1. How much of the transactions below should be charged against CELESTINE's Net Income for the year ended 2020? 2. Compute for the amount presented as noncash Assets in the balance sheet on December 31, 2020 using the transactions below.

1. How much of the transactions below should be charged against CELESTINE's Net Income for the year ended 2020? 2. Compute for the amount presented as noncash Assets in the balance sheet on December 31, 2020 using the transactions below.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 11P

Related questions

Question

1. How much of the transactions below should be charged against CELESTINE's Net Income for the year ended 2020?

2. Compute for the amount presented as noncash Assets in the balance sheet on December 31, 2020 using the transactions below.

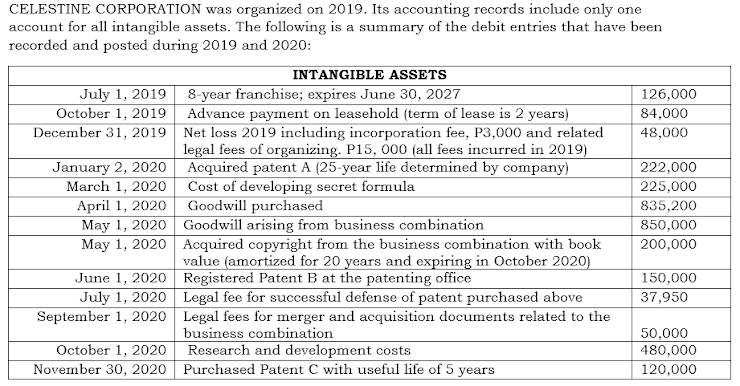

Transcribed Image Text:CELESTINE CORPORATION was organized on 2019. Its accounting records include only one

account for all intangible assets. The following is a summary of the debit entries that have been

recorded and posted during 2019 and 2020:

INTANGIBLE ASSETS

July 1, 2019 8-year franchise; expires June 30, 2027

126,000

Advance payment on leasehold (term of lease is 2 years)

December 31, 2019 Net loss 2019 including incorporation fee, P3,000 and related

legal fees of organizing. P15, 000 (all fees incurred in 2019)

Acquired patent A (25-year life determined by company)

October 1, 2019

84,000

48,000

January 2, 2020

222,000

March 1, 2020

Cost of developing secret formula

Goodwill purchased

May 1, 2020 Goodwill arising from business combination

May 1, 2020 Acquired copyright from the business combination with book

225,000

April 1, 2020

835,200

850,000

200,000

value (amortized for 20 years and expiring in October 2020)

June 1, 2020 Registered Patent B at the patenting office

July 1, 2020 Legal fee for successful defense of patent purchased above

September 1, 2020 Legal fees for merger and acquisition documents related to the

150,000

37,950

business combination

Research and development costs

November 30, 2020 Purchased Patent C with useful life of 5 years

50,000

480,000

October 1, 2020

120,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning