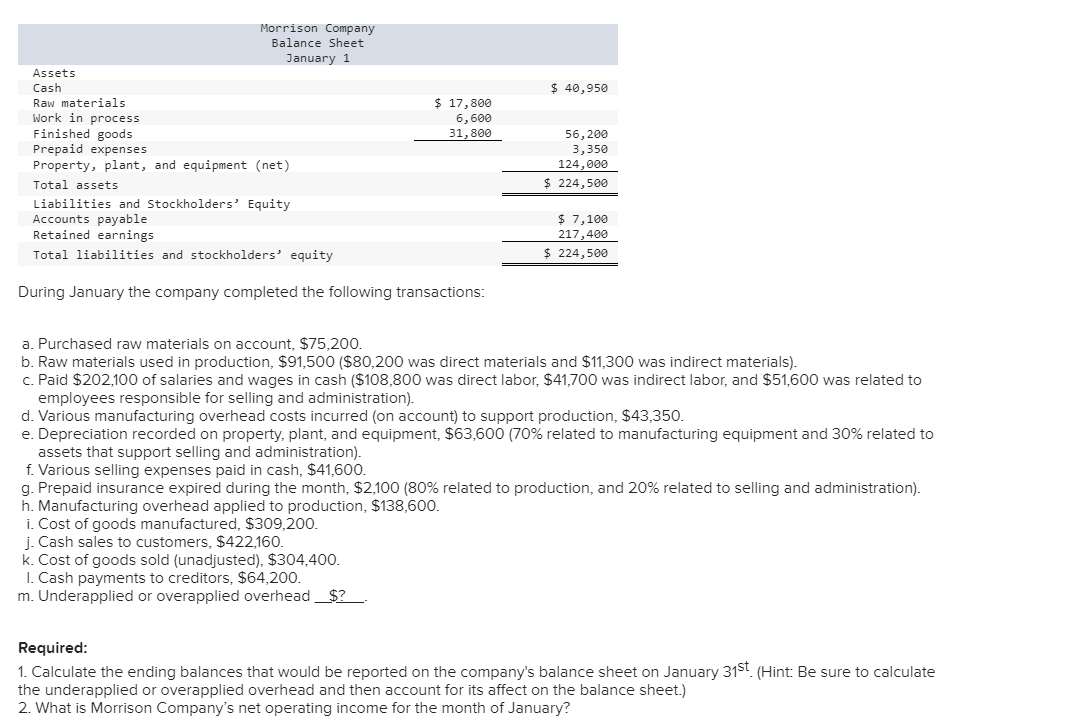

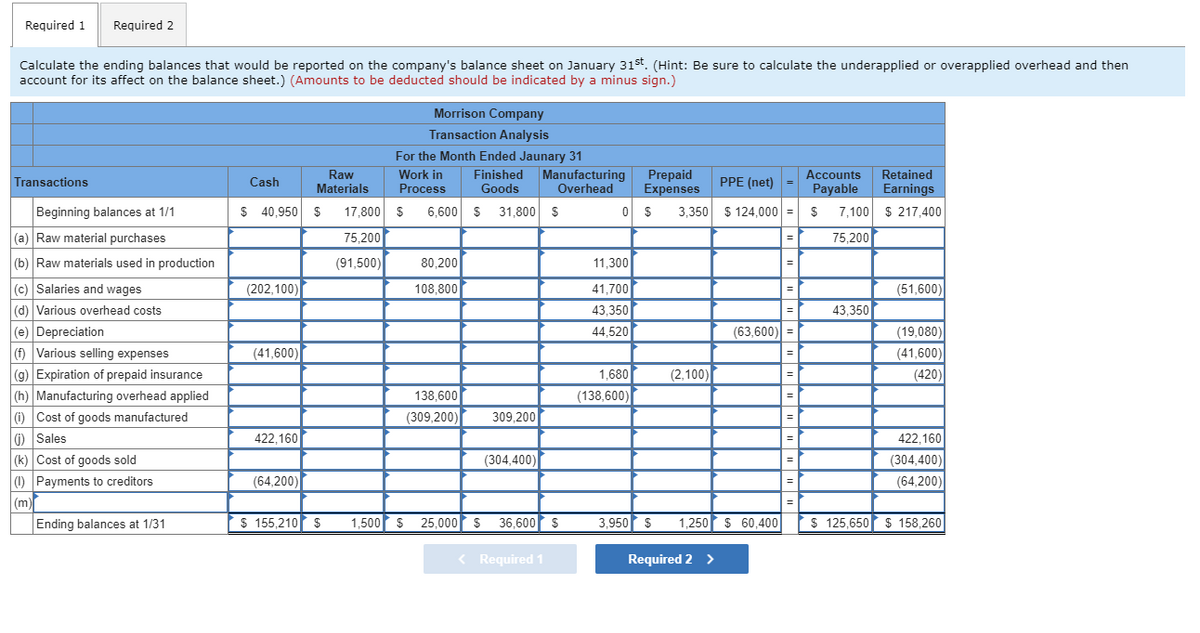

Morrison Company Balance Sheet January 1 Assets Cash $ 40,950 Raw materials Work in process Finished goods Prepaid expenses Property, plant, and equipment (net) $ 17,800 6,600 31,800 56,200 3,350 124,000 $ 224,500 Total assets Liabilities and Stockholders' Equity Accounts payable Retained earnings $ 7,100 217,400 Total liabilities and stockholders' equity $ 224,500 During January the company completed the following transactions: a. Purchased raw materials on account, $75,200. b. Raw materials used in production, $91,500 ($80,200 was direct materials and $11,300 was indirect materials). c. Paid $202,100 of salaries and wages in cash ($108,800 was direct labor, $41,700 was indirect labor, and $51,600 was related to employees responsible for selling and administration). d. Various manufacturing overhead costs incurred (on account) to support production, $43,350. e. Depreciation recorded on property, plant, and equipment, $63,600 (70% related to manufacturing equipment and 30% related to assets that support selling and administration). f. Various selling expenses paid in cash, $41,600. g. Prepaid insurance expired during the month, $2,100 (80% related to production, and 20% related to selling and administration). h. Manufacturing overhead applied to production, $138,600. i. Cost of goods manufactured, $309,200. j. Cash sales to customers, $422,160. k. Cost of goods sold (unadjusted), $304,400. I. Cash payments to creditors, $64,200. m. Underapplied or overapplied overhead_$? Required: 1. Calculate the ending balances that would be reported on the company's balance sheet on January 31st. (Hint: Be sure to calculate the underapplied or overapplied overhead and then account for its affect on the balance sheet.) 2. What is Morrison Company's net operating income for the month of January?

Introduction-

A balance sheet (also known as a statement of financial position or a statement of financial condition) is a summary of a person's or organization's financial balances, whether it's a sole proprietorship, a business partnership, a corporation, a private limited company, or another entity like the government or a not-for-profit organisation. The assets, liabilities, and ownership equity of a company are listed as of a given date, such as the end of the fiscal year. A balance sheet is frequently referred to as a "snapshot of a company's financial situation." The balance sheet is the only one of the four main financial statements that pertains to a single point in time within a business' calendar year.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps