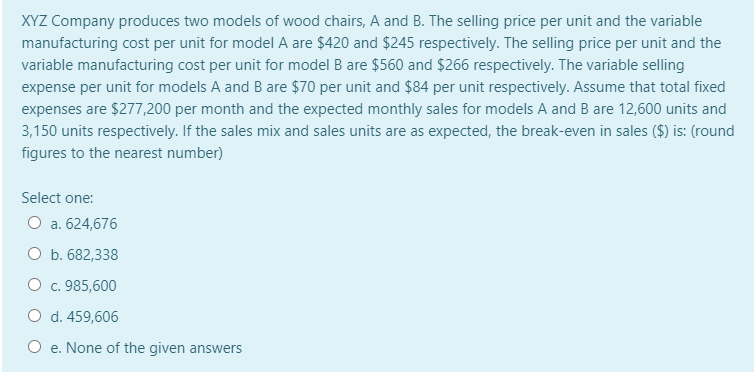

XYZ Company produces two models of wood chairs, A and B. The selling price per unit and the variable manufacturing cost per unit for model A are $420 and $245 respectively. The selling price per unit and the variable manufacturing cost per unit for model B are $560 and $266 respectively. The variable selling expense per unit for models A and B are $70 per unit and $84 per unit respectively. Assume that total fixed expenses are $277,200 per month and the expected monthly sales for models A and B are 12,600 units and 3,150 units respectively. If the sales mix and sales units are as expected, the break-even in sales ($) is: (round figures to the nearest number) Select one: O a. 624,676 O b. 682,338 O c. 985,600 O d. 459,606

XYZ Company produces two models of wood chairs, A and B. The selling price per unit and the variable manufacturing cost per unit for model A are $420 and $245 respectively. The selling price per unit and the variable manufacturing cost per unit for model B are $560 and $266 respectively. The variable selling expense per unit for models A and B are $70 per unit and $84 per unit respectively. Assume that total fixed expenses are $277,200 per month and the expected monthly sales for models A and B are 12,600 units and 3,150 units respectively. If the sales mix and sales units are as expected, the break-even in sales ($) is: (round figures to the nearest number) Select one: O a. 624,676 O b. 682,338 O c. 985,600 O d. 459,606

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

Transcribed Image Text:XYZ Company produces two models of wood chairs, A and B. The selling price per unit and the variable

manufacturing cost per unit for model A are $420 and $245 respectively. The selling price per unit and the

variable manufacturing cost per unit for model B are $560 and $266 respectively. The variable selling

expense per unit for models A and B are $70 per unit and $84 per unit respectively. Assume that total fixed

expenses are $277,200 per month and the expected monthly sales for models A and B are 12,600 units and

3,150 units respectively. If the sales mix and sales units are as expected, the break-even in sales ($) is: (round

figures to the nearest number)

Select one:

O a. 624,676

O b. 682,338

O c. 985,600

O d. 459,606

O e. None of the given answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT