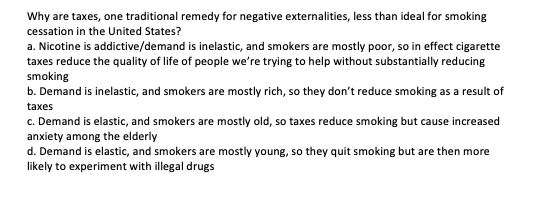

Why are taxes, one traditional remedy for negative externalities, less than ideal for smoking cessation in the United States? a. Nicotine is addictive/demand is inelastic, and smokers are mostly poor, so in effect cigarette taxes reduce the quality of life of people we're trying to help without substantially reducing smoking b. Demand is inelastic, and smokers are mostly rich, so they don't reduce smoking as a result of taxes c. Demand is elastic, and smokers are mostly old, so taxes reduce smoking but cause increased anxiety among the elderly d. Demand is elastic, and smokers are mostly young, so they quit smoking but are then more likely to experiment with illegal drugs

Why are taxes, one traditional remedy for negative externalities, less than ideal for smoking cessation in the United States? a. Nicotine is addictive/demand is inelastic, and smokers are mostly poor, so in effect cigarette taxes reduce the quality of life of people we're trying to help without substantially reducing smoking b. Demand is inelastic, and smokers are mostly rich, so they don't reduce smoking as a result of taxes c. Demand is elastic, and smokers are mostly old, so taxes reduce smoking but cause increased anxiety among the elderly d. Demand is elastic, and smokers are mostly young, so they quit smoking but are then more likely to experiment with illegal drugs

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter12: Environmental Protection And Negative Externalities

Section: Chapter Questions

Problem 40P: Show the market for cigarettes in equilibrium, assuming that there are no laws banning smoking in...

Related questions

Question

Transcribed Image Text:Why are taxes, one traditional remedy for negative externalities, less than ideal for smoking

cessation in the United States?

a. Nicotine is addictive/demand is inelastic, and smokers are mostly poor, so in effect cigarette

taxes reduce the quality of life of people we're trying to help without substantially reducing

smoking

b. Demand is inelastic, and smokers are mostly rich, so they don't reduce smoking as a result of

taxes

c. Demand is elastic, and smokers are mostly old, so taxes reduce smoking but cause increased

anxiety among the elderly

d. Demand is elastic, and smokers are mostly young, so they quit smoking but are then more

likely to experiment with illegal drugs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning