Whispering Corporation had net sales of $2,417,800 and interest revenue of $34,900 during 2020. Expenses for 2020 were cost of goods sold $1,455,200, administrative expenses $216,400, selling expenses $288,900, and interest expense $49,100. Whispering's tax rate is 30%. The corporation had 104,200 shares of common stock authorized and 74,310 shares issued and outstanding during 2020. Prepare a single-step income statement for the year ended December 31, 2020. (Round earnings per share to 2 decimal places, e.g. 1.48.)

Whispering Corporation had net sales of $2,417,800 and interest revenue of $34,900 during 2020. Expenses for 2020 were cost of goods sold $1,455,200, administrative expenses $216,400, selling expenses $288,900, and interest expense $49,100. Whispering's tax rate is 30%. The corporation had 104,200 shares of common stock authorized and 74,310 shares issued and outstanding during 2020. Prepare a single-step income statement for the year ended December 31, 2020. (Round earnings per share to 2 decimal places, e.g. 1.48.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 8MC: Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde...

Related questions

Question

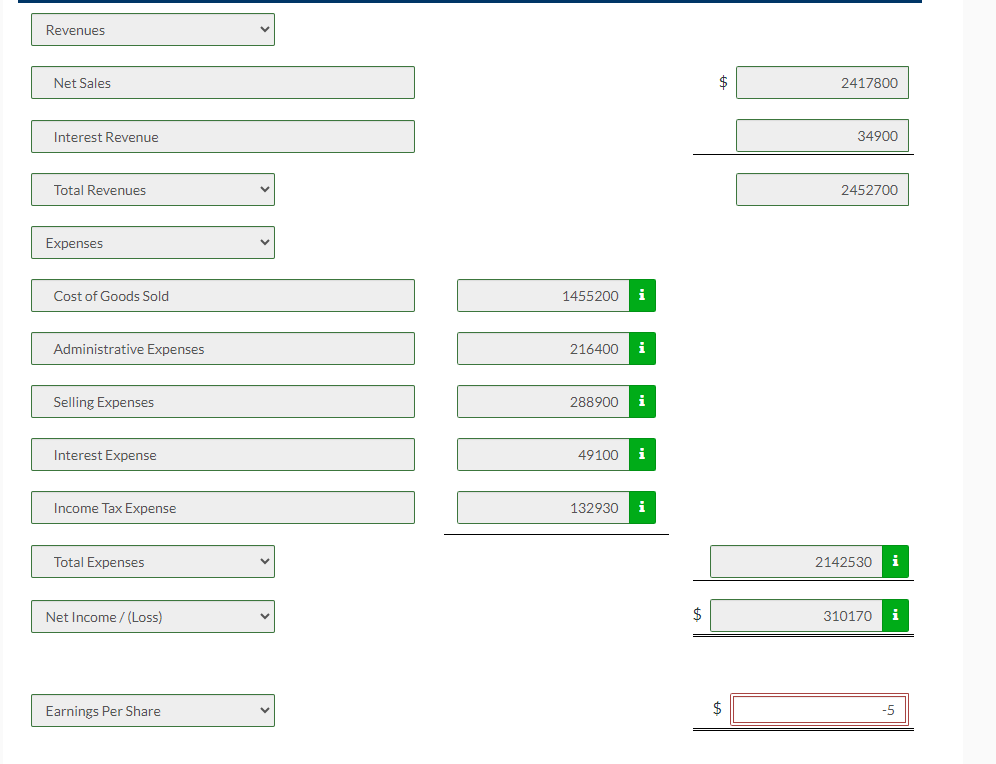

What am I doing wrong for my earning per share? Also why is it saying that the net income can be negative?

Transcribed Image Text:Whispering Corporation had net sales of $2,417,800 and interest revenue of $34,900 during 2020. Expenses for 2020 were cost of

goods sold $1,455,200, administrative expenses $216,400, selling expenses $288,900, and interest expense $49,100. Whispering's

tax rate is 30%. The corporation had 104,200 shares of common stock authorized and 74,310 shares issued and outstanding during

2020. Prepare a single-step income statement for the year ended December 31, 2020. (Round earnings per share to 2 decimal places, e.g.

1.48.)

Transcribed Image Text:Revenues

Net Sales

Interest Revenue

Total Revenues

Expenses

Cost of Goods Sold

Administrative Expenses

Selling Expenses

Interest Expense

Income Tax Expense

Total Expenses

Net Income /(Loss)

Earnings Per Share

1455200 i

216400 i

288900

49100 i

132930

i

$

$

2417800

34900

2452700

2142530 i

310170

i

-5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning