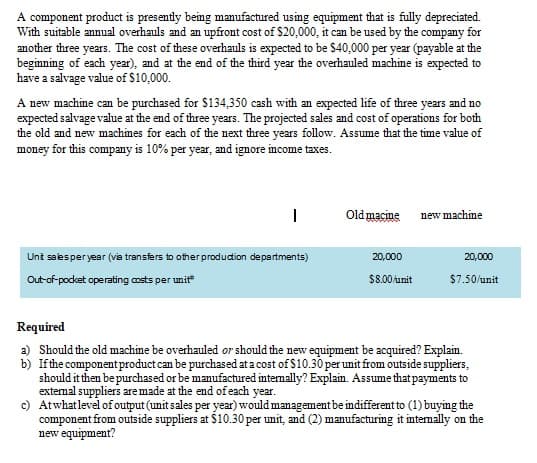

A component product is presently being manufactured using equipment that is fully depreciated. With suitable annual overhauls and an upfront cost of $20,000, it can be used by the company for another three years. The cost of these overhauls is expected to be $40,000 per year (payable at the beginning of each year), and at the end of the third year the overhauled machine is expected to have a salvage value of $10,000. A new machine can be purchased for $134,350 cash with an expected life of three years and no expected salvage value at the end of three years. The projected sales and cost of operations for both the old and new machines for each of the next three years follow. Assume that the time value of money for this company is 10% per year, and ignore income taxes. Old macine new machine Unt salesper year (vie transfers to other produdion departments) 20,000 20,000 Out-of-podket operating costs per unit $8.00 uanit $7.50/unit Required a) Should the old machine be overhauled or should the new equipment be acquired? Explain. b) Ifthe component product can be purchased at a cost of $10.30 per unit from outside suppliers, should it then be purchased or be manufactured intemally? Explain. Assume that payments to external suppliers aremade at the end of each year. c) Atwhatlevel of output (unit sales per year) would management be indifferent to (1) buying the component from outside suppliers at $10.30 per unit, and (2) manufacturing it internally on the new equipment?

A component product is presently being manufactured using equipment that is fully depreciated. With suitable annual overhauls and an upfront cost of $20,000, it can be used by the company for another three years. The cost of these overhauls is expected to be $40,000 per year (payable at the beginning of each year), and at the end of the third year the overhauled machine is expected to have a salvage value of $10,000. A new machine can be purchased for $134,350 cash with an expected life of three years and no expected salvage value at the end of three years. The projected sales and cost of operations for both the old and new machines for each of the next three years follow. Assume that the time value of money for this company is 10% per year, and ignore income taxes. Old macine new machine Unt salesper year (vie transfers to other produdion departments) 20,000 20,000 Out-of-podket operating costs per unit $8.00 uanit $7.50/unit Required a) Should the old machine be overhauled or should the new equipment be acquired? Explain. b) Ifthe component product can be purchased at a cost of $10.30 per unit from outside suppliers, should it then be purchased or be manufactured intemally? Explain. Assume that payments to external suppliers aremade at the end of each year. c) Atwhatlevel of output (unit sales per year) would management be indifferent to (1) buying the component from outside suppliers at $10.30 per unit, and (2) manufacturing it internally on the new equipment?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 22P: The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500,...

Related questions

Question

100%

Hello

Please solve the question

Transcribed Image Text:A component product is presently being manufactured using equipment that is fully depreciated.

With suitable annual overhauls and an upfront cost of $20,000, it can be used by the company for

another three years. The cost of these overhauls is expected to be $40,000 per year (payable at the

beginning of each year), and at the end of the third year the overhauled machine is expected to

have a salvage value of $10,000.

A new machine can be purchased for $134,350 cash with an expected life of three years and no

expected salvage value at the end of three years. The projected sales and cost of operations for both

the old and new machines for each of the next three years follow. Assume that the time value of

money for this company is 10% per year, and ignore income taxes.

Old macine

new machine

Unt salesper year (vie transfers to other produdion departments)

20,000

20,000

Out-of-podket operating costs per unit

$8.00 uanit

$7.50/unit

Required

a) Should the old machine be overhauled or should the new equipment be acquired? Explain.

b) Ifthe component product can be purchased at a cost of $10.30 per unit from outside suppliers,

should it then be purchased or be manufactured intemally? Explain. Assume that payments to

external suppliers aremade at the end of each year.

c) Atwhatlevel of output (unit sales per year) would management be indifferent to (1) buying the

component from outside suppliers at $10.30 per unit, and (2) manufacturing it internally on the

new equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning