year, Crane, Inc. will be introducing its first product, a wrist brace that protects serious video gar es. The brace will be sold for $10.00 to retailers throughout the country. All sales will be made on will be collected within the quarter of the sale, and another 30% in the quarter following the sale. e expected to be uncollectible. The sales budget for the coming year is as follows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

year, Crane, Inc. will be introducing its first product, a wrist brace that protects serious video gar es. The brace will be sold for $10.00 to retailers throughout the country. All sales will be made on will be collected within the quarter of the sale, and another 30% in the quarter following the sale. e expected to be uncollectible. The sales budget for the coming year is as follows: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 5P

Related questions

Question

Can someone help me with best effort? Answer correctly and completely for all with all working. Answer in text not image. Thanks!

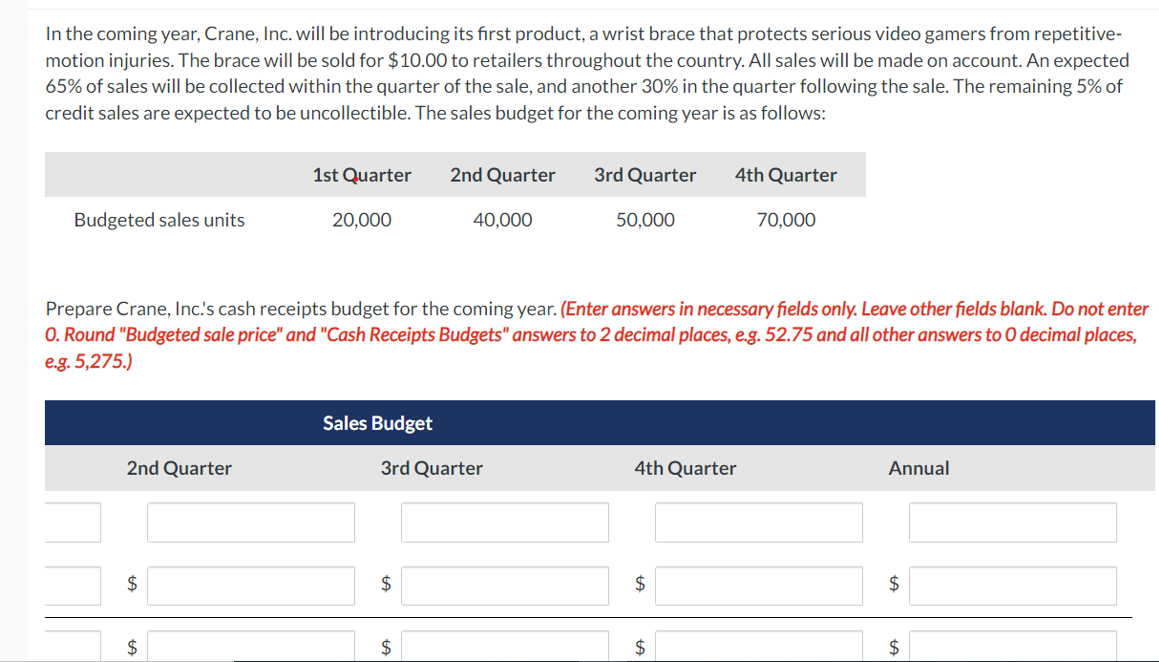

Transcribed Image Text:In the coming year, Crane, Inc. will be introducing its first product, a wrist brace that protects serious video gamers from repetitive-

motion injuries. The brace will be sold for $10.00 to retailers throughout the country. All sales will be made on account. An expected

65% of sales will be collected within the quarter of the sale, and another 30% in the quarter following the sale. The remaining 5% of

credit sales are expected to be uncollectible. The sales budget for the coming year is as follows:

Budgeted sales units

2nd Quarter

$

1st Quarter

$

20,000

Sales Budget

2nd Quarter

Prepare Crane, Inc.'s cash receipts budget for the coming year. (Enter answers in necessary fields only. Leave other fields blank. Do not enter

O. Round "Budgeted sale price" and "Cash Receipts Budgets" answers to 2 decimal places, e.g. 52.75 and all other answers to O decimal places,

e.g. 5,275.)

$

40,000

3rd Quarter

$

3rd Quarter

50,000

4th Quarter

4th Quarter

$

$

70,000

Annual

$

$

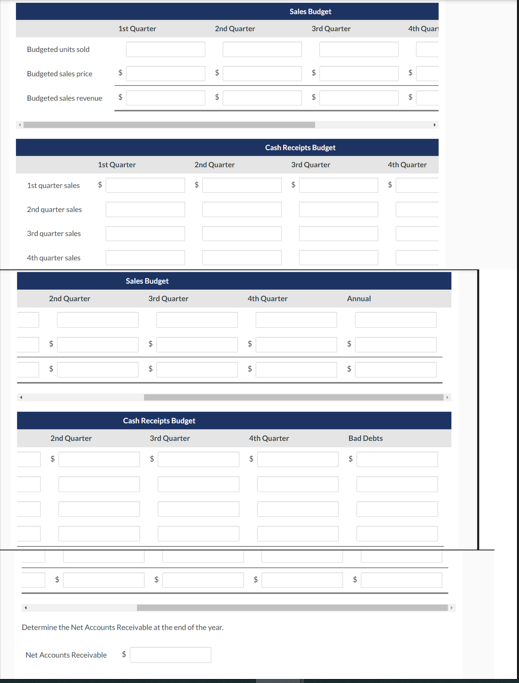

Transcribed Image Text:Budgeted units sold

Budgeted sales price

Budgeted sales revenue

1st quarter sales

2nd quarter sales

3rd quarter sales

4th quarter sales

2nd Quarter

$

$

2nd Quarter

$

1st Quarter

$

$

$

1st Quarter

Sales Budget

3rd Quarter

$

Net Accounts Receivable $

$

Cash Receipts Budget

3rd Quarter

$

$

2nd Quarter

$

2nd Quarter

S

Determine the Net Accounts Receivable at the end of the year.

4th Quarter

$

$

Sales Budget

$

4th Quarter

3rd Quarter

Cash Receipts Budget

3rd Quarter

$

1000

Annual

$

$

Bad Debts

$

4th Quar

4th Quarter

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning