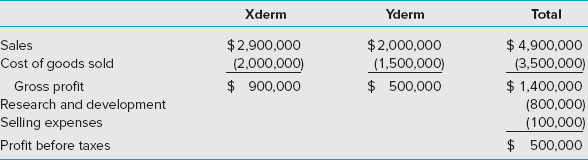

Xderm Yderm Total Sales Cost of goods sold $2,900,000 $2,000,000 (1,500,000) $4,900,000 (2,000,000) $ 900,000 (3,500,000) Gross profit Research and development Selling expenses Profit before taxes $500,000 $1,400,000 (800,000) (100,000) $500,000

Life-Cycle Costing Kate Stephens, the COO of BioDerm, has asked her cost management team for a product-line profitability analysis for her firm’s two products, Xderm and Yderm. The two skin care products require a large amount of research and development and advertising. After receiving the following statement from BioDerm’s accountants, Kate concludes that Xderm is the more profitable product and that perhaps cost-cutting measures should be applied to Yderm:

Required

-

Explain why Kate may be wrong in her assessment of the relative performance of the two products.

-

Suppose that 75% of the R&D and selling expenses are traceable to Xderm. Using this assumption, compute the life-cycle income for each product and the return on sales for each product.

-

Consider your answers to requirements 1 and 2 with the following additional information: R&D and selling expenses are substantially higher for Xderm because it is a new product. Kate has strongly supported development of the new product, including the high selling and R&D expenses. She has assured senior managers that the Xderm investment will pay off in improved profits for the firm. What are the ethical issues, if any, facing Kate as she reports to top management on the profitability of the firm’s two products?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images