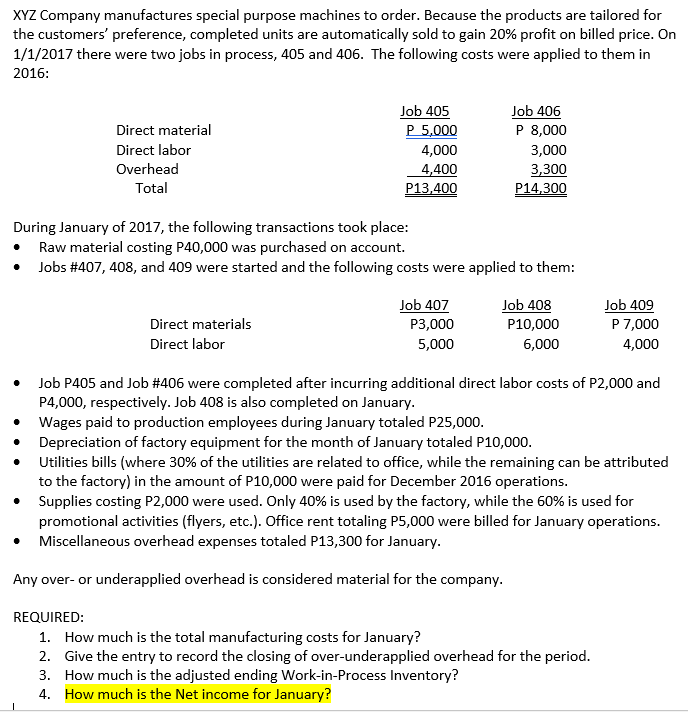

XYZ Company manufactures special purpose machines to order. Because the products are tailored for the customers' preference, completed units are automatically sold to gain 20% profit on billed price. On 1/1/2017 there were two jobs in process, 405 and 406. The following costs were applied to them in 2016: Job 405 P 5,000 Job 406 P 8,000 Direct material 4,000 4,400 P13,400 Direct labor 3,000 Overhead 3,300 P14,300 Total During January of 2017, the following transactions took place: Raw material costing P40,000 was purchased on account. • Jobs #407, 408, and 409 were started and the following costs were applied to them: Job 407 Job 408 Job 409 P 7,000 Direct materials P3,000 P10,000 Direct labor 5,000 6,000 4,000 Job P405 and Job #406 were completed after incurring additional direct labor costs of P2,000 and P4,000, respectively. Job 408 is also completed on January. Wages paid to production employees during January totaled P25,000. Depreciation of factory equipment for the month of January totaled P10,000. Utilities bills (where 30% of the utilities are related to office, while the remaining can be attributed to the factory) in the amount of P10,000 were paid for December 2016 operations. • Supplies costing P2,000 were used. Only 40% is used by the factory, while the 60% is used for promotional activities (flyers, etc.). Office rent totaling P5,000 were billed for January operations. Miscellaneous overhead expenses totaled P13,300 for January. Any over- or underapplied overhead is considered material for the company. REQUIRED: 1. How much is the total manufacturing costs for January? 2. Give the entry to record the closing of over-underapplied overhead for the period. 3. How much is the adjusted ending Work-in-Process Inventory? 4. How much is the Net income for January?

XYZ Company manufactures special purpose machines to order. Because the products are tailored for the customers' preference, completed units are automatically sold to gain 20% profit on billed price. On 1/1/2017 there were two jobs in process, 405 and 406. The following costs were applied to them in 2016: Job 405 P 5,000 Job 406 P 8,000 Direct material 4,000 4,400 P13,400 Direct labor 3,000 Overhead 3,300 P14,300 Total During January of 2017, the following transactions took place: Raw material costing P40,000 was purchased on account. • Jobs #407, 408, and 409 were started and the following costs were applied to them: Job 407 Job 408 Job 409 P 7,000 Direct materials P3,000 P10,000 Direct labor 5,000 6,000 4,000 Job P405 and Job #406 were completed after incurring additional direct labor costs of P2,000 and P4,000, respectively. Job 408 is also completed on January. Wages paid to production employees during January totaled P25,000. Depreciation of factory equipment for the month of January totaled P10,000. Utilities bills (where 30% of the utilities are related to office, while the remaining can be attributed to the factory) in the amount of P10,000 were paid for December 2016 operations. • Supplies costing P2,000 were used. Only 40% is used by the factory, while the 60% is used for promotional activities (flyers, etc.). Office rent totaling P5,000 were billed for January operations. Miscellaneous overhead expenses totaled P13,300 for January. Any over- or underapplied overhead is considered material for the company. REQUIRED: 1. How much is the total manufacturing costs for January? 2. Give the entry to record the closing of over-underapplied overhead for the period. 3. How much is the adjusted ending Work-in-Process Inventory? 4. How much is the Net income for January?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 15E: Kenkel, Ltd. uses backflush costing to account for its manufacturing costs. The trigger points are...

Related questions

Question

Please answer highlighted question only.

Transcribed Image Text:XYZ Company manufactures special purpose machines to order. Because the products are tailored for

the customers' preference, completed units are automatically sold to gain 20% profit on billed price. On

1/1/2017 there were two jobs in process, 405 and 406. The following costs were applied to them in

2016:

Job 405

P 5,000

Job 406

P 8,000

Direct material

Direct labor

4,000

3,000

Overhead

3,300

P14.300

4,400

Total

P13,400

During January of 2017, the following transactions took place:

Raw material costing P40,000 was purchased on account.

Jobs #407, 408, and 409 were started and the following costs were applied to them:

Job 407

Job 408

Job 409

P 7,000

4,000

Direct materials

Р3,000

P10,000

Direct labor

5,000

6,000

Job P405 and Job #406 were completed after incurring additional direct labor costs of P2,000 and

P4,000, respectively. Job 408 is also completed on January.

Wages paid to production employees during January totaled P25,000.

Depreciation of factory equipment for the month of January totaled P10,000.

Utilities bills (where 30% of the utilities are related to office, while the remaining can be attributed

to the factory) in the amount of P10,000 were paid for December 2016 operations.

• Supplies costing P2,000 were used. Only 40% is used by the factory, while the 60% is used for

promotional activities (flyers, etc.). Office rent totaling P5,000 were billed for January operations.

• Miscellaneous overhead expenses totaled P13,300 for January.

Any over- or underapplied overhead is considered material for the company.

REQUIRED:

1. How much is the total manufacturing costs for January?

2. Give the entry to record the closing of over-underapplied overhead for the period.

3. How much is the adjusted ending Work-in-Process Inventory?

4. How much is the Net income for January?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning