work i = aw 11 INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow $ 27,571 17,573 1,406 $ 8,592 2022 million million million 521 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 In 2022 Quick Burger had capital expenditures of $3,053. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 Saved 121 620 $ 4,420 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment < Prev Accounts payable Total current liabilities Long-term debt $ 22,839 Other long-term liabilities 2,657 Total liabilities 3,103 Total shareholders' equity $ 33,019 Total liabilities and shareholders' equity b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. 5 of 5 2022 Next > $3,407 $ 3,407 $ 13,637 3,061 $ 20,105 15,309 $ 35,414 Help 2021 $ 379 3,147 $ 3,526 $ 12,138 2,961 Save $ 18,625 14,394 $ 33,019 C

work i = aw 11 INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income Federal taxes (@ 21%) Net income Assets Current assets Cash and marketable securities Receivables Inventories Other current assets Total current assets Fixed assets Property, plant, and equipment Intangible assets (goodwill) Other long-term assets Total assets a. Free cash flow b. Additional tax c. Free cash flow $ 27,571 17,573 1,406 $ 8,592 2022 million million million 521 8,071 1,695 $ 6,376 BALANCE SHEET OF QUICK BURGER CORPORATION, 2022 (Figures in $ millions) 2021 $ 2,340 1,379 126 1,093 $ 4,938 In 2022 Quick Burger had capital expenditures of $3,053. a. Calculate Quick Burger's free cash flow in 2022. Note: Enter your answer in millions. $ 24,681 2,808 2,987 $ 35,414 $ 2,340 1,339 Saved 121 620 $ 4,420 Liabilities and Shareholders' Equity Current liabilities Debt due for repayment < Prev Accounts payable Total current liabilities Long-term debt $ 22,839 Other long-term liabilities 2,657 Total liabilities 3,103 Total shareholders' equity $ 33,019 Total liabilities and shareholders' equity b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.) Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. c. What would the company's free cash flow have been if it was all-equity financed? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number. 5 of 5 2022 Next > $3,407 $ 3,407 $ 13,637 3,061 $ 20,105 15,309 $ 35,414 Help 2021 $ 379 3,147 $ 3,526 $ 12,138 2,961 Save $ 18,625 14,394 $ 33,019 C

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter6: Accounting For Financial Management

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:W

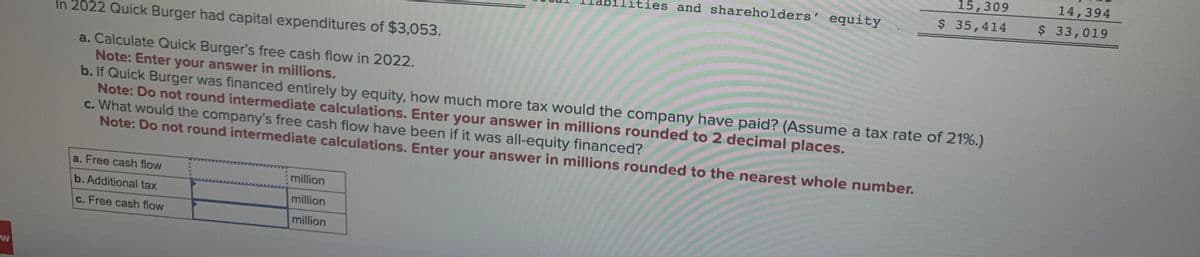

In 2022 Quick Burger had capital expenditures of $3,053.

a. Calculate Quick Burger's free cash flow in 2022.

Note: Enter your answer in millions.

b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.)

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

c. What would the company's free cash flow have been if it was all-equity financed?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number.

a. Free cash flow

b. Additional tax

c. Free cash flow

million

million

million

ities and shareholders' equity

15,309

$ 35,414

14,394

$ 33,019

Transcribed Image Text:mework i

0

ences

Mc

Graw

Hill

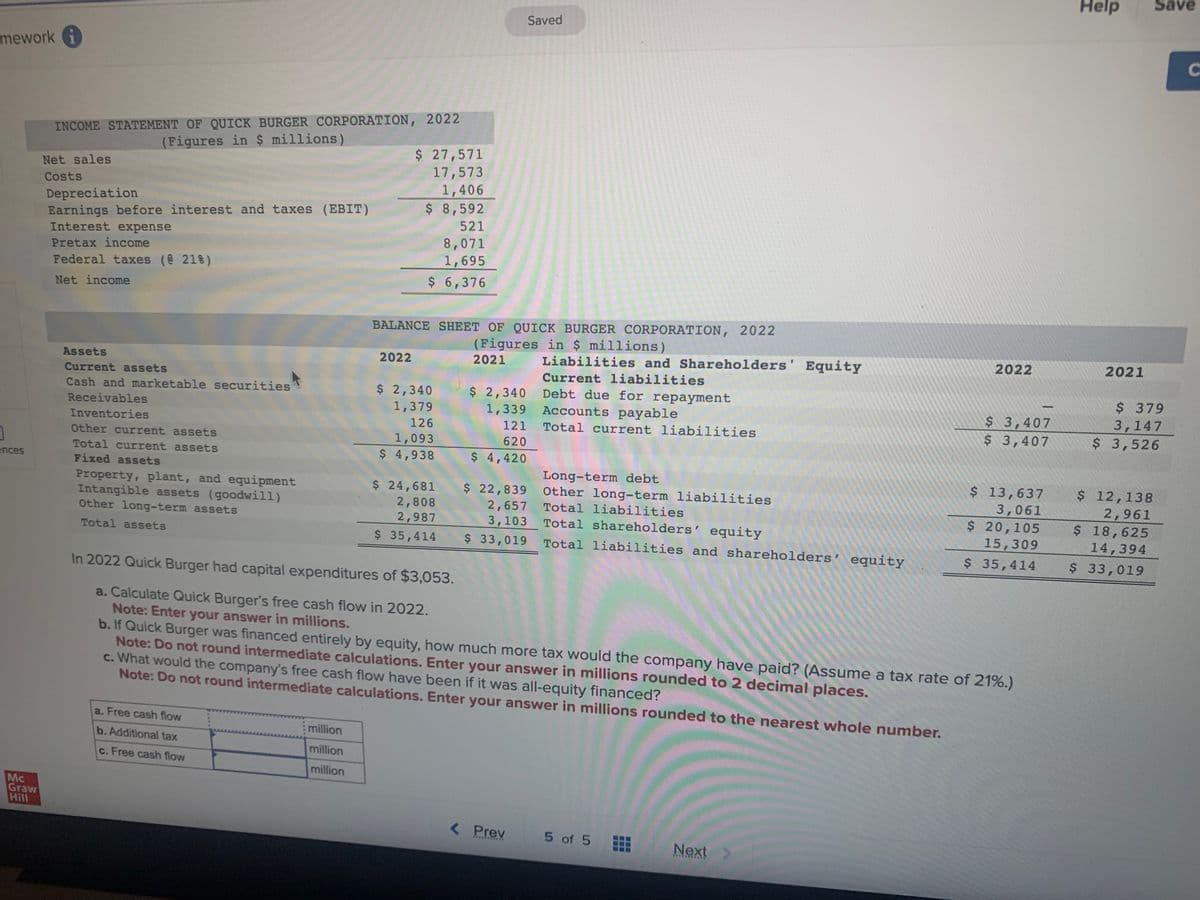

INCOME STATEMENT OF QUICK BURGER CORPORATION, 2022

(Figures in $ millions)

Net sales

Costs

Depreciation

Earnings before interest and taxes (EBIT)

Interest expense

Pretax income

Federal taxes (@ 21%)

Net income

Assets

Current assets

Cash and marketable securities

Receivables

Inventories

Other current assets

Total current assets

Fixed assets

Property, plant, and equipment

Intangible assets (goodwill)

Other long-term assets

Total assets

a. Free cash flow

b. Additional tax

c. Free cash flow

million

million

million

$ 27,571

17,573

1,406

$ 8,592

521

2022

8,071

1,695

$ 6,376

BALANCE SHEET OF QUICK BURGER CORPORATION, 2022

(Figures in $ millions)

2021

$ 2,340

1,379

126

1,093

$ 4,938

$ 24,681

2,808

2,987

$ 35,414

$ 2,340

1,339

121

620

$ 4,420

Saved

$ 22,839

2,657

3,103

Liabilities and Shareholders' Equity

Current liabilities

Debt due for repayment

Long-term debt

Other long-term liabilities

Total liabilities

Total shareholders' equity

$ 33,019 Total liabilities and shareholders' equity

< Prev

***********

Accounts payable

Total current liabilities

In 2022 Quick Burger had capital expenditures of $3,053.

a. Calculate Quick Burger's free cash flow in 2022.

Note: Enter your answer in millions.

b. If Quick Burger was financed entirely by equity, how much more tax would the company have paid? (Assume a tax rate of 21%.)

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

c. What would the company's free cash flow have been if it was all-equity financed?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole number.

5 of 5

2022

Next

SHARROAK

$ 3,407

$ 3,407

-

$ 13,637

3,061

$ 20,105

15,309

$ 35,414

Help

2021

Save

$ 379

3,147

$ 3,526

$ 12,138

2,961

$ 18,625

14,394

$ 33,019

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning