Work in Process Materials Machinery Accounts Payable Common Stock Retained Earnings 65,000 15,000 44,000 70,600 118,750 200,000 69,850 Details of the three inventories are: Finished goods inventory: Item A - 2,000 units at P 12.50 Item B - 4,000 units at P 10.00 Total P 25,000 40,000 P 65,000 Job 102 Work in process inventory: Job 101 Direct materials: 1,000 units at P 5.00 P 5,000 400 units at P 3.00 P 1,200 Direct labor: 1,000 hours at P 4.00 400 hours at P 5.00 4,000 2,000 Factory overhead: Applied at P 2.00/hour Total Materials inventory: 800 2,000 PL1,000 P 4,000 Material X - 4,000 units at P 5.00 Material Y-8,000 units at P 3.00 Total P 20,000 24,000 44,000 P.

Work in Process Materials Machinery Accounts Payable Common Stock Retained Earnings 65,000 15,000 44,000 70,600 118,750 200,000 69,850 Details of the three inventories are: Finished goods inventory: Item A - 2,000 units at P 12.50 Item B - 4,000 units at P 10.00 Total P 25,000 40,000 P 65,000 Job 102 Work in process inventory: Job 101 Direct materials: 1,000 units at P 5.00 P 5,000 400 units at P 3.00 P 1,200 Direct labor: 1,000 hours at P 4.00 400 hours at P 5.00 4,000 2,000 Factory overhead: Applied at P 2.00/hour Total Materials inventory: 800 2,000 PL1,000 P 4,000 Material X - 4,000 units at P 5.00 Material Y-8,000 units at P 3.00 Total P 20,000 24,000 44,000 P.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 5AP

Related questions

Topic Video

Question

Transcribed Image Text:On December 31, 2019, after closing, the ledgers of Golden Shower Company

contained these accounts and balances:

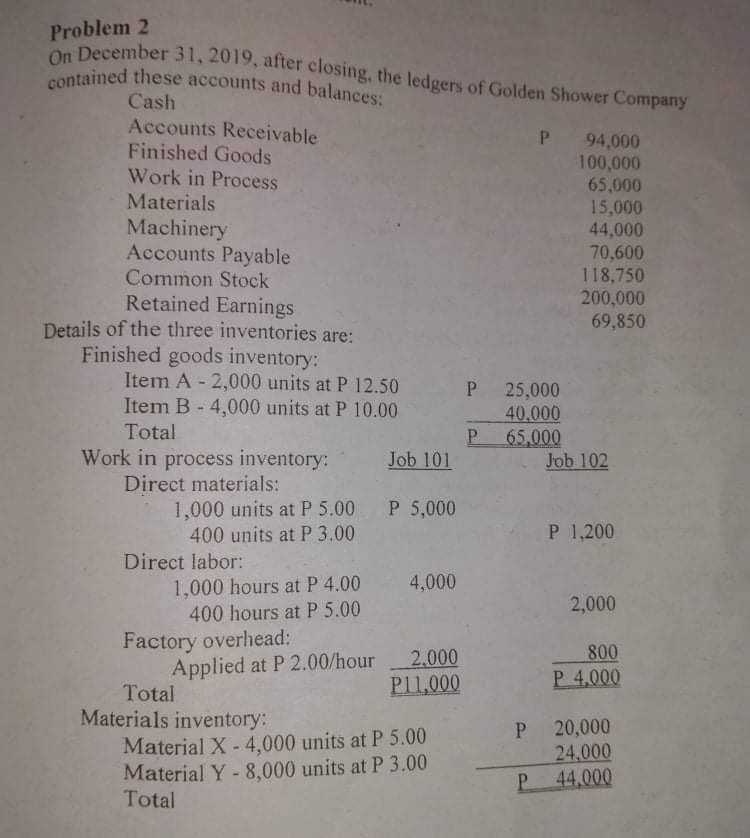

Problem 2

On December 31, 2019, after closing, the ledgers of Golden Shower Company

contained these accounts and balances:

Cash

Accounts Receivable

Finished Goods

Work in Process

P 94,000

100,000

65,000

15,000

44,000

70,600

118,750

200,000

69,850

Materials

Machinery

Accounts Payable

Common Stock

Retained Earnings

Details of the three inventories are:

Finished goods inventory:

Item A - 2,000 units at P 12.50

Item B - 4,000 units at P 10.00

P 25,000

40.000

P 65,000

Job 102

Total

Work in process inventory:

Job 101

Direct materials:

1,000 units at P 5.00 P 5,000

400 units at P 3.00

P 1,200

Direct labor:

1,000 hours at P 4.00

400 hours at P 5.00

4,000

2,000

Factory overhead:

Applied at P 2.00/hour

Total

800

2,000

PL1,000

P 4,000

Materials inventory:

20,000

Material X- 4,000 units at P 5.00

Material Y- 8,000 units at P 3.00

Total

P.

24,000

P 44,000

Transcribed Image Text:a) Purchases on account: Material X- 20,000 units at P5.20; Material Y -24,000

b) Payroll totaling P220,000 was paid. Of the total payroll, P40,000 was for

marketing and administrative salaries. Payroll deductions consisted of P31,000

c) Payroll is to be distributed as follows: Job 101 - 10,000 direct labor hours at P

for withholding taxes, P7,000 for SSS premiums, P 440 for Medicare

4.00, Job 102 - 16,000 direct labor hours at P5.00; Job 103 - 12,000 direct

labor hours at P3.00; indirect labor - P24,000; marketing and administrative

d) Materials were issued on a FIFO basis as follows: Material X- 20,000 units

salaries - P40,000. Employer's payroll taxes are: SSS Premiums 5%,

146

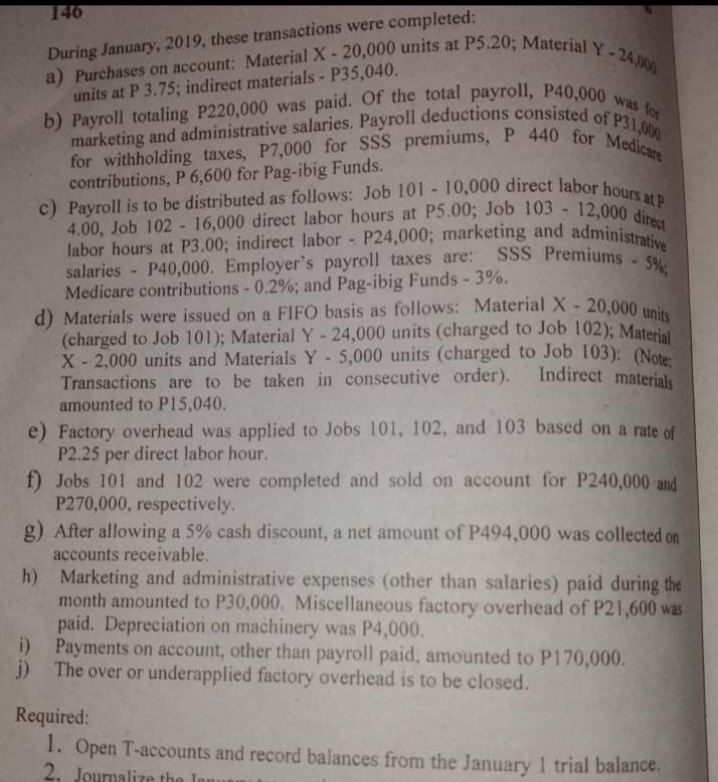

During January, 2019, these transactions were completed:

units at P 3.75; indirect materials - P35,040.

contributions, P 6,600 for Pag-ibig Funds.

labor hours at P3.00; indirect labor - P24,000; marketing and administ

salaries - P40,000. Employer's payroll taxes are:

Medicare contributions - 0.2%; and Pag-ibig Funds - 3%.

(charged to Job 101); Material Y- 24,000 units (charged to Job 102): Materi

X - 2,000 units and Materials Y-5,000 units (charged to Job 103): (Note

Transactions are to be taken in consecutive order).

amounted to P15,040.

Indirect materials

e) Factory overhead was applied to Jobs 101, 102, and 103 based on a rate of

P2.25 per direct labor hour.

f) Jobs 101 and 102 were completed and sold on account for P240,000 and

P270,000, respectively.

g) After allowing a 5% cash discount, a net amount of P494,000 was collected on

accounts receivable.

h) Marketing and administrative expenses (other than salaries) paid during the

month amounted to P30,000. Miscellaneous factory overhead of P21,600 was

paid. Depreciation on machinery was P4,000.

i) Payments on account, other than payroll paid, amounted to P170,000.

j) The over or underapplied factory overhead is to be closed.

Required:

1. Open T-accounts and record balances from the January 1 trial balance.

2. Journalize the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage