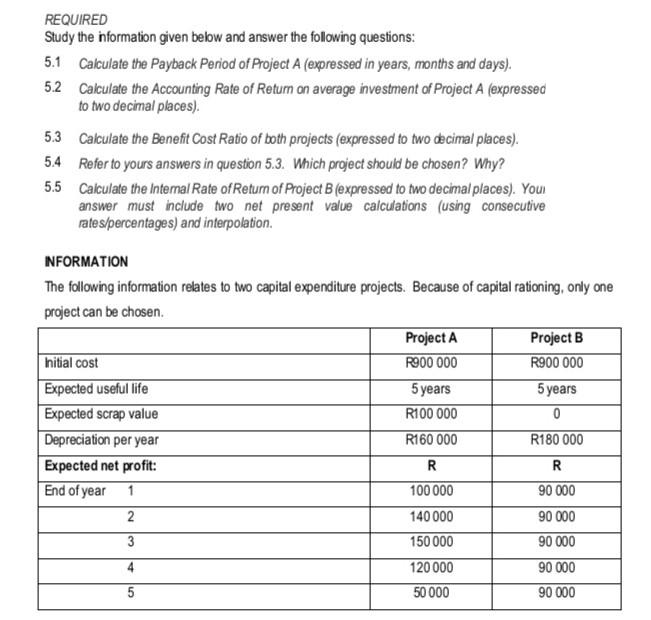

REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). 5.2 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? 5.5 Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen. hitial cost Expected useful life Expected scrap value Depreciation per year Expected net profit: End of year 1 2 3 4 5 Project A R900 000 5 years R100 000 R160 000 R 100 000 140 000 150 000 120 000 50 000 Project B R900 000 5 years 0 R180 000 R 90 000 90 000 90 000 90 000 90 000

REQUIRED Study the information given below and answer the following questions: 5.1 Calculate the Payback Period of Project A (expressed in years, months and days). Calculate the Accounting Rate of Return on average investment of Project A (expressed to two decimal places). 5.2 5.3 Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places). 5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why? 5.5 Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION The following information relates to two capital expenditure projects. Because of capital rationing, only one project can be chosen. hitial cost Expected useful life Expected scrap value Depreciation per year Expected net profit: End of year 1 2 3 4 5 Project A R900 000 5 years R100 000 R160 000 R 100 000 140 000 150 000 120 000 50 000 Project B R900 000 5 years 0 R180 000 R 90 000 90 000 90 000 90 000 90 000

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

100%

Transcribed Image Text:REQUIRED

Study the information given below and answer the following questions:

5.1 Calculate the Payback Period of Project A (expressed in years, months and days).

Calculate the Accounting Rate of Return on average investment of Project A (expressed

to two decimal places).

5.2

5.3

Calculate the Benefit Cost Ratio of both projects (expressed to two decimal places).

5.4 Refer to yours answers in question 5.3. Which project should be chosen? Why?

5.5

Calculate the Internal Rate of Return of Project B (expressed to two decimal places). Your

answer must include two net present value calculations (using consecutive

rates/percentages) and interpolation.

INFORMATION

The following information relates to two capital expenditure projects. Because of capital rationing, only one

project can be chosen.

Initial cost

Expected useful life

Expected scrap value

Depreciation per year

Expected net profit:

End of year

1

2

3

4

5

Project A

R900 000

5 years

R100 000

R160 000

R

100 000

140 000

150 000

120 000

50 000

Project B

R900 000

5 years

0

R180 000

R

90 000

90 000

90 000

90 000

90 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Can I please get the solution for question 5.4 and 5.5

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning