year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost

year will be $130,000. (2) The firm expects to pay $30,000 in cash dividends. (3) The firm wishes to maintain a minimum cash balance of $25,000. (4) Accounts receivable represent approximately 20% of annual sales. (5) The firm’s ending inventory represents 60% of Cost

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.17E

Related questions

Question

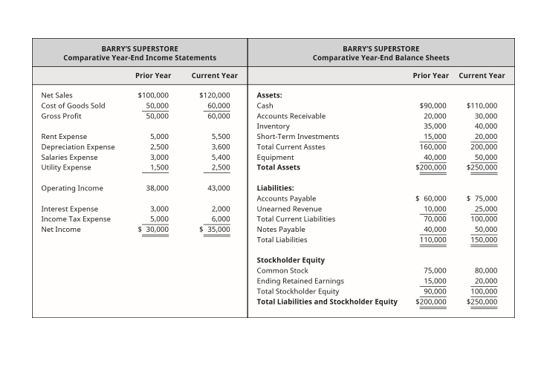

- Barry’s Superstore wishes to prepare financial plans. Use the financial statements on the next page and the other information provided below to prepare the financial plans.

The following financial data are also available:

(1) The firm has estimated that its sales for next year will be $130,000.

(2) The firm expects to pay $30,000 in cash dividends.

(3) The firm wishes to maintain a minimum cash balance of $25,000.

(4)

(5) The firm’s ending inventory represents 60% of Cost of Goods Sold.

(6) A new machine costing $15,000 will be purchased next year.

(7) Accounts payable will increase by 5%.

(8) Unearned Revenue will be earned.

(9) Notes Payable would decrease by $5000.

(10) Short-Term Investments and common stock will remain unchanged.

Requirement:

- Prepare a pro forma income statement for the year ended December 31, 2021, using the percent-of-sales method. Tax Rate is expected to be 15%.

- Prepare a pro forma balance sheet dated December 31, 2021, using the judgmental approach.

- Analyze these statements, and discuss the resulting external financing required.

Transcribed Image Text:BARRY'S SUPERSTORE

BARRY'S SUPERSTORE

Comparative Year-End Income Statements

Comparative Year-End Balance Sheets

Prior Year

Current Year

Prior Year Current Year

Assets:

Cash

Net Sales

$100,000

$120,000

Cost of Goods Sold

50.000

60,000

$90,000

$110,000

Gross Profit

50,000

60,000

Accounts Receivable

20,000

30,000

35,000

15,000

160,000

40,000

$200.000

Inventory

40,000

5,000

20,000

200.000

50,000

$250.000

Rent Expense

Depreciation Expense

5,500

Short-Term Investments

2.500

3,600

Total Current Asstes

Salaries Expense

Utlity Expense

3,000

5,400

Equipment

Total Assets

1.500

2,500

Operating Income

38,000

43,000

Liabilities:

$ 75.000

25.000

100,000

Accounts Payable

$ 60.000

Interest Expense

3,000

2,000

Unearned Revenue

10.000

Income Tax Expense

70,000

5.000

$ 30,000

6,000

Total Current Liabilities

Net Income

$ 35,000

Notes Payable

Total Liabilities

40,000

110,000

50,000

150.000

Stockholder Equity

Common Stock

75,000

80.000

Ending Retained Earnings

Total Stockholder Equity

Total Liabilities and Stockholder Equity

20.000

100.000

15,000

90,000

$200.000

$250.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning