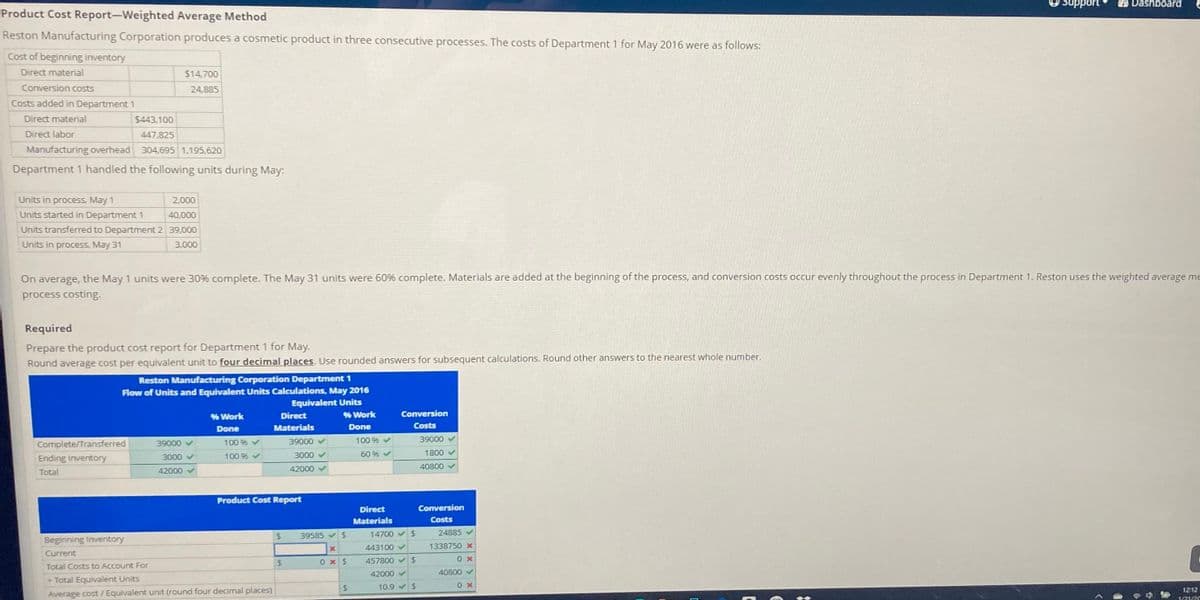

With the information given how do I calculate the current cost conversion?

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter18: Activity-Based Costing

Section: Chapter Questions

Problem 18.3TIF: Communication The controller of New Wave Sounds Inc. prepared the following product profitability...

Related questions

Question

With the information given how do I calculate the current cost conversion?

Transcribed Image Text:Support

2 Dashboard

Product Cost Report-Weighted Average Method

Reston Manufacturing Corporation produces a cosmetic product in three consecutive processes. The costs of Department 1 for May 2016 were as follows:

Cost of beginning inventory

Direct material

$14,700

Conversion costs

24,885

Costs added in Department 1

Direct material

$443,100

Direct labor

447,825

Manufacturing overhead

304,695 1.195,620

Department 1 handled the following units during May:

Units in process, May 1

2,000

Units started in Department 1

40,000

Units transferred to Department 2 39,000

Units in process, May 31

3,000

On average, the May 1 units were 30% complete. The May 31 units were 60% complete. Materials are added at the beginning of the process, and conversion costs occur evenly throughout the process in Department 1. Reston uses the weighted average me

process costing.

Required

Prepare the product cost report for Department 1 for May.

Round average cost per equivalent unit to four decimal places. Use rounded answers for subsequent calculations. Round other answers to the nearest whole number.

Reston Manufacturing Corporation Department 1

Flow of Units and Equivalent Units Calculations, May 2016

Equivalent Units

% Work

Direct

% Work

Conversion

Done

Materials

Done

Costs

Complete/Transferred

39000

100 % V

39000 v

100 % V

39000

3000 v

100 96 v

3000

60 % v

1800 v

Ending Inventory

42000

40800 V

Total

42000

Product Cost Report

Direct

Conversion

Materials

Costs

39585

14700

24885 V

Beginning Inventory

443100 v

1338750 x

Current

0 x $

457800 vS

0 x

Total Costs to Account For

42000 v

40800 v

+ Total Equivalent Units

10.9 $

1212

Average cost / Equivalent unit (round four decimal places)

1/2120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning