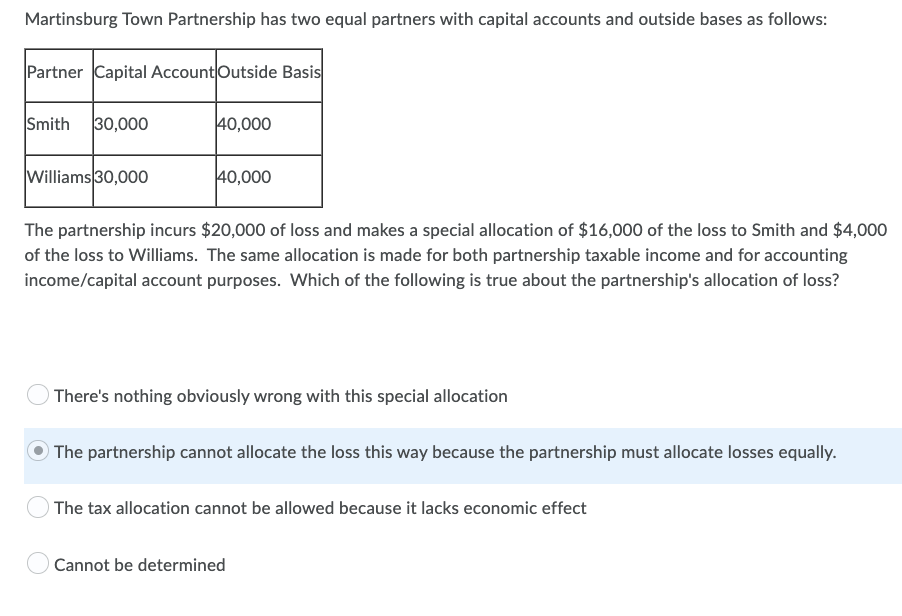

Transcribed Image Text:Martinsburg Town Partnership has two equal partners with capital accounts and outside bases as follows:

Partner Capital Account Outside Basis

Smith 30,000

40,000

Williams 30,000

40,000

The partnership incurs $20,000 of loss and makes a special allocation of $16,000 of the loss to Smith and $4,000

of the loss to Williams. The same allocation is made for both partnership taxable income and for accounting

income/capital account purposes. Which of the following is true about the partnership's allocation of loss?

There's nothing obviously wrong with this special allocation

The partnership cannot allocate the loss this way because the partnership must allocate losses equally.

The tax allocation cannot be allowed because it lacks economic effect

Cannot be determined

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT