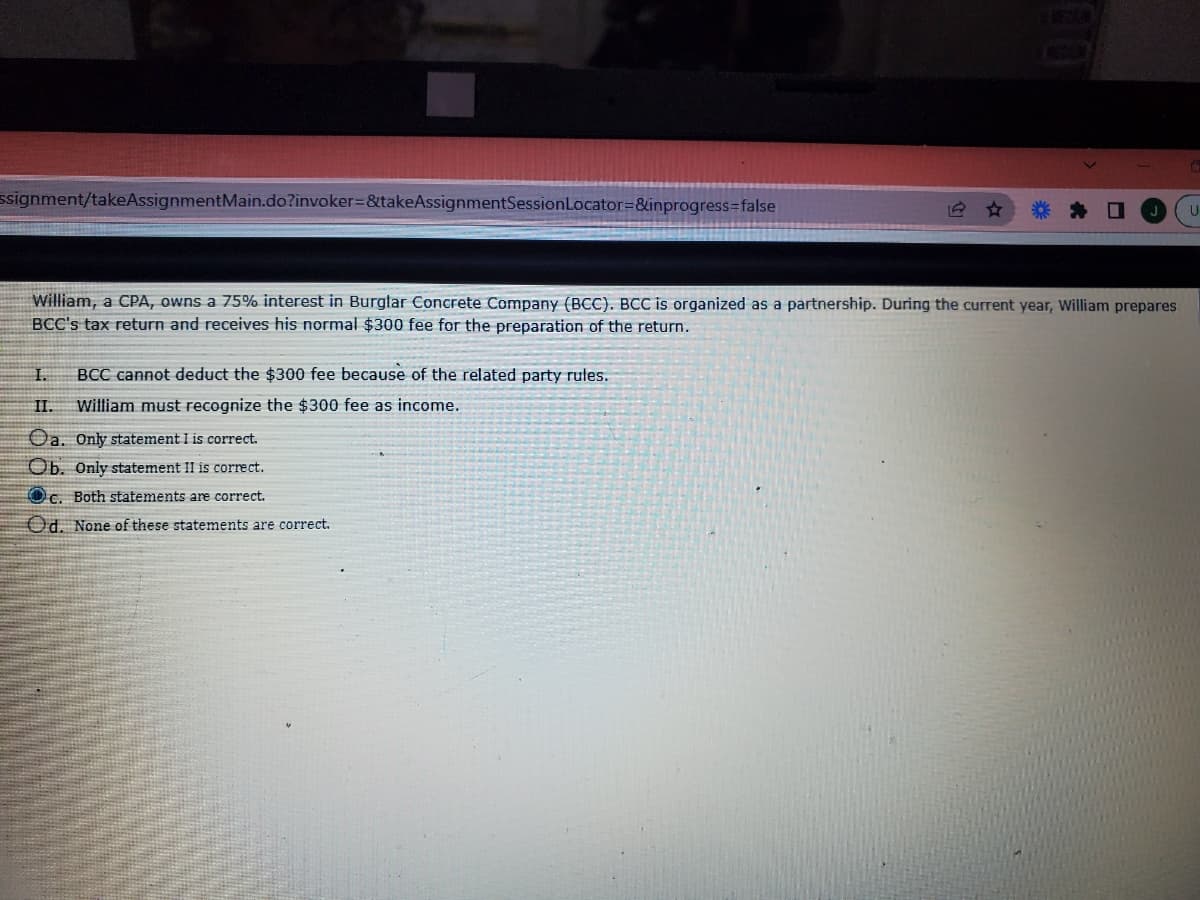

William, a CPA, owns a 75% interest in Burglar Concrete Company (BCC). BCC is organized as a partnership. During the current year, William prepares BCC's tax return and receives his normal $300 fee for the preparation of the return.

William, a CPA, owns a 75% interest in Burglar Concrete Company (BCC). BCC is organized as a partnership. During the current year, William prepares BCC's tax return and receives his normal $300 fee for the preparation of the return.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:ssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%=&inprogress=false

U

William, a CPA, owns a 75% interest in Burglar Concrete Company (BCC). BCC is organized as a partnership. During the current year, William prepares

BCC's tax return and receives his normal $300 fee for the preparation of the return.

I.

BCC cannot deduct the $300 fee because of the related party rules.

I.

William must recognize the $300 fee as income.

Oa. Only statement I is correct.

Ob. Only statement II is correct.

Oc. Both statements are correct.

Od. None of these statements are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you