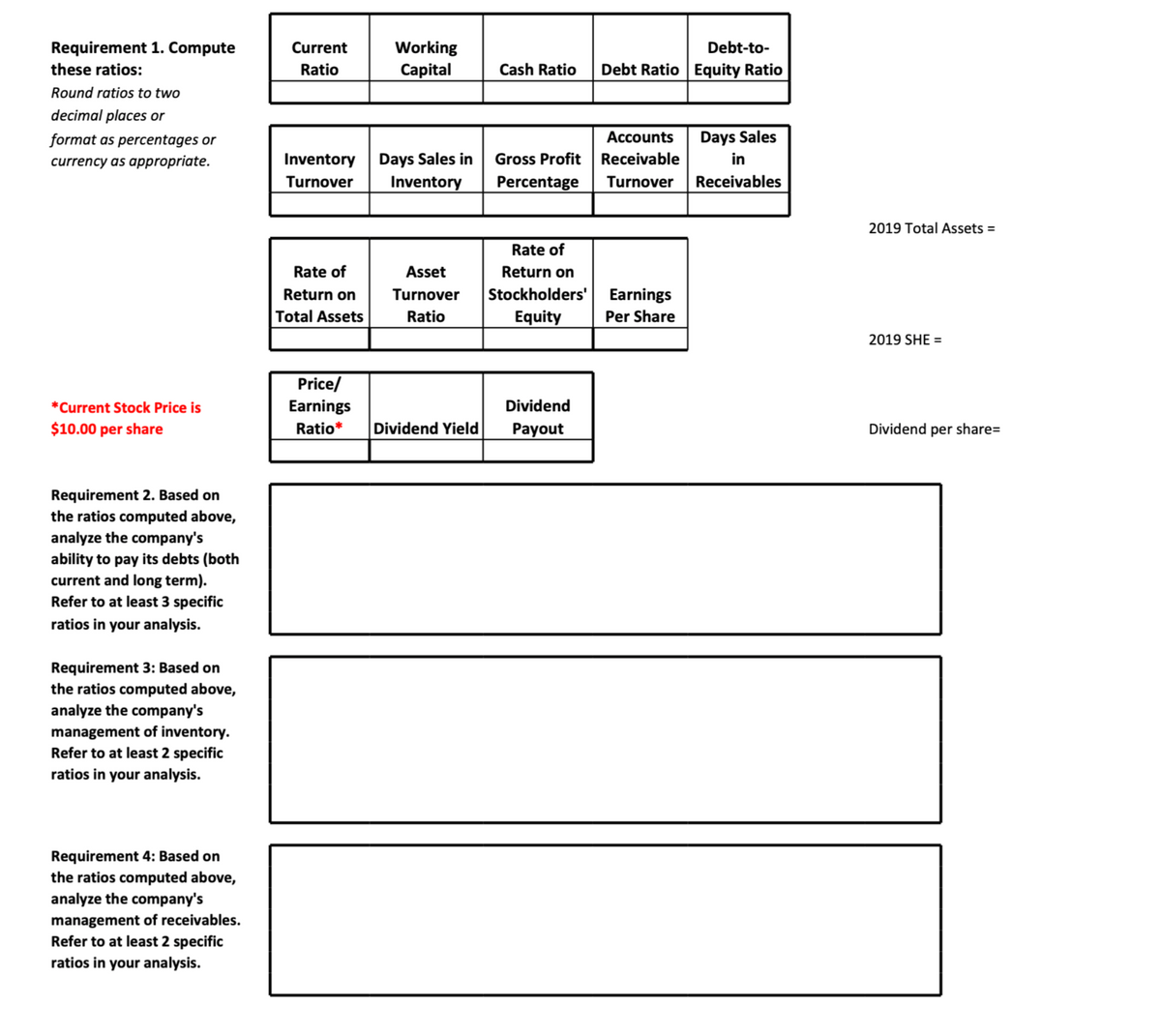

Working Capital Requirement 1. Compute Current Debt-to- these ratios: Ratio Cash Ratio Debt Ratio Equity Ratio Round ratios to two decimal places or format as percentages or Accounts Days Sales Gross Profit Receivable Days Sales in Inventory currency as appropriate. Inventory in Turnover Percentage Turnover Receivables

Working Capital Requirement 1. Compute Current Debt-to- these ratios: Ratio Cash Ratio Debt Ratio Equity Ratio Round ratios to two decimal places or format as percentages or Accounts Days Sales Gross Profit Receivable Days Sales in Inventory currency as appropriate. Inventory in Turnover Percentage Turnover Receivables

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5PA: The following selected accounts and their current balances appear in the ledger of Clairemont Co....

Related questions

Question

Transcribed Image Text:Requirement 1. Compute

Current

Working

Debt-to-

these ratios:

Ratio

Capital

Cash Ratio

Debt Ratio Equity Ratio

Round ratios to two

decimal places or

format as percentages or

Accounts

Days Sales

Inventory Days Sales in

Inventory

Gross Profit Receivable

Percentage

currency as appropriate.

in

Turnover

Turnover Receivables

2019 Total Assets =

Rate of

Rate of

Asset

Return on

Stockholders'| Earnings

Equity

Return on

Turnover

Total Assets

Ratio

Per Share

2019 SHE =

Price/

*Current Stock Price is

Earnings

Dividend

$10.00 per share

Ratio*

Dividend Yield

Рayout

Dividend per share=

Requirement 2. Based on

the ratios computed above,

analyze the company's

ability to pay its debts (both

current and long term).

Refer to at least 3 specific

ratios in your analysis.

Requirement 3: Based on

the ratios computed above,

analyze the company's

management of inventory.

Refer to at least 2 specific

ratios in your analysis.

Requirement 4: Based on

the ratios computed above,

analyze the company's

management of receivables.

Refer to at least 2 specific

ratios in your analysis.

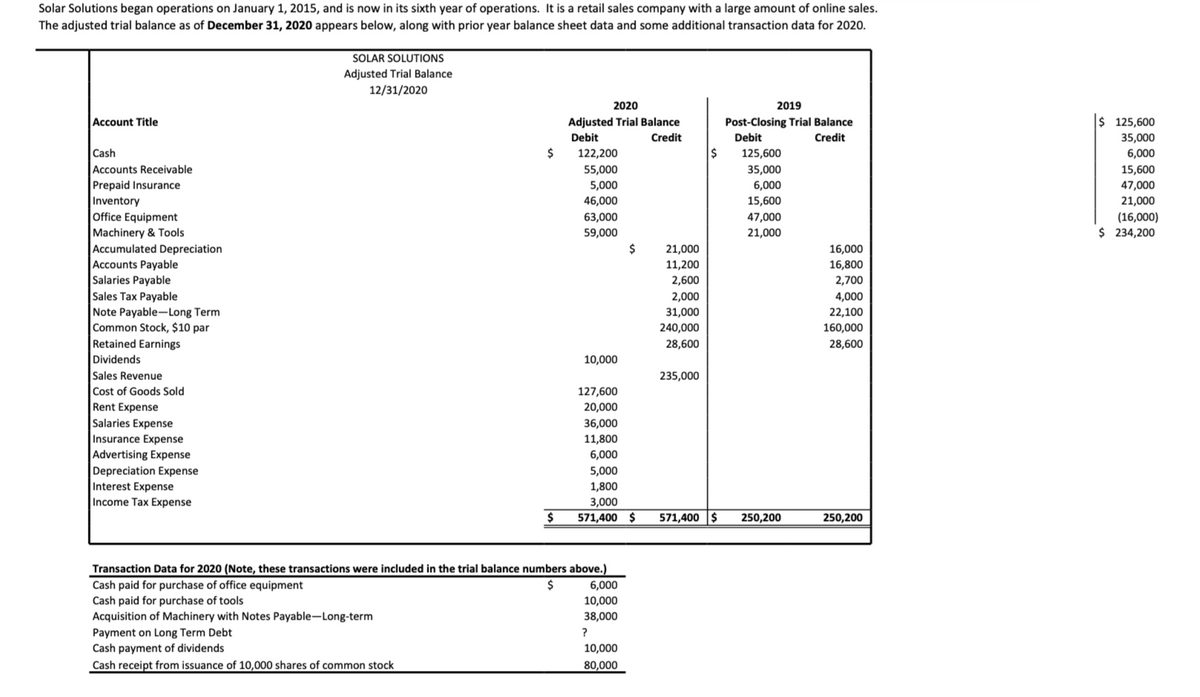

Transcribed Image Text:Solar Solutions began operations on January 1, 2015, and is now in its sixth year of operations. It is a retail sales company with a large amount of online sales.

The adjusted trial balance as of December 31, 2020 appears below, along with prior year balance sheet data and some additional transaction data for 2020.

SOLAR SOLUTIONS

Adjusted Trial Balance

12/31/2020

2020

2019

Account Title

Adjusted Trial Balance

Post-Closing Trial Balance

$ 125,600

Debit

Credit

Debit

Credit

35,000

Cash

122,200

125,600

6,000

Accounts Receivable

55,000

35,000

15,600

47,000

21,000

Prepaid Insurance

5,000

6,000

Inventory

46,000

15,600

Office Equipment

Machinery & Tools

Accumulated Depreciation

Accounts Payable

Salaries Payable

|Sales Tax Payable

Note Payable-Long Term

Common Stock, $10 par

Retained Earnings

63,000

47,000

(16,000)

59,000

21,000

$ 234,200

$

21,000

16,000

11,200

16,800

2,600

2,700

2,000

4,000

31,000

22,100

240,000

160,000

28,600

28,600

Dividends

10,000

Sales Revenue

Cost of Goods Sold

235,000

127,600

Rent Expense

Salaries Expense

Insurance Expense

Advertising Expense

Depreciation Expense

Interest Expense

20,000

36,000

11,800

6,000

5,000

1,800

Income Tax Expense

3,000

$

571,400 $

571,400 $

250,200

250,200

Transaction Data for 2020 (Note, these transactions were included in the trial balance numbers above.)

Cash paid for purchase of office equipment

Cash paid for purchase of tools

Acquisition of Machinery with Notes Payable-Long-term

Payment on Long Term Debt

Cash payment of dividends

6,000

10,000

38,000

?

10,000

Cash receipt from issuance of 10,000 shares of common stock

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage