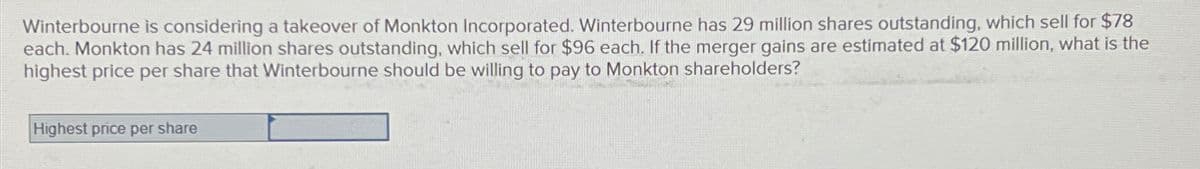

Winterbourne is considering a takeover of Monkton Incorporated. Winterbourne has 29 million shares outstanding, which sell for $78 each. Monkton has 24 million shares outstanding, which sell for $96 each. If the merger gains are estimated at $120 million, what is the highest price per share that Winterbourne should be willing to pay to Monkton shareholders? Highest price per share

Q: Olivia plans to secure a 5-year balloon mortgage of $220,000 toward the purchase of a condominium.…

A: The objective of this question is to calculate Olivia's monthly mortgage payment for the first 5…

Q: An investor currently holds the following portfolio: Amount Invested 8,000 shares of Stock A $16,000…

A: Invested Value of Stock A = va = $16,000Invested Value of Stock B = vb = $48,000Invested Value of…

Q: Alpha Beta Delta Morso Current Assets 350 612 411 406 Current Liabilities 175 411 613 198 Debt 500…

A: Debt to Equity Ratio: The debt to equity ratio measures how much debt a company has taken on…

Q: Foundation, Incorporated, is comparing two different capital structures: an all-equity plan (Plan I)…

A: The value of a firm, also known as its enterprise value, represents the total worth of the company.…

Q: You find the following corporate bond quotes. To calculate the number of years until maturity,…

A: A bond provides the issuing company access to debt capital from investors and other non-traditional…

Q: 23 Question 12: Mad Max Inc. has a dividend policy that increases annual dividends by 3% each year.…

A: Step 1: Calculate the next year's expected dividend (D1).D1 = D0 × (1 + g)D1 = $2.50 × (1 + 0.03) =…

Q: The Telwar Company has just gone public. Under a firm commitment agreement, the company received…

A: Solution:Floatation cost refers to the cost incurred by a company while issuing its securities in…

Q: Journalize the entries to record the transactions of Air Systems Company. Refer to the chart of…

A: Let's journalize the transactions for Air Systems Company based on the provided chart of accounts.…

Q: ABC Inc. has distributed a $1.31 annual dividend to its stockholders. For the following seven years,…

A: Current Dividend = d0 = $1.31Growth Rate for next 7 Years = g7 = 24%Growth Rate after year 7 = g =…

Q: Amarjeet graduated from the University of Calgary on May 2 and has student loans totalling…

A: A student loan refers to a loan that is extended to students to finance their education fees. It…

Q: Don't provide hand writing solution

A: Step 1: Calculate the cash flow from the old steamer.Sale of old steamer at the end of its useful…

Q: The stock market data is given in the following table. Correlation Coefficients Telmex Telmex Mexico…

A: Capital Asset Pricing Model is used to calculate the required rate of return of the stock or equity…

Q: Bond J has a coupon of 7.8 percent. Bond K has a coupon of 11.8 percent. Both bonds have 12 years to…

A: The yield to maturity measures the bond's interest payments as well as any capital gains or losses…

Q: determine the present value that will grow to a future value of $1250 in 5 years at 10% interest…

A: Future value = $1250Number of years = 5Interest rate = 10%To find: The present value.

Q: What is the duration of a bond with a $1,000 par value and a 7% coupon rate. The bond matures in 3…

A: The objective of the question is to calculate the duration of a bond. Duration is a measure of the…

Q: The following table contains data to calculate forward rates using pure expectations theory. a) Find…

A: (1 + 10 year spot rate)10 = (1 + 2 year spot rate)2 * (1 + 8 year forward rate 2 years from now)8(1…

Q: A 20-year mortgage has an annual interest rate of 5.5 percent and a loan amount of $210,000. (Hint:…

A: A mortgage refers to a loan borrowed for a property purchase that is covered by the property itself.…

Q: For this question, please refer to the Fact Pattern below (Same fact pattern as previous question).…

A: Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) can be calculated…

Q: Consider the following information on Stocks I and II: Probability of Rate of Return if State Occurs…

A: Beta and standard deviation are critical components in finance for assessing investment risk. Beta…

Q: The so-called ``flight to quality'', which happens during a financial crisis, causes the risk…

A: The objective of the question is to understand the impact of a 'flight to quality' during a…

Q: der the following two mutually exclusive projects: Cash Flow (A) Cash Flow (B) Year -$ -$ 0 354,000…

A: This question is related to capital budgeting. Here two mutually exclusive projects are given. Hence…

Q: Cost of common stock equity Ross Textiles wishes to measure its cost of common stock equity. The…

A: The objective of the question is to calculate the average annual dividend growth rate over the past…

Q: Calculate the interest amount and current yield for the following $1,000 bonds: Note: Round your…

A: Bonds are debt instruments issued by governments, municipalities, or corporations to raise funds,…

Q: A contract requires lease payments of $ 900 at the beginning of every month for 6 years. What is the…

A: Formula used for present value is given belowwhere,Monthly lease payment PMT = $900Annual interest…

Q: Bretton, Inc., just paid a dividend of $3.15 on its stock. The growth rate in dividends is expected…

A: Variables in the question:D0=$3.15 g=5% per year (indefinitely)Required rate of return for first…

Q: Rebecky's Flowers 4U, Inc., had free cash flows during 2021 of $40 million, NOPAT of $80 million,…

A: Balance Sheet -A declaration that depicts the company's financial situation is the balance sheet.…

Q: What annual lease payment must Ajax (lessor) require from the lessee if the required rate of return…

A: Lease payment is the amount of money a person spends annually to rent a vehicle or a house from…

Q: Olivia plans to secure a 5-year balloon mortgage of $220,000 toward the purchase of a condominium.…

A: A balloon payment is a large, lump sum payment made at the end of a long-term loan or mortgage. It…

Q: A thirty-year annuity has end - value of the annuity if i = 3 % - of month payments. The first year…

A: Step 1:It is given that, A thirty-year annuity has end of month payment and the first-year payment…

Q: Solve for the Yield using the following data: Frequency Semi If Held to Maturity Coupon 7% Cash Flow…

A: Coupon rate = 7%Maturity = 5 yearsPar value = $1000Current price = $1047Call price = $1040Years till…

Q: Suppose you will need $43,000 in 21 years. If your bank compounds interest at an annual rate of 4%,…

A: Future Value (FV) of amount needed = $43,000Interest rate (r) = 4% or 0.04We need to calculate the…

Q: A firm has a weighted average cost of capital of 8.4%, a cost of equity is 11%, and a pretax cost of…

A: GivenWeighted Average Cost of Capital (WACC) = 8.40%Company's Cost of Equity =11%Pre-tax cost of…

Q: K Roundtree Software is going public using an auction IPO. The firm has received the following bids:…

A: Step 1: PricesNo. of Shares 14120,000 13.8200,000 13.6560,000 13.41,100,000…

Q: Lacy has a $43,500.00 student loan when she graduates on May 4, and the prime rate is set at 5.25%.…

A: Amortization refers to a systematic and regular repayment of a loan and interest. Each payment…

Q: DE Inc.'s current (and optimal) capital structure is 40% debt, 10% preferred stock, and 50% common…

A: Price of common stock = $98Expected dividend per share = $1Flotation cost = $2Growth rate = 11% Cost…

Q: a. What is the standard deviation of your portfollo? (Do not round Intermediate calculations. Round…

A: The standard deviation can be used to calculate how dispersed a set of numbers is. It is minimal…

Q: Consider a firm with an annual net income of $25 million, revenue of $68 million and cost of goods…

A: The problem requires the weeks of supply the firm holds. The given are net income of $25 million,…

Q: The manager of a firm at t=0 has to decide whether to liquidate or to continue. If he decides to…

A: Step 1:The image you sent is a decision-making problem about a firm facing financial difficulty. The…

Q: Vijay

A: given :free cash flow = 59.1 millioninvestment in operating capital = 42.1 milliondepreciation =…

Q: Q1. mr. Nowak has accumulated $ 138 at the end of each six months into an RRSP paying 5% per annum…

A: Given:P = $138r=0.05n=20

Q: he following table shows the net cash flow for each currency for Cleveland Co. Currency Euro Total…

A: Transaction exposure is the risk due to the change in exchange rate of currency in doing…

Q: Clayton Moore's Money Fund. Clayton Moore is the manager of an international money market fund…

A: Initial Investment £ 11,75,000.00Fixed Rate of RM for 7 years( RM/ $) RM…

Q: are Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: WACC is the cost of capital and is the weighted cost of equity and weighted cost of debt and is the…

Q: On July 15, when the prime rate was set at 3.5%, Canadian Footwear took out an operating loan from…

A: 1. August 15: - Balance before transaction: $9,750.00 - Annual interest rate: 3.5% - Number of…

Q: Maple Tree Industries has $265, 000 to invest. The company is trying to decide between two…

A: NPV : It stands for net present value. Net present value is the financial calculation to determine…

Q: roblem 17-18 Real Estate Valuation (LO4, CFA3) enterland Partners has collected information on the…

A: Shopping CenterNOIValuationCastleton Round$3.4$11.20Fashion Commons$5.0$39.22Belden…

Q: he table below shows information for 3 stocks. Security Beta Risk-free rate Expected market return…

A: The CAPM refers to the relationship between the systematic risk faced by the investment and the…

Q: ces A stock has had returns of 10 percent, 28 percent, 15 percent, -16 percent, 28 percent, and -6…

A: The arithmetic return is considered the simplest form of average. In arithmetic average return what…

Q: A portfolio manager is assessing the interest rate risk of three bonds as she considers making an…

A: Part 2: Explanation:Step 1: Understand Macaulay duration:Macaulay duration is a measure of the…

Q: 15. Find the implied volatility (to 2 decimals, for example, σ = 8.23%) of a Put option with a time…

A: We can decide the cost of a put choice utilizing BSOPM utilizing the equation underneath: We can…

Step by step

Solved in 2 steps

- McNabb Enterprises is considering going private through a leveraged buyout by management. Management currently owns 21 percent of the 5 million shares outstanding. Market price per share is $20, and it is felt that a 40 percent premium over the present price will be necessary to entice public shareholders to tender their shares in a cash offer. Management intends to keep its shares and to obtain senior debt equal to 80 percent of the funds necessary to consummate the buyout. The remaining 20 percent will come from junior subordinated debentures. Terms on the senior debt are 2 percent above the prime rate with principal reductions of 20 percent of the initial loan at the end of each of the next five years. The junior subordinated debentures bear a 13 percent interest rate and must be retired at the end of six years with a single balloon payment. The debentures have warrants attached that enable the holders to purchase 30 percent of the stock at the end of the sixth year. Management…e. Rearden Metal is thinking of buying Associated Steel, which has earnings per share of $1.25, 4 million shares outstanding, and a price per share of $15. Rearden Metal will pay for Associated Steel by issuing new shares. There are no expected synergies from the transaction. If Rearden pays no premium to buy Associated Steel, then Rearden's price-earnings ratio after the merger will be closest to: 10.0. 10.42. 12.0. 7.8.The Woods Co. and the Mickelson Co. have both announced IPOs at $53 per share. One of these is undervalued by $11, and the other is overvalued by $2, but you have no way of knowing which is which. You plan to buy 800 shares of each issue. If an issue is underpriced, it will be rationed, and only half your order will be filled. If you could get 800 shares in Woods and 800 shares in Mickelson, what would your profit be? (Do not round intermediate calculations.) I found the price of an ideal situaiton but am not sure how to distribute numbers in the expected profit situation

- LYFT IPO was issued at $72/share. Before the IPO, Lyft had 240 million class A shares outstanding and wanted to issue additional 30 million class A shares. On top of that, Lyft gave its underwriters options to purchase another 5 million shares at $72 each. When Lyft stock price fell below the IPO price of $72, to support the stock price, up to how many shares the underwriters could buy from the open market without losing money? 5 million shares 30 million shares 35 million shares 240 million shares 275 million sharesBeedles Inc. needed to raise $14 million in an IPO and chose Security Brokers Inc. to underwrite the offering The agreement stated that Security Brokers would sell 3 million shares to the public and provide $14 million net proceeds to Beedles. The out- of- pocket expenses incurred by Security Brokers in the design and distribution of the issue were $460,000 . What profit Or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. For example, 5 million should be entered as 5, 000, 000. Round your answers to the hearest dollar. Loss should be indicated by a minus sign. $5.25 per share? $ $6 per share? $ $3.5 per share? $Rearden Metal has earnings per share of $2. It has 10 million shares outstanding and is trading at $20 per share. Rearden Metal is thinking of buying Associated Steel, which has earnings per share of $1.25, 4 million shares outstanding, and a price per share of $15. Rearden Metal will pay for Associated Steel by issuing new shares. There are no expected synergies from the transaction. If Rearden pays no premium to buy Associated Steel, then Rearden's price/earnings ratio after the merger will be closest to: Answer choices A) 12 B) 10.42 C) 7.80 D) 10

- Beedles Inc. needed to raise $14 million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated that Security Brokers would sell 3 million shares to the public and provide $14 million in net proceeds to Beedles. The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $300,000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. A. $6.5 per share? B.$3.5 per share?Beedles Inc. needed to raise $14 million in an IPO and chose Security Brokers Inc. to underwrite the offering. The agreement stated that Security Brokers would sell 3 million shares to the public and provide $14 million in net proceeds to Beedles. The out-of-pocket expenses incurred by Security Brokers in the design and distribution of the issue were $490,000. What profit or loss would Security Brokers incur if the issue were sold to the public at the following average price? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answers to the nearest dollar. Loss should be indicated by a minus sign. $5 per share? $ $7 per share? $ $4 per share? $The managing directors of Track PLC are considering what value to place on Money Plus PLC, a company which they are planning to take over soon. Track PLC’s share price is currently £4.21, and the company’s earnings per share stand at 29p. Track’s weighted average cost of capital is 12%.The board estimates that annual after-tax synergy benefits resulting from the takeover will be £5m, that Money Plus’s distributable earnings will grow at an annual rate of 2% and that duplication will allow the sale of £25m of assets, net of corporate tax (currently standing at 30%), in a year’s time. Information relating to Money Plus PLC:Financial Position Statement of Money plus PLC.£m Non-Current Assets 296 Current Assets 70366 Equity:Ordinary Shares (£1) 156 Reserves 75 2317% Bonds 83 Current Liabilities 52 Total Liabilities 366 Statement of Profit or Loss Extracts£m Profit before interest and tax 76.0 Interest payments 8.3 Profit before tax 67.7 Taxation 20.3 Distributable Earnings 47.4Other…

- Fishwick Enterprises has 201,500 shares outstanding, half of which are owned by Jennifer Fishwick and half by her cousin. The two cousins have decided to sell 101,000 shares in an IPO. Half of these shares would be issued by the company to raise new cash, and half would be shares that are currently held by Jennifer Fishwick. Suppose that the shares are sold at an issue price of $50 but rise to $80 by the end of the first day’s trading. Suppose also that investors would have been prepared to buy the issue at $80. a. Percentage of ownership 20 % b. Stock value $4,020,000 c. Number of shares 63,125 d. Total wealth ?? million e. Cost of underpricing shares ?? millionThe Sullivan Co. needs to raise $78 million to finance its expansion into new markets. The company will sell new shares of equity via a general cash offering to raise the needed funds. If the offer price is $31 per share and the company's underwriters charge a spread of 7 percent, how many shares need to be sold? In the previous problem, if the SEC filing fee and associated administrative expenses of the offering are $1,425,000, how many shares need to be sold now?A large manufacturing company has offered to purchase Composites, Inc. for$32 per share. Before the merger proposal announcement, Composites wastrading at $20/share and, after the announcement, its share price jumped up to$28/share. It is estimated that, if the merger fails to go through, the price ofComposites will drop to $15/share. a) Assuming that the risk-free interest rate is 0%, how would you describea long position in Composites as a combination of positions in a risk-freebond and a binary put option? Please show your workings in detial.b) Assuming that the risk-free interest rate is 0%, how would you describea long position in Composites as a combination of positions in a risk-freebond and a binary call option? Please show your workings in detial.c) Please explain the event-driven strategies through the selling insuranceview.