What is the Acid-test ratio of Nezuko Inc

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 24E

Related questions

Question

What is the Acid-test ratio of Nezuko Inc

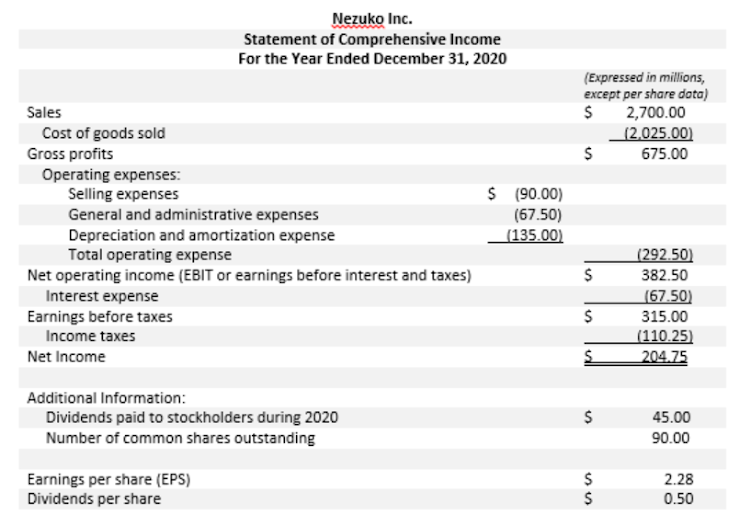

Transcribed Image Text:Nezuko Inc.

Statement of Comprehensive Income

For the Year Ended December 31, 2020

(Expressed in millions,

except per share data)

2,700.00

(2,025.00)

675.00

Sales

Cost of goods sold

Gross profits

Operating expenses:

Selling expenses

General and administrative expenses

$ (90.00)

(67.50)

(135.00)

Depreciation and amortization expense

Total operating expense

Net operating income (EBIT or earnings before interest and taxes)

Interest expense

Earnings before taxes

(292.50)

382.50

(67.50)

315.00

(110.25)

204.75

Income taxes

Net Income

Additional Information:

Dividends paid to stockholders during 2020

Number of common shares outstanding

45.00

90.00

Earnings per share (EPS)

Dividends per share

2.28

0.50

%24

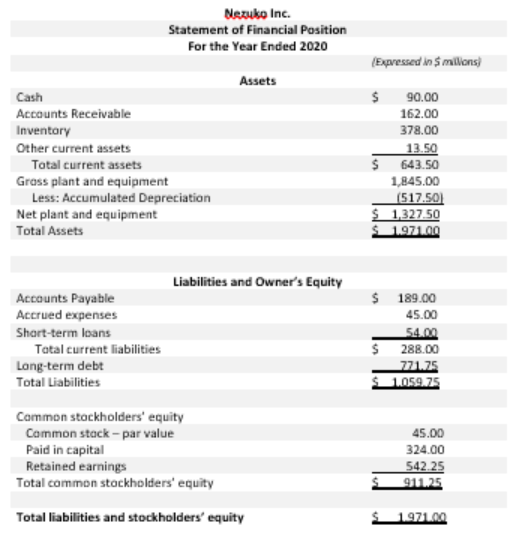

Transcribed Image Text:Nezuko Inc.

Statement of Financial Position

For the Year Ended 2020

(Expressed in $ millions)

Assets

Cash

90.00

Accounts Receivable

162.00

Inventory

378.00

Other current assets

13.50

$ 643.50

Tatal current assets

Grass plant and equipment

Less: Accumulated Depreciation

Net plant and equipment

Total Assets

1,845.00

(517.50)

Ŝ 1,327.50

$ 1.971.00

Liabilities and Owner's Equity

$ 189.00

Accounts Payable

Accrued expenses

45.00

Shart-term loans

54.00

$ 288.00

771.75

1.059.75

Tatal current liabilities

Lang-term debt

Total Liabilities

Common stackholders' equity

Common stack - par value

Paid in capital

Retained earnings

Total common stockholders' equity

45.00

324.00

542.25

911.25

Total liabilities and stockholders' equity

Ŝ 1971.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning