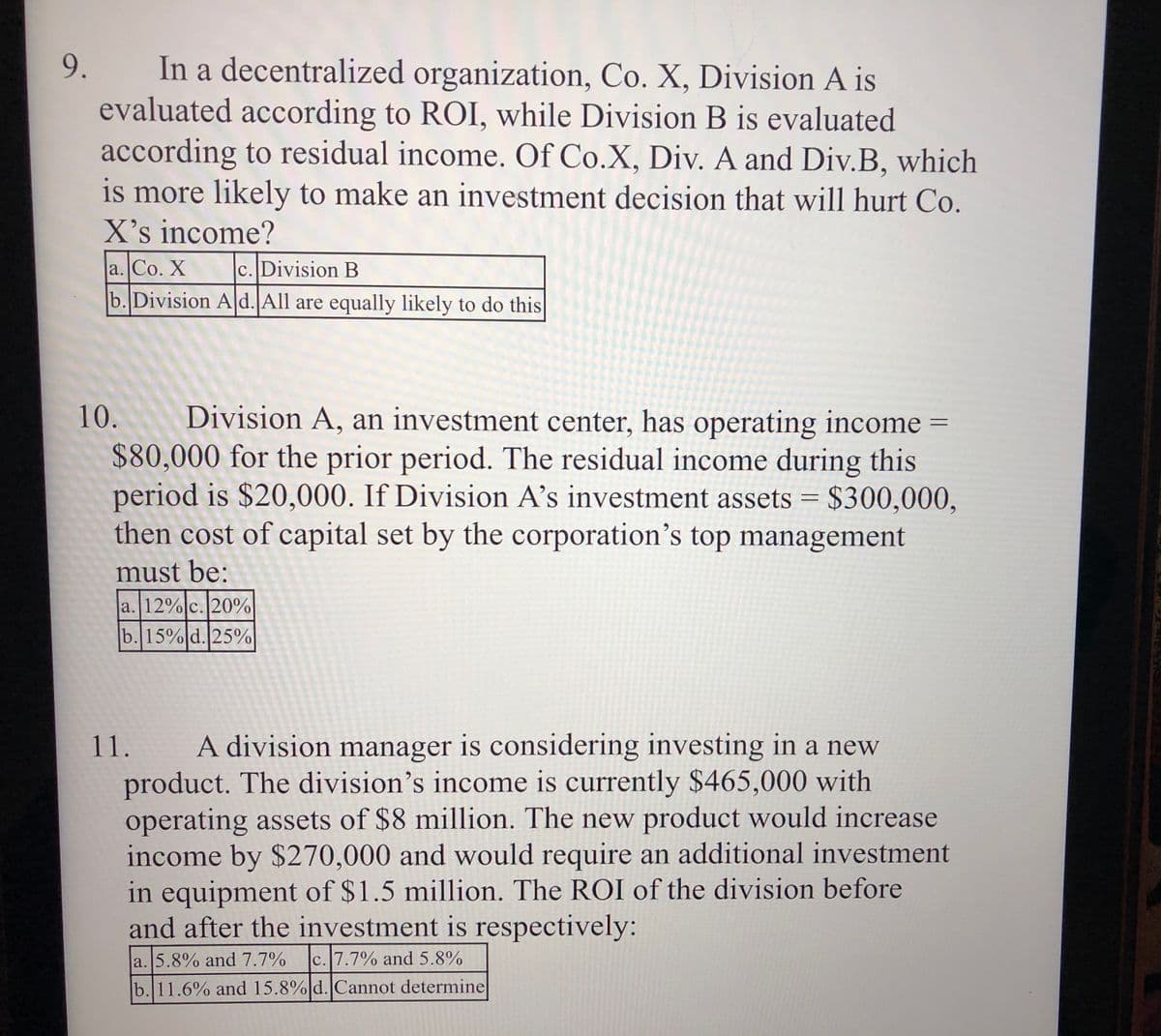

In a decentralized organization, Co. X, Division A is evaluated according to ROI, while Division B is evaluated according to residual income. Of Co.X, Div. A and Div.B, which is more likely to make an investment decision that will hurt Co. 9. X's income? a. Co. X c. Division B b. Division A d. All are equally likely to do this

In a decentralized organization, Co. X, Division A is evaluated according to ROI, while Division B is evaluated according to residual income. Of Co.X, Div. A and Div.B, which is more likely to make an investment decision that will hurt Co. 9. X's income? a. Co. X c. Division B b. Division A d. All are equally likely to do this

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 9E: Refer to the data given in Exercise 10.8. Required: 1. Compute the residual income for each of the...

Related questions

Question

Transcribed Image Text:In a decentralized organization, Co. X, Division A is

evaluated according to ROI, while Division B is evaluated

according to residual income. Of Co.X, Div. A and Div.B, which

is more likely to make an investment decision that will hurt Co.

X's income?

a. Co. X

b. Division A d. All are equally likely to do this

9.

c. Division B

10. Division A, an investment center, has operating income =

$80,000 for the prior period. The residual income during this

period is $20,000. If Division A’s investment assets = $300,000,

then cost of capital set by the corporation's top management

must be:

a. 12%|c.20%

b. 15% d. 25%

11.

A division manager is considering investing in a new

product. The division's income is currently $465,000 with

operating assets of $8 million. The new product would increase

income by $270,000 and would require an additional investment

in equipment of $1.5 million. The ROI of the division before

and after the investment is respectively:

a. 5.8% and 7.7%

c. 7.7% and 5.8%

b. 11.6% and 15.8%|d. Cannot determine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College