2017, Jett started work on a P35,000,000 co nformation was taken from Jett's 2017 acco P11.000,000 10,500,000 7,000,000 plete 21.000,000

Q: The annual amount of a series of payments to be made at the end of the next twelve years is P500. Wh...

A: Answered:

Q: Cheatem Trading Company's master budget reflects budgeted sales information for the month of March, ...

A: Sales Budgeted : It's financial plan that estimates a company's total sales in a specific time per...

Q: FORTEN COMPANY Income Statement For Current Year Ended December 31 $ 642,500 297,000 345,500 Sales C...

A: The cash flow statement is prepared to record the cash flow from various activities during the perio...

Q: On July 1, 2022, bonds of P2,000,000 face amount were Interest on the bonds is payable semiannually ...

A: The procedure of entering commercial transactions for the very first time in the books of accounts i...

Q: Wildcat, Incorporated, has estimated sales (in millions) for the next four quarters as follows: Q3 Q...

A: The question is based on the concept of Cost Accounting.

Q: You are testing the dividend income recorded by LASTNATO company. Which audit procedure is least lik...

A: Dividend income is the income which has been earned by the company by way of on the investments made...

Q: y Jay and RJ are partners sharing profits and losses e ated and after all assets are converted to ca...

A: When a partner is insolvent , the capital deficit is to be distributed in the profit sharing ratio. ...

Q: Skyline Industries is analyzing a capital investment project. The new equipment is required by the p...

A: Capital investment project are the one in which capital is invested to receive required gains in fut...

Q: Headland Company is in the process of preparing its financial statements for 2020. Assume that no en...

A: Depreciation is the charge on the asset implemented by the entity due to its use or its normal wear ...

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A: Break even point is the point of sale where there is no profit and no loss to the company . in othe...

Q: For items #6-10 - Financial Statement: Below is the balance sheet of ABM International for June 30, ...

A: Liquidity ratios are the measures that are used to depict the capacity of the entity to meet up its ...

Q: On Feb, 5, 2017, an employee filed a P 2,000,000 lawsuit against Sans Co. for damages suffered when ...

A: When their are two amounts between the range and the entity cannot provide a better estimate between...

Q: Month Units Sold Total Cost $ 6,570 $ 7,14O $ 9,300 $ 4,500 JanuarY 1,020 February 1,920 March 2,640...

A: Solution: Under high low method, cost at highest point of activity and cost at lowest point of activ...

Q: Problem 11-12 (Algo) Effect of transactions on liquidity measures LO 1 Selected balance sheet acc...

A: Current Ratio - Current Ratio shows the company's liquidity. This ratio indicates how much short ter...

Q: Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory...

A: Carrying Value of Inventory: Carrying value of inventory is the absolute of all costs connected with...

Q: Sales $755,000 $ 620,000 Cost of goods sold other operating expenses Interest expense $445,450 234,0...

A: The asset turnover ratio relates the worth of a company's sales or revenues to the value of its asse...

Q: payments of $53,000 are to be made at the beginning of each lease year (December 31). The interest r...

A: A journal entry is an accounting entry which is used to record a business recorded in the accounting...

Q: 21. A non-VAT business reported the following: Sales P 2,500,000 Cost of Sales 1,000,000 Purchases, ...

A: Value-added tax is an indirect tax charged on the value of goods or services at each stage of supply...

Q: The current assets and liabilities sections of the comparative balance sheet of Wildhorse Inc., a pr...

A: Working:

Q: Jill buys a house for $100,000 with no mortgage. Jill's buying c of Jill's house grows 4.5% per year...

A: RR is discount rate for which present value of cash inflows is equal present value of cash outflow

Q: P12,000 is borrowed now at 12% interest. The first payment is P4000 and is made 3 years from now. Th...

A: The interest is the cost of debt levied in order to hold the time value of money and inflation adjus...

Q: Based on a predicted level of production and sales of 21,000 units, a company anticipates total vari...

A: Variable cost varies with production . Variable cost per unit remains same and total variable cost v...

Q: On January 1, a company issued and sold a $430,000, 5%, 10-year bond payable, and received proceeds ...

A: GIVEN On January 1, a company issued and sold a $430,000, 5%, 10-year bond payable, and received p...

Q: 6.If return on investment is a measure used on the balanced scorecard, under which perspective woul...

A: 6. Return on Investment measure is used under Financial Perspective. 7. Benchmarking is the process ...

Q: Call Systems Company, a telephone service and supply company, has just completed its fourth year of ...

A: Bad debts expense results from the goods sold on credit and payment not received till the due date.

Q: 9. A change in accounting principle requires that the cumulative effect of the change for prior peri...

A: Change in Accounting Principle - Change in the accounting principle includes changing the inventory ...

Q: On December 31, 2018, an entity reported the following equity items: 8% cumulative preference shares...

A: Common stock: Common stock is a type of stock recorded in the company's balance sheet as one of the ...

Q: Input Cost/Block Direct materials 0.5 Ib. @ $12/lb. $ 6.00 Direct manufacturing labour 1.4 hours @ $...

A: Variances mean the difference in the budgeted and actual figures. These can have both favorable (F) ...

Q: 1. Equipment with an original cost of $75,100 was sold during the year. 2. New equipment was purchas...

A: The question is related to Cash Flow Statement. The Cash Flow Statement is summary of cash receipts ...

Q: For each of the following inventory errors occurring in 2021, determine the effect of the error on 2...

A: The entire amount your organization spent as a cost directly tied to the selling of merchandise is k...

Q: A mother borrowed P200.000 with 2% interest monthly and promised to pay the amount in 30 equal month...

A: EMI or Equated monthly installment is an arrangement entered between the lending institution and the...

Q: The Performing Arts Club at your school wants to build a music studio. The studio would be available...

A: Financing small projects require low investments. There are various ways to fund small projects i.e....

Q: On Janaury 31, 2016, Large Corp. issued P 3,000,000 maturity value 12% bonds for P 3,000,000 cash. T...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: Determine the annual cost of ownership for a vehicle that has the following cos Use an interest rate...

A: Cost of ownership includes all different cost incurred at various time from initial payment to other...

Q: Duck Corporation "forecasted" on December 21, 2020 to sell a machine to a company in Italy. The sell...

A: A forward contract is a type of derivative instrument which is used to hedge against risk. The forwa...

Q: As regards capitalist partners, the prohibition may extend to operation which is of

A: A capitalist partner is one who contributes money or property to the capital of the company.

Q: Puffin Corporation makes a property distribution to its sole shareholder, Bonnie. The property distr...

A: A dividend is a payment made by a corporation to its stockholders. When a company makes a profit or ...

Q: TRUE OR FALSE? A fraudulent return with 30% understatement of income reported is subject to a penal...

A: Different countries follow different tax rules and regulations. Here this case is shown to be applic...

Q: nuary 1, 2020, Cullumber Corporation had inventory of $50,00O. At December 31, 2020, Cullumber Ces. ...

A: Gross profit is the amount of profit which is arrived by deducting cost of goods sold from sales rev...

Q: 3. Below is information pertaining to The Lime Green Wasp Corporation for the current year. On a sep...

A: Income statement shows the net income of the company and it is the difference between total revenue ...

Q: Mara Company reported the following accounts on December 31, 2021: 50,000 180,000 Premium on bonds p...

A: Introduction Bonds are investment securities that is issued by company and in which investor invest ...

Q: Keira purchased several pieces of equipment (all 7-year property) during 2021 for $2.100.000. She ue...

A: * As per Bartleby policy, if the question is unrelated then answer first only. Section 179 Expense...

Q: KALIBO CORP. prepared the following absorption-costing income statement for the year ended May 31, 2...

A: The income statement is prepared to record the revenues and expenses of the current period and furth...

Q: Greek Manufacturing Company produces and sells a line of product that are sold usually all year roun...

A:

Q: Garcon Company Pepper Company $22,500 Beginning finished goods inventory Beginning work in process i...

A: Cost of goods manufactured = Beginning WIP + Direct materials used + direct labor + manufacturing ov...

Q: Multiple Cholce $446,400. $28,760. $39,700. $515,300. $39,800.

A: Solution... Contribution margin ratio = 25% Fixed cost = $39,600 Desired profit = $71,900 Sal...

Q: The comparative balance sheet of Merrick Equipment Co. for December 31, 20Y9 and 20Y8, is as follows...

A: A cash flow statement indicates cash inflow and cash outflow information of a particular time period...

Q: Cost of long-term asset = $50,000 Accumulated Depreciation = $25,000 Sales price of L-T asset = $30,...

A:

Q: Kiddie World uses a periodic inventory system and the retail inventory method to estimate ending inv...

A: Cost to retail methods is simple method . This help them to find relationship between cost of merc...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: In the case of a multipart question, the first three subparts are solved. The cost of equity is the ...

Step by step

Solved in 2 steps

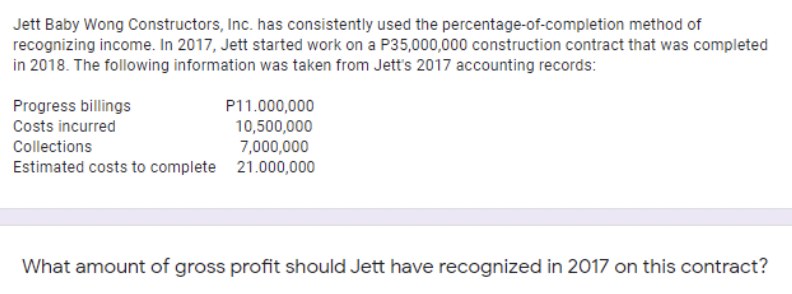

- PAPASA Co. has consistently used the percentage of completion to account for its construction projects. On January 31, 2017, the company began work on a P4,500,000 construction contract. At the inception date, the estimated cost of the construction was P3,375,000. The following relates to the project Gross profit – 2017 450,000 Cost incurred to date – 2018 2,700,000 Estimated cost to complete – 2018 900,000 Progress billings 2018 3,500,000 How much is the Gross Profit/Loss Realized in 2018? Kindly show your good accounting form for the solution. Thank you!Khodra Construction has consistently used the percentage-of-completion method of recognizing income. In 2021 Khodra started work on a $3,000,000 construction contract, which was completed in 2022. Progress billings were $1,100,000 and $1,900,000 for 2021 and 2022 respectively. Costs incurred were $900,000 and $1,800,000 for 2021 and 2022 respectively. $700,000 and $2,300,000 were collected in 2021 and 2022 respectively. The estimated cost to completed at the end of 2021 was $1,800,000 How much gross profit should Khodra have recognized in 2021? $AnswerAdler Construction Co. uses the percentage-of-completion method. In 2010, Adler began work on a contract for $3,300,000 and it was completed in 2011. Data on the costs are: Year Ended December 31 2010 2011 Costs incurred $1,170,000 $840,000 Estimated costs to complete 780,000 — For the years 2010 and 2011, Adler should recognize gross profit of

- Kiner, Inc. began work in 2024 on a contract for $21,000,000. Other data are as follows: Cost incurred to date $9,000,000 14,000,000 Estimated costs to complete $6,000,000 - Billings to date $7,000,000 $21,000,000 Collections to date $5,000,000 $18,000,000 If Kiner uses the cost -recovery method, the gross profit to be recognized in 2025 is A) $14,000,000 B) $7,000,000 c) 3,500,000 D) 3,400,000The following data relate to a construction job started by Worthington Co. during 2009: Total contract price................................................................ P300,000Actual costs incurred during 2002......................................... 60,000Estimated remaining costs.................................................... 120,000Billed to customer during 2002.............................................. 90,000Received from customer during 2003................................... 30,000 Under the completed-contract method, how much should Worthington recognize as gross profit for 2009?a. 0b. 40,000c. 80,000d. 100,000Solve the following problem in good accounting form. During 2009, Mason Construction, Inc. started work on a P 5,200,000 fixedprice construction contract to be completed in two years. The accounting records disclosed the following data for the year ended December 31, 2009: Cost incurred P 2,650,000Estimated cost to complete 2,720,000Progress billings 2,500,000Collections 2,000,000. What amount of net income or loss should have been recognized in 2009?

- Solve the following problem in good accounting form. Last year, Stone Builders, Inc. started work on a P10,600,000 constructioncontract which was completed this year. It has consistently used the percentage of completion method of recognizing income. Accounting data provided last year were as follows: Debit: Progress Billings P4,300,000; Credits: Cost incurred 3,450,000 Collections 3,900,000 Estimated cost to complete 3,630,000. What amount of this contract was recognized last year?Roger Inc. began work in 2021 on a contract for $8,400,000. Other data are as follows: 2021 2022 Costs incurred to date $3,600,000 $5,600,000 Estimated costs to complete 2,400,000 — Billings to date 2,800,000 8,400,000 Collections to date 2,000,000 7,200,000 Roger uses the percentage-of-completion method. Calculate the gross profit to be recognized in 2021.The Skyline Corporation began constructing a building with a contract price of P 43,800,000 in 2009. The ledgers of Skyline for 2010 shows the following accounts: Construction in Progress P 10,400,000 Accounts Receivable 3,200,000 Gross Profit earned 3,952,000 Progress billings to date 6,500,000. What was the amount of collection in 2009?

- Last year, Stone Builders, Inc. started work on a P10,600,000 construction contract which was completed this year. It has consistently used the percentage of completion method of recognizing income. Accounting data provided last year were as follows: Debit: Progress Billings P4,300,000; Credits: Cost incurred 3,450,000 Collections 3,900,000 Estimated cost to complete 3,630,000 What amount of this contract was recognized last year? Brave Corporation authorized Heart on January 1, 2010 to operate as a franchisee for an initial franchise fee of P2,500,000. Of this amount, P1,500,000 was received upon signing of the contract and the balance is due in two equal annual payments beginning January 1, 2011. The contract provides that the nonrefundable downpayment represents fair measure of the services already performed, however, substantial performance is still required of Brave. Collectibility of the note is reasonably certain. If the present value of the two annual payments is P895,000,…The information provided below was taken from the records of Chotoo Projects for the financialyear ended 31 May 2020.Extract of statement of comprehensive income for the year ended 31 May 2020RRevenue 480 000Direct costs 240 000Rent income 150 000Advertising 4 800Salaries and wages 90 000Rates and taxes 1 200Other operating expenses 80 000Additional information1. Revenue is calculated as direct cost plus 25%.2. Revenue is divided equally each month. Revenue is expected to increase by 18% for thefinancial year ending 31 May 2021.POSTGRADUATE DIPLOMA IN PROJECT MANAGEMENT – ACADEMIC AND ASSESSMENT CALENDARREGENT BUSINESS SCHOOL (RBS) January 2021 173. Fifty percent (50%) of the revenue is for cash and the balance is on credit. Debtorsnormally pay their accounts as follows:• 40% in the month of the invoice, and these debtors are entitled toa 5% discount;• 55% one month after the invoice;The balance is usually written off as bad debts.4. Purchases for June and July are expected to be 30…Josh Cablesource has sales for 2016 of $1,566,777. Information regarding resources for the year are as follows: Resources used Resources SuppliedAdministration $67,000.00 $90,000.00Depreciation $33,000.00 $37,000.00Energy $54,000.00 $125,000.00Training $20,000.00 $23,000.00Short term labor $89,000.00 $89,000.00Long term labor $433,000.00 $435,000.00Marketing $100,000.00 $112,000.00Prepare and activity based Income Statement like the one for exercise 10-53. Show me profit and profit percent.