Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Please help solve 21-30

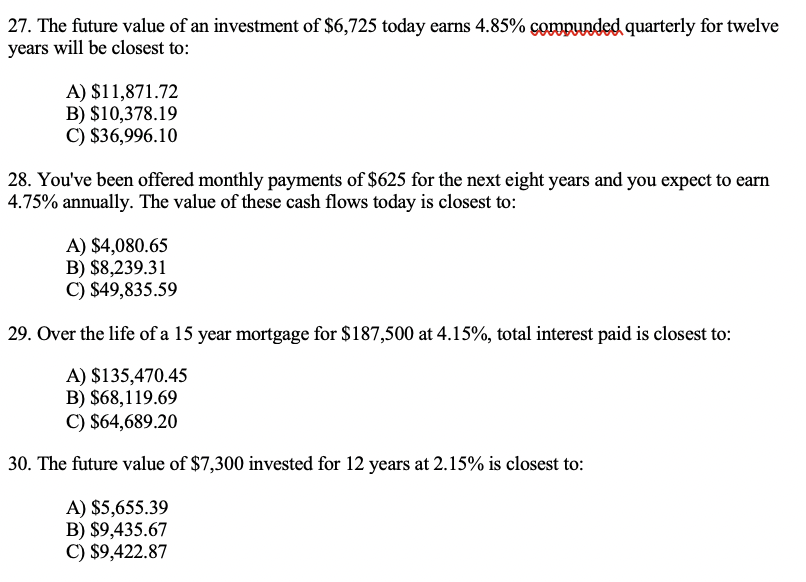

Transcribed Image Text:27. The future value of an investment of $6,725 today earns 4.85% compunded quarterly for twelve

years will be closest to:

A) $11,871.72

B) $10,378.19

C) $36,996.10

28. You've been offered monthly payments of $625 for the next eight years and you expect to earn

4.75% annually. The value of these cash flows today is closest to:

A) $4,080.65

B) $8,239.31

C) $49,835.59

29. Over the life of a 15 year mortgage for $187,500 at 4.15%, total interest paid is closest to:

A) $135,470.45

B) $68,119.69

C) $64,689.20

30. The future value of $7,300 invested for 12 years at 2.15% is closest to:

A) $5,655.39

B) $9,435.67

C) $9,422.87

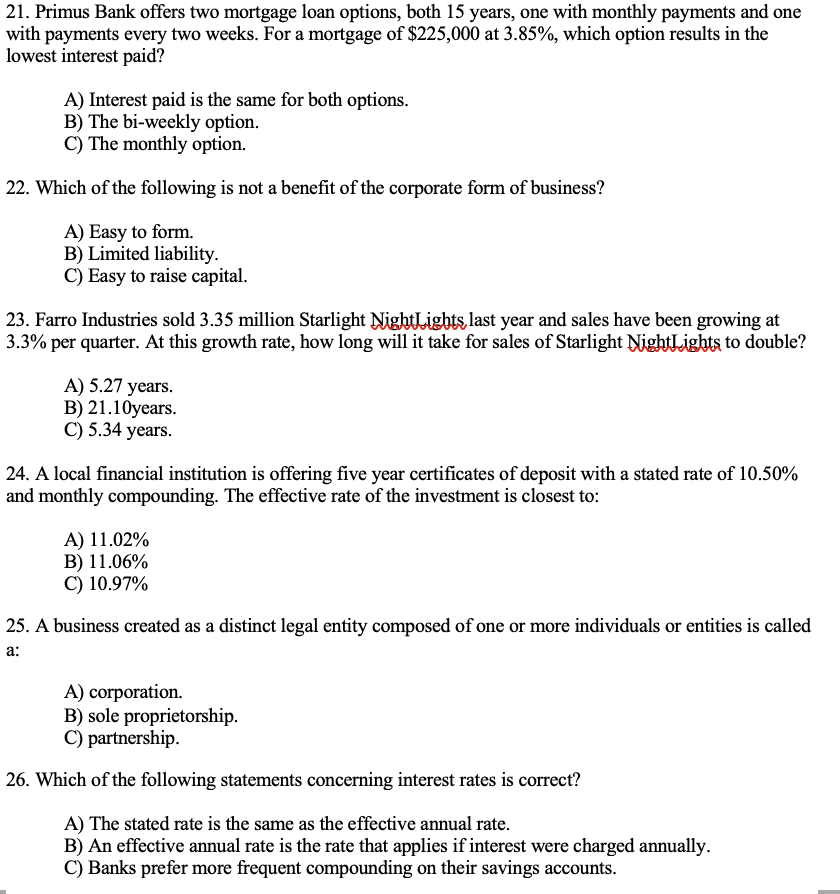

Transcribed Image Text:21. Primus Bank offers two mortgage loan options, both 15 years, one with monthly payments and one

with payments every two weeks. For a mortgage of $225,000 at 3.85%, which option results in the

lowest interest paid?

A) Interest paid is the same for both options.

B) The bi-weekly option.

C) The monthly option.

22. Which of the following is not a benefit of the corporate form of business?

A) Easy to form.

B) Limited liability.

C) Easy to raise capital.

23. Farro Industries sold 3.35 million Starlight NightLights last year and sales have been growing at

3.3% per quarter. At this growth rate, how long will it take for sales of Starlight NightLights to double?

A) 5.27 years.

B) 21.10years.

C) 5.34 years.

24. A local financial institution is offering five year certificates of deposit with a stated rate of 10.50%

and monthly compounding. The effective rate of the investment is closest to:

A) 11.02%

B) 11.06%

C) 10.97%

25. A business created as a distinct legal entity composed of one or more individuals or entities is called

a:

A) corporation.

B) sole proprietorship.

C) partnership.

26. Which of the following statements concerning interest rates is correct?

A) The stated rate is the same as the effective annual rate.

B) An effective annual rate is the rate that applies if interest were charged annually.

C) Banks prefer more frequent compounding on their savings accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning