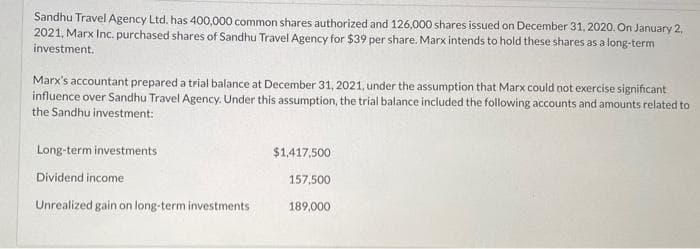

Sandhu Travel Agency Ltd. has 400,000 common shares authorized and 126,000 shares issued on December 31, 2020. On January 2 2021, Marx Inc. purchased shares of Sandhu Travel Agency for $39 per share. Marx intends to hold these shares as a long-term investment. Marx's accountant prepared a trial balance at December 31, 2021, under the assumption that Marx could not exercise significant influence over Sandhu Travel Agency. Under this assumption, the trial balance included the following accounts and amounts related= the Sandhu investment: Long-term investments Dividend income Unrealized gain on long-term investments $1,417,500 157,500 189,000

Sandhu Travel Agency Ltd. has 400,000 common shares authorized and 126,000 shares issued on December 31, 2020. On January 2 2021, Marx Inc. purchased shares of Sandhu Travel Agency for $39 per share. Marx intends to hold these shares as a long-term investment. Marx's accountant prepared a trial balance at December 31, 2021, under the assumption that Marx could not exercise significant influence over Sandhu Travel Agency. Under this assumption, the trial balance included the following accounts and amounts related= the Sandhu investment: Long-term investments Dividend income Unrealized gain on long-term investments $1,417,500 157,500 189,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 26E

Related questions

Question

Transcribed Image Text:Sandhu Travel Agency Ltd. has 400,000 common shares authorized and 126,000 shares issued on December 31, 2020. On January 2,

2021, Marx Inc. purchased shares of Sandhu Travel Agency for $39 per share. Marx intends to hold these shares as a long-term

investment.

Marx's accountant prepared a trial balance at December 31, 2021, under the assumption that Marx could not exercise significant

influence over Sandhu Travel Agency. Under this assumption, the trial balance included the following accounts and amounts related to

the Sandhu investment:

Long-term investments

Dividend income

Unrealized gain on long-term investments

$1,417,500

157,500

189,000

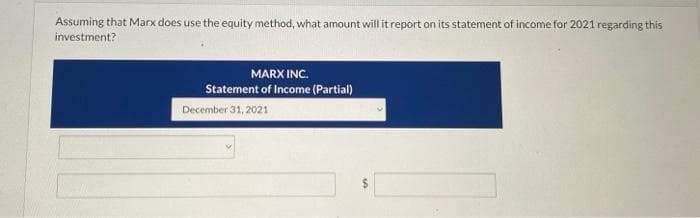

Transcribed Image Text:Assuming that Marx does use the equity method, what amount will it report on its statement of income for 2021 regarding this

investment?

MARX INC.

Statement of Income (Partial)

December 31, 2021

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning