es cash of $120. B contributes er, the land is sold to a third pa justed basis) is allocated betv method or the new regulation - be casier as you do not ha

es cash of $120. B contributes er, the land is sold to a third pa justed basis) is allocated betv method or the new regulation - be casier as you do not ha

Chapter21: Partnerships

Section: Chapter Questions

Problem 43P

Related questions

Question

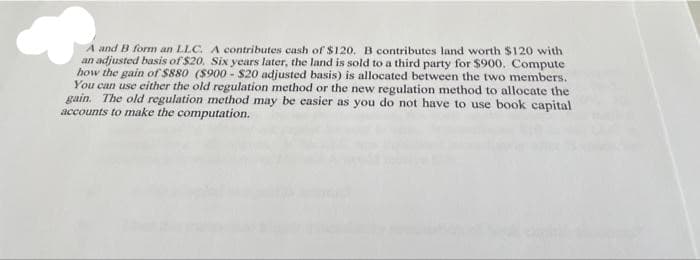

Transcribed Image Text:A and B form an LLC. A contributes cash of $120, B contributes land worth $120 with

an adjusted basis of $20. Six years later, the land is sold to a third party for $900. Compute

how the gain of $880 ($900 - $20 adjusted basis) is allocated between the two members.

You can use either the old regulation method or the new regulation method to allocate the

gain. The old regulation method may be casier as you do not have to use book capital

accounts to make the computation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT