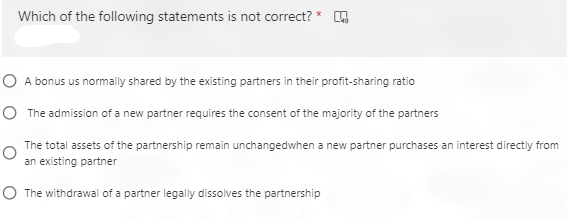

Which of the following statements is not correct? * O A bonus us normally shared by the existing partners in their profit-sharing ratio O The admission of a new partner requires the consent of the majority of the partners The total assets of the partnership remain unchangedwhen a new partner purchases an interest directly from an existing partner O The withdrawal of a partner legally dissolves the partnership

Which of the following statements is not correct? * O A bonus us normally shared by the existing partners in their profit-sharing ratio O The admission of a new partner requires the consent of the majority of the partners The total assets of the partnership remain unchangedwhen a new partner purchases an interest directly from an existing partner O The withdrawal of a partner legally dissolves the partnership

Chapter10: Partnership Taxation

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

question 34

choose the correct answer from the choices

Transcribed Image Text:Which of the following statements is not correct? *

O A bonus us normally shared by the existing partners in their profit-sharing ratio

O The admission of a new partner requires the consent of the majority of the partners

The total assets of the partnership remain unchangedwhen a new partner purchases an interest directly from

an existing partner

O The withdrawal of a partner legally dissolves the partnership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you