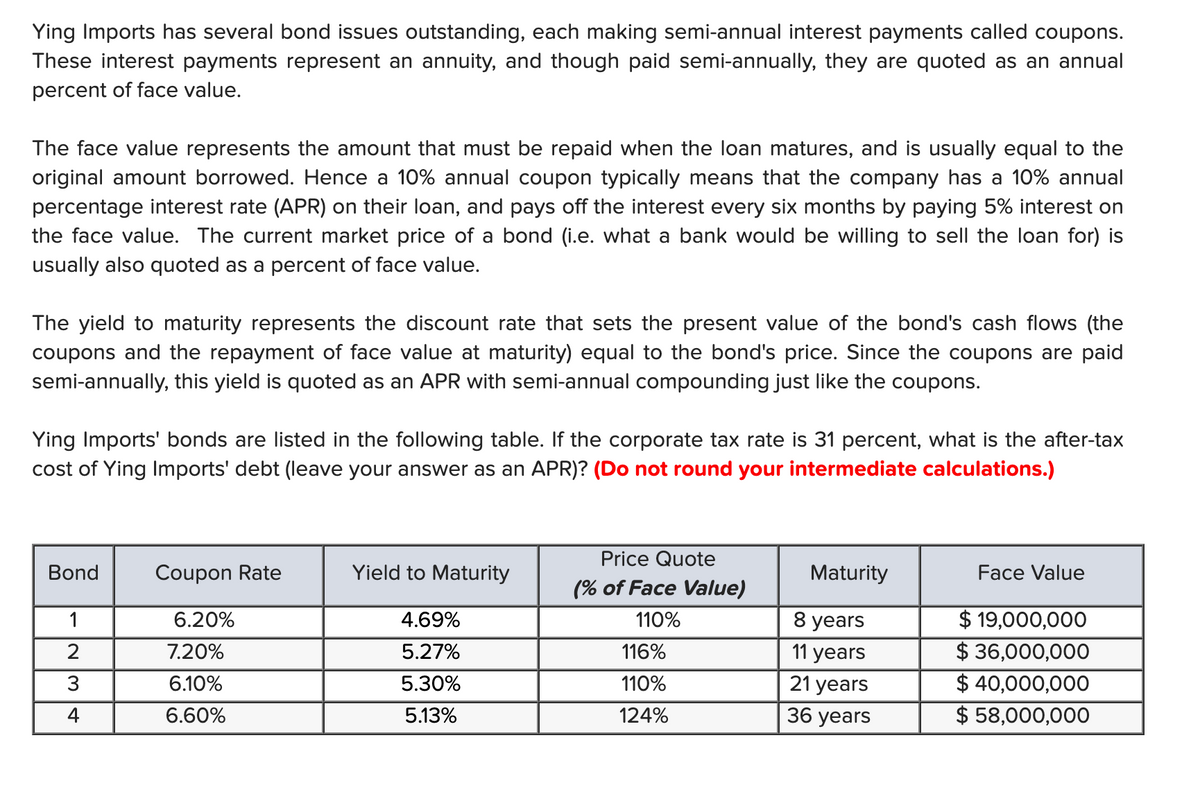

Ying Imports has several bond issues outstanding, each making semi-annual interest payments called coupons. These interest payments represent an annuity, and though paid semi-annually, they are quoted as an annual percent of face value. The face value represents the amount that must be repaid when the loan matures, and is usually equal to the original amount borrowed. Hence a 10% annual coupon typically means that the company has a 10% annual percentage interest rate (APR) on their loan, and pays off the interest every six months by paying 5% interest on the face value. The current market price of a bond (i.e. what a bank would be willing to sell the loan for) is usually also quoted as a percent of face value. The yield to maturity represents the discount rate that sets the present value of the bond's cash flows (the coupons and the repayment of face value at maturity) equal to the bond's price. Since the coupons are paid semi-annually, this yield is quoted as an APR with semi-annual compounding just like the coupons. Ying Imports' bonds are listed in the following table. If the corporate tax rate is 31 percent, what is the after-tax

Ying Imports has several bond issues outstanding, each making semi-annual interest payments called coupons. These interest payments represent an annuity, and though paid semi-annually, they are quoted as an annual percent of face value. The face value represents the amount that must be repaid when the loan matures, and is usually equal to the original amount borrowed. Hence a 10% annual coupon typically means that the company has a 10% annual percentage interest rate (APR) on their loan, and pays off the interest every six months by paying 5% interest on the face value. The current market price of a bond (i.e. what a bank would be willing to sell the loan for) is usually also quoted as a percent of face value. The yield to maturity represents the discount rate that sets the present value of the bond's cash flows (the coupons and the repayment of face value at maturity) equal to the bond's price. Since the coupons are paid semi-annually, this yield is quoted as an APR with semi-annual compounding just like the coupons. Ying Imports' bonds are listed in the following table. If the corporate tax rate is 31 percent, what is the after-tax

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 10P

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

Transcribed Image Text:Ying Imports has several bond issues outstanding, each making semi-annual interest payments called coupons.

These interest payments represent an annuity, and though paid semi-annually, they are quoted as an annual

percent of face value.

The face value represents the amount that must be repaid when the loan matures, and is usually equal to the

original amount borrowed. Hence a 10% annual coupon typically means that the company has a 10% annual

percentage interest rate (APR) on their loan, and pays off the interest every six months by paying 5% interest on

the face value. The current market price of a bond (i.e. what a bank would be willing to sell the loan for) is

usually also quoted as a percent of face value.

The yield to maturity represents the discount rate that sets the present value of the bond's cash flows (the

coupons and the repayment of face value at maturity) equal to the bond's price. Since the coupons are paid

semi-annually, this yield is quoted as an APR with semi-annual compounding just like the coupons.

Ying Imports' bonds are listed in the following table. If the corporate tax rate is 31 percent, what is the after-tax

cost of Ying Imports' debt (leave your answer as an APR)? (Do not round your intermediate calculations.)

Price Quote

Bond

Coupon Rate

Yield to Maturity

Maturity

Face Value

(% of Face Value)

$ 19,000,000

$ 36,000,000

$ 40,000,000

$ 58,000,000

1

6.20%

4.69%

110%

8 years

2

7.20%

5.27%

116%

11 years

3

6.10%

5.30%

110%

21 years

4

6.60%

5.13%

124%

36 years

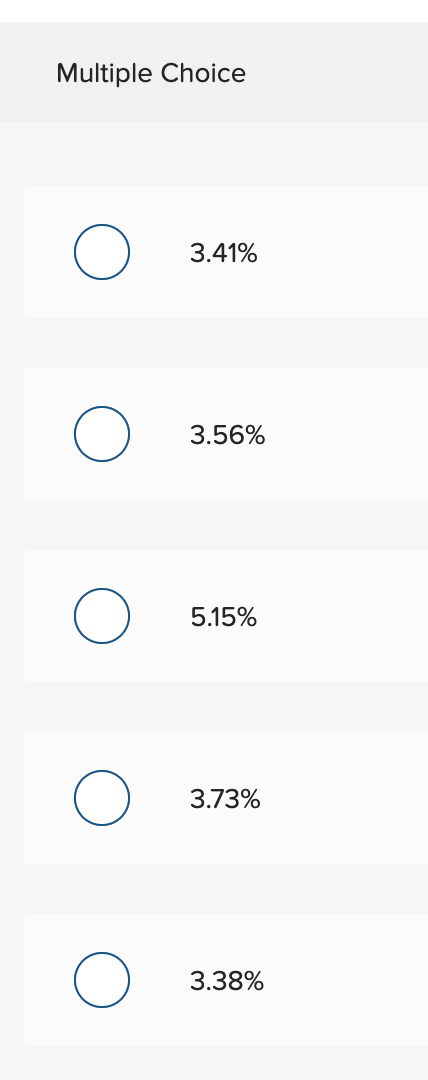

Transcribed Image Text:Multiple Choice

3.41%

3.56%

5.15%

3.73%

3.38%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning