The following income received by officials and employees in the public sector are not subject to income Eax and withholding tax on compensation, except The excess of the 13th month pay and other benefits paid or accrued during the year over P90,000 Representation and transportation allowance (RATA) granted under the General Appropriations Act Personnel Economic Relief Allowance (PERA) granted to government personnel Monetized value of leave credits paid to government officials and employees

The following income received by officials and employees in the public sector are not subject to income Eax and withholding tax on compensation, except The excess of the 13th month pay and other benefits paid or accrued during the year over P90,000 Representation and transportation allowance (RATA) granted under the General Appropriations Act Personnel Economic Relief Allowance (PERA) granted to government personnel Monetized value of leave credits paid to government officials and employees

Chapter9: Deductions: Employee And Self-employed-related Expenses

Section: Chapter Questions

Problem 17DQ

Related questions

Question

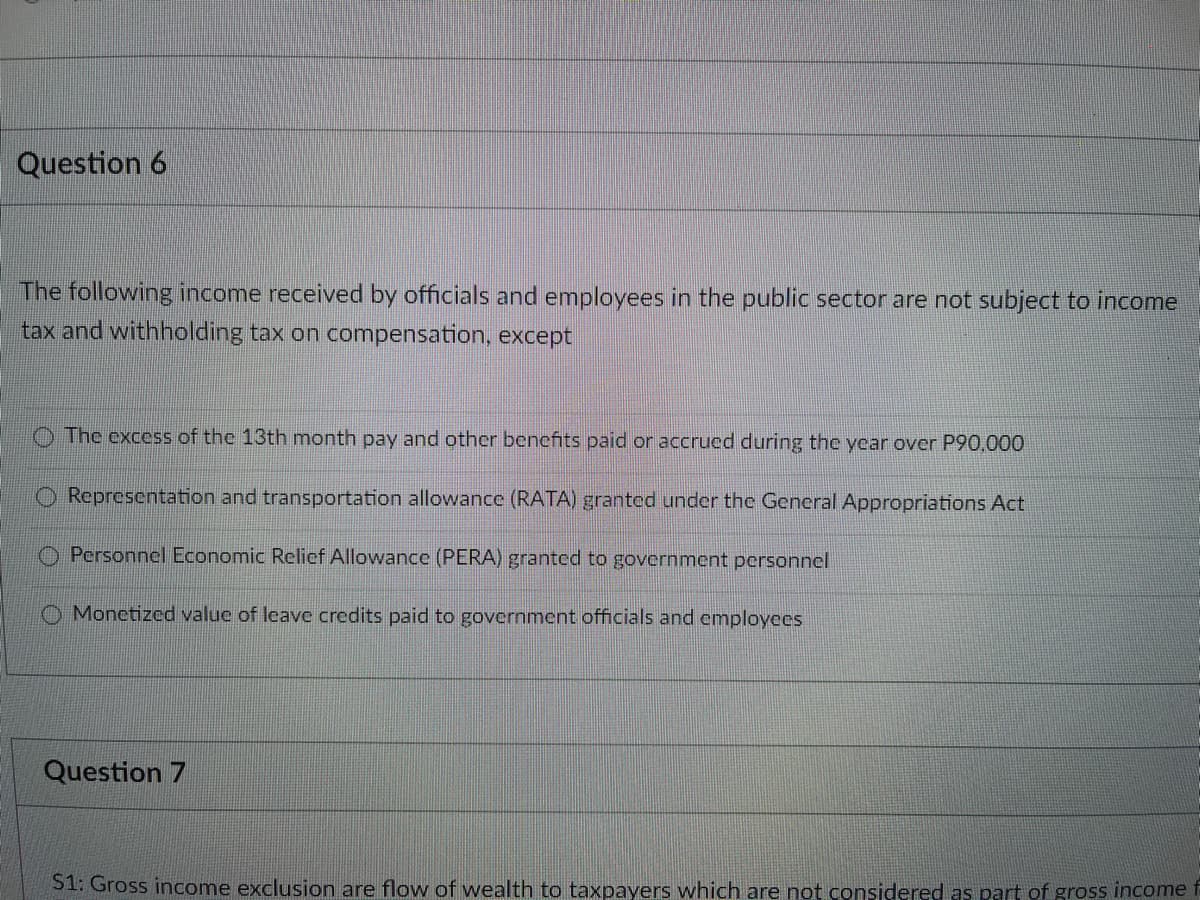

Transcribed Image Text:Question 6

The following income received by officials and employees in the public sector are not subject to income

tax and withholding tax on compensation, except

The excess of the 13th month pay and other benefits paid or accrued during the year over P90,000

Representation and transportation allowance (RATA) granted under the General Appropriations Act

Personnel Economic Relief Allowance (PERA) granted to government personnel

Monetized value of leave credits paid to government officials and employees

Question 7

S1: Gross income exclusion are flow of wealth to taxpayers which are not considered as part of gross income f

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning