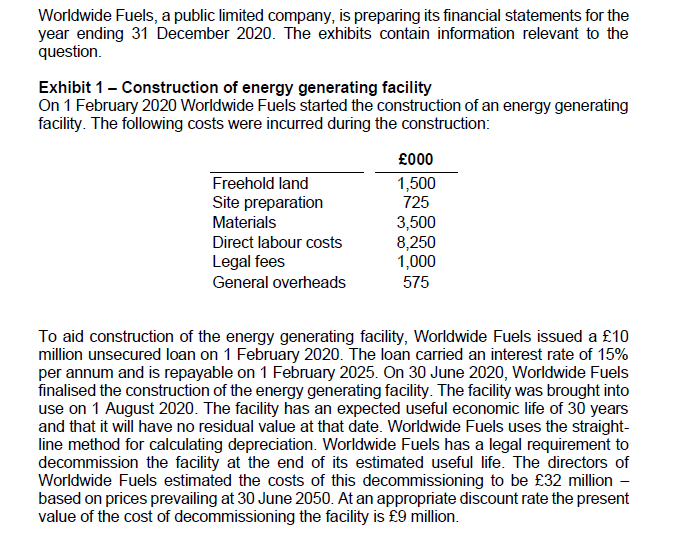

Worldwide Fuels, a public limited company, is preparing its financial statements for the year ending 31 December 2020. The exhibits contain information relevant to the question. Exhibit 1- Construction of energy generating facility On 1 February 2020 Worldwide Fuels started the construction of an energy generating facility. The following costs were incurred during the construction: £000 Freehold land Site preparation Materials 1,500 725 Direct labour costs Legal fees 3,500 8,250 1,000 General overheads 575 To aid construction of the energy generating facility, Worldwide Fuels issued a £10 million unsecured loan on 1 February 2020. The loan carried an interest rate of 15% per annum and is repayable on 1 February 2025. On 30 June 2020, Worldwide Fuels finalised the construction of the energy generating facility. The facility was brought into use on 1 August 2020. The facility has an expected useful economic life of 30 years and that it will have no residual value at that date. Worldwide Fuels uses the straight- line method for calculating depreciation. Worldwide Fuels has a legal requirement to decommission the facility at the end of its estimated useful life. The directors of Worldwide Fuels estimated the costs of this decommissioning to be £32 million - based on prices prevailing at 30 June 2050. At an appropriate discount rate the present value of the cost of decommissioning the facility is £9 million.

Worldwide Fuels, a public limited company, is preparing its financial statements for the year ending 31 December 2020. The exhibits contain information relevant to the question. Exhibit 1- Construction of energy generating facility On 1 February 2020 Worldwide Fuels started the construction of an energy generating facility. The following costs were incurred during the construction: £000 Freehold land Site preparation Materials 1,500 725 Direct labour costs Legal fees 3,500 8,250 1,000 General overheads 575 To aid construction of the energy generating facility, Worldwide Fuels issued a £10 million unsecured loan on 1 February 2020. The loan carried an interest rate of 15% per annum and is repayable on 1 February 2025. On 30 June 2020, Worldwide Fuels finalised the construction of the energy generating facility. The facility was brought into use on 1 August 2020. The facility has an expected useful economic life of 30 years and that it will have no residual value at that date. Worldwide Fuels uses the straight- line method for calculating depreciation. Worldwide Fuels has a legal requirement to decommission the facility at the end of its estimated useful life. The directors of Worldwide Fuels estimated the costs of this decommissioning to be £32 million - based on prices prevailing at 30 June 2050. At an appropriate discount rate the present value of the cost of decommissioning the facility is £9 million.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 40P

Related questions

Question

Transcribed Image Text:Worldwide Fuels, a public limited company, is preparing its financial statements for the

year ending 31 December 2020. The exhibits contain information relevant to the

question.

Exhibit 1- Construction of energy generating facility

On 1 February 2020 Worldwide Fuels started the construction of an energy generating

facility. The following costs were incurred during the construction:

£000

Freehold land

Site preparation

1,500

725

Materials

3,500

8,250

1,000

Direct labour costs

Legal fees

General overheads

575

To aid construction of the energy generating facility, Worldwide Fuels issued a £10

million unsecured loan on 1 February 2020. The loan carried an interest rate of 15%

per annum and is repayable on 1 February 2025. On 30 June 2020, Worldwide Fuels

finalised the construction of the energy generating facility. The facility was brought into

use on 1 August 2020. The facility has an expected useful economic life of 30 years

and that it will have no residual value at that date. Worldwide Fuels uses the straight-

line method for calculating depreciation. Worldwide Fuels has a legal requirement to

decommission the facility at the end of its estimated useful life. The directors of

Worldwide Fuels estimated the costs of this decommissioning to be £32 million -

based on prices prevailing at 30 June 2050. At an appropriate discount rate the present

value of the cost of decommissioning the facility is £9 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning