Why the answer is letter D. Company A’s lower voluntary employee turnover rate will likely increase valuation? How will performance on SASB metrics impact Company A’s valuation as compared to Company B? A. Company B’s higher percentage of revenue from leisure customers will likely decrease valuation. B. Company B’s lower reclamation rate of hotel room keys will likely increase valuation. C. Company A’s lower percentage of revenue from coastal regions will likely decrease valuation. D. Company A’s lower voluntary employee turnover rate will likely increase valuation

Why the answer is letter D. Company A’s lower voluntary employee turnover rate will likely increase valuation? How will performance on SASB metrics impact Company A’s valuation as compared to Company B? A. Company B’s higher percentage of revenue from leisure customers will likely decrease valuation. B. Company B’s lower reclamation rate of hotel room keys will likely increase valuation. C. Company A’s lower percentage of revenue from coastal regions will likely decrease valuation. D. Company A’s lower voluntary employee turnover rate will likely increase valuation

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 27PC: Starwood Hotels (Starwood) owns and operates many hotel properties under well-known brand names,...

Related questions

Question

Why the answer is letter D. Company A’s lower voluntary employee turnover rate will likely increase valuation?

How will performance on SASB metrics impact Company A’s valuation as compared to Company B?

A. Company B’s higher percentage of revenue from leisure customers will likely decrease valuation.

B. Company B’s lower reclamation rate of hotel room keys will likely increase valuation.

C. Company A’s lower percentage of revenue from coastal regions will likely decrease valuation.

D. Company A’s lower voluntary employee turnover rate will likely increase valuation

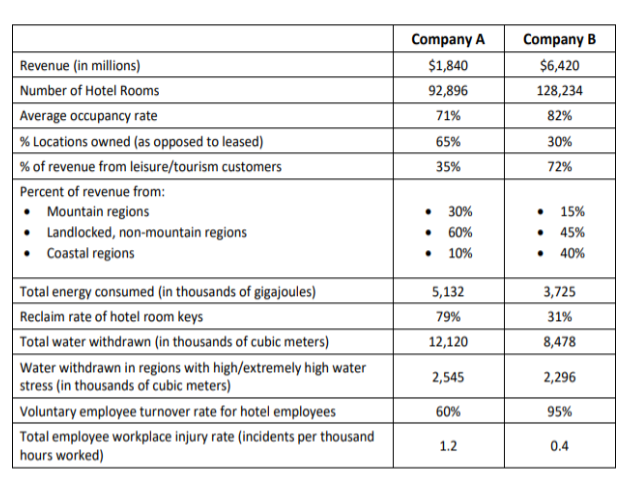

Transcribed Image Text:Company A

Company B

Revenue (in millions)

$1,840

$6,420

Number of Hotel Rooms

92,896

128,234

Average occupancy rate

71%

82%

|% Locations owned (as opposed to leased)

65%

30%

% of revenue from leisure/tourism customers

35%

72%

Percent of revenue from:

Mountain regions

30%

15%

• Landlocked, non-mountain regions

• Coastal regions

• 60%

• 10%

• 45%

• 40%

| Total energy consumed (in thousands of gigajoules)

5,132

3,725

Reclaim rate of hotel room keys

79%

31%

Total water withdrawn (in thousands of cubic meters)

12,120

8,478

Water withdrawn in regions with high/extremely high water

stress (in thousands of cubic meters)

2,545

2,296

Voluntary employee turnover rate for hotel employees

60%

95%

Total employee workplace injury rate (incidents per thousand

hours worked)

1.2

0.4

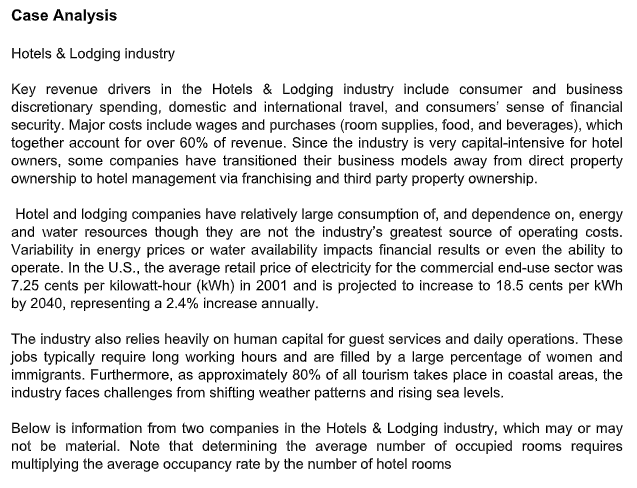

Transcribed Image Text:Case Analysis

Hotels & Lodging industry

Key revenue drivers in the Hotels & Lodging industry include consumer and business

discretionary spending, domestic and international travel, and consumers' sense of financial

security. Major costs include wages and purchases (room supplies, food, and beverages), which

together account for over 60% of revenue. Since the industry is very capital-intensive for hotel

owners, some companies have transitioned their business models away from direct property

ownership to hotel management via franchising and third party property ownership.

Hotel and lodging companies have relatively large consumption of, and dependence on, energy

and water resources though they are not the industry's greatest source of operating costs.

Variability in energy prices or water availability impacts financial results or even the ability to

operate. In the U.S., the average retail price of electricity for the commercial end-use sector was

7.25 cents per kilowatt-hour (kWh) in 2001 and is projected to increase to 18.5 cents per kWh

by 2040, representing a 2.4% increase annually.

The industry also relies heavily on human capital for guest services and daily operations. These

jobs typically require long working hours and are filled by a large percentage of women and

immigrants. Furthermore, as approximately 80% of all tourism takes place in coastal areas, the

industry faces challenges from shifting weather patterns and rising sea levels.

Below is information from two companies in the Hotels & Lodging industry, which may or may

not be material. Note that determining the average number of occupied rooms requires

multiplying the average occupancy rate by the number of hotel rooms

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning