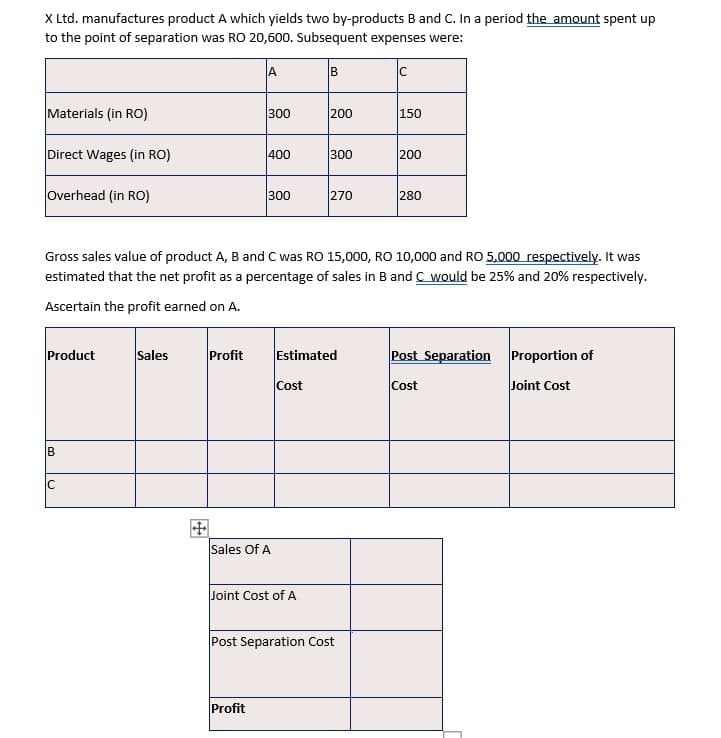

X Ltd. manufactures product A which yields two by-products B and C. In a period the amount spent up to the point of separation was RO 20,600. Subsequent expenses were: A B Materials (in RO) 300 200 150 Direct Wages (in RO) 400 300 200 Overhead (in RO) 300 270 280 Gross sales value of product A, B and C was RO 15,000, RO 10,000 and RO 5,000 respectively. It was estimated that the net profit as a percentage of sales in B and C would be 25% and 20% respectively. Ascertain the profit earned on A. Product Sales Profit Estimated Post Separation Proportion of Cost Cost Joint Cost IC 田 Sales Of A Joint Cost of A Post Separation Cost Profit

X Ltd. manufactures product A which yields two by-products B and C. In a period the amount spent up to the point of separation was RO 20,600. Subsequent expenses were: A B Materials (in RO) 300 200 150 Direct Wages (in RO) 400 300 200 Overhead (in RO) 300 270 280 Gross sales value of product A, B and C was RO 15,000, RO 10,000 and RO 5,000 respectively. It was estimated that the net profit as a percentage of sales in B and C would be 25% and 20% respectively. Ascertain the profit earned on A. Product Sales Profit Estimated Post Separation Proportion of Cost Cost Joint Cost IC 田 Sales Of A Joint Cost of A Post Separation Cost Profit

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 12PB: Laramie Industries produces two joint products, H and C. Prior to the split-off point, the company...

Related questions

Question

Transcribed Image Text:X Ltd. manufactures product A which yields two by-products B and C. In a period the amount spent up

to the point of separation was RO 20,600. Subsequent expenses were:

A

Materials (in RO)

300

200

150

Direct Wages (in RO)

400

300

200

Overhead (in RO)

300

270

280

Gross sales value of product A, B and C was RO 15,000, RO 10,000 and RO 5,000 respectively. It was

estimated that the net profit as a percentage of sales in B and C would be 25% and 20% respectively.

Ascertain the profit earned on A.

Product

Sales

Profit

Estimated

Post Separation Proportion of

Cost

Cost

Joint Cost

B

田

Sales Of A

Joint Cost of A

Post Separation Cost

Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning