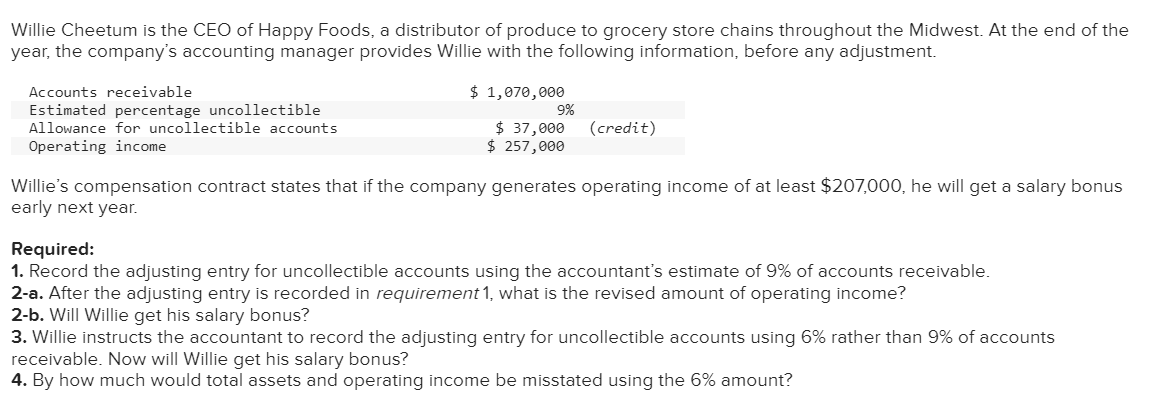

Willie Cheetum is the CEO of Happy Foods, a distributor of produce to grocery store chains throughout the Midwest. At the end of the year, the company's accounting manager provides Willie with the following information, before any adjustment. $ 1,070,000 Accounts receivable Estimated percentage uncollectible Allowance for uncollectible accounts Operating income 9% $ 37,000 (credit) $ 257,000 Willie's compensation contract states that if the company generates operating income of at least $207,000, he will get a salary bonus early next year. Required: 1. Record the adjusting entry for uncollectible accounts using the accountant's estimate of 9% of accounts receivable. 2-a. After the adjusting entry is recorded in requirement 1, what is the revised amount of operating income? 2-b. Will Willie get his salary bonus? 3. Willie instructs the accountant to record the adjusting entry for uncollectible accounts using 6% rather than 9% of accounts receivable. Now will Willie get his salary bonus? 4. By how much would total assets and operating income be misstated using the 6% amount?

Willie Cheetum is the CEO of Happy Foods, a distributor of produce to grocery store chains throughout the Midwest. At the end of the year, the company's accounting manager provides Willie with the following information, before any adjustment. $ 1,070,000 Accounts receivable Estimated percentage uncollectible Allowance for uncollectible accounts Operating income 9% $ 37,000 (credit) $ 257,000 Willie's compensation contract states that if the company generates operating income of at least $207,000, he will get a salary bonus early next year. Required: 1. Record the adjusting entry for uncollectible accounts using the accountant's estimate of 9% of accounts receivable. 2-a. After the adjusting entry is recorded in requirement 1, what is the revised amount of operating income? 2-b. Will Willie get his salary bonus? 3. Willie instructs the accountant to record the adjusting entry for uncollectible accounts using 6% rather than 9% of accounts receivable. Now will Willie get his salary bonus? 4. By how much would total assets and operating income be misstated using the 6% amount?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 2PA: The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal...

Related questions

Question

Transcribed Image Text:Willie Cheetum is the CEO of Happy Foods, a distributor of produce to grocery store chains throughout the Midwest. At the end of the

year, the company's accounting manager provides Willie with the following information, before any adjustment.

$ 1,070,000

Accounts receivable

Estimated percentage uncollectible

Allowance for uncollectible accounts

Operating income

9%

$ 37,000 (credit)

$ 257,000

Willie's compensation contract states that if the company generates operating income of at least $207,000, he will get a salary bonus

early next year.

Required:

1. Record the adjusting entry for uncollectible accounts using the accountant's estimate of 9% of accounts receivable.

2-a. After the adjusting entry is recorded in requirement 1, what is the revised amount of operating income?

2-b. Will Willie get his salary bonus?

3. Willie instructs the accountant to record the adjusting entry for uncollectible accounts using 6% rather than 9% of accounts

receivable. Now will Willie get his salary bonus?

4. By how much would total assets and operating income be misstated using the 6% amount?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,