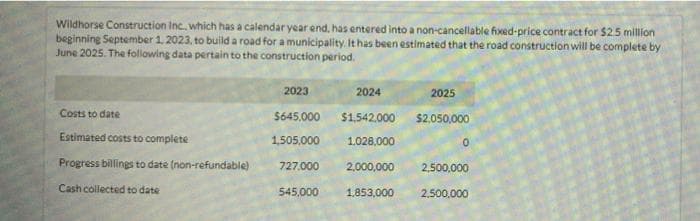

Wildhorse Construction Inc. which has a calendar year end, has entered into a non-cancellable fixed-price contract for $2.5 million beginning September 1, 2023, to build a road for a municipality. It has been estimated that the road construction will be complete by June 2025. The following data pertain to the construction period. Costs to date Estimated costs to complete Progress billings to date (non-refundable) Cash collected to date 2023 2024 2025 $645,000 $1,542,000 $2,050,000 1,505,000 1.028,000 727,000 545,000 2,000,000 1,853,000 2,500,000 2,500,000

Wildhorse Construction Inc. which has a calendar year end, has entered into a non-cancellable fixed-price contract for $2.5 million beginning September 1, 2023, to build a road for a municipality. It has been estimated that the road construction will be complete by June 2025. The following data pertain to the construction period. Costs to date Estimated costs to complete Progress billings to date (non-refundable) Cash collected to date 2023 2024 2025 $645,000 $1,542,000 $2,050,000 1,505,000 1.028,000 727,000 545,000 2,000,000 1,853,000 2,500,000 2,500,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 9MC

Related questions

Question

Please do not give solution in image format thanku

Transcribed Image Text:Wildhorse Construction Inc. which has a calendar year end, has entered into a non-cancellable fixed-price contract for $2.5 million

beginning September 1, 2023, to build a road for a municipality. It has been estimated that the road construction will be complete by

June 2025. The following data pertain to the construction period.

Costs to date

Estimated costs to complete

Progress billings to date (non-refundable)

Cash collected to date

2023

2024

2025

$645,000 $1,542,000 $2,050,000

1,505,000

1.028,000

727,000

545.000

2,000,000 2,500,000

2,500,000

1,853,000

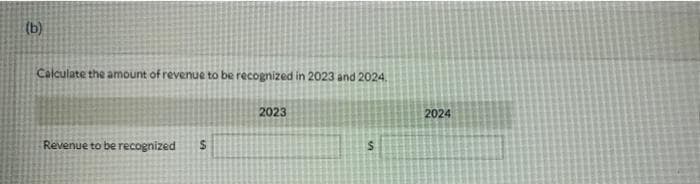

Transcribed Image Text:(b)

Calculate the amount of revenue to be recognized in 2023 and 2024.

Revenue to be recognized

S

2023

S

2024

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT