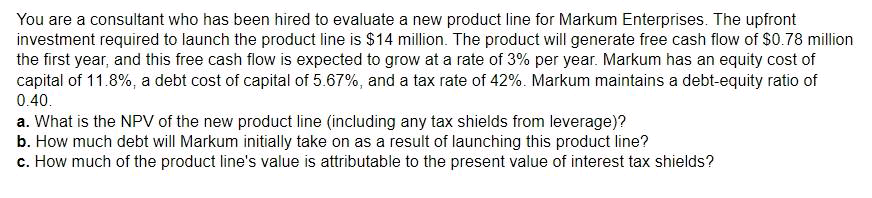

You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $14 million. The product will generate free cash flow of $0.78 million the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of capital of 11.8%, a debt cost of capital of 5.67%, and a tax rate of 42%. Markum maintains a debt-equity ratio of 0.40. a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields?

You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront investment required to launch the product line is $14 million. The product will generate free cash flow of $0.78 million the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of capital of 11.8%, a debt cost of capital of 5.67%, and a tax rate of 42%. Markum maintains a debt-equity ratio of 0.40. a. What is the NPV of the new product line (including any tax shields from leverage)? b. How much debt will Markum initially take on as a result of launching this product line? c. How much of the product line's value is attributable to the present value of interest tax shields?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 10E

Related questions

Question

P3

Transcribed Image Text:You are a consultant who has been hired to evaluate a new product line for Markum Enterprises. The upfront

investment required to launch the product line is $14 million. The product will generate free cash flow of $0.78 million

the first year, and this free cash flow is expected to grow at a rate of 3% per year. Markum has an equity cost of

capital of 11.8%, a debt cost of capital of 5.67%, and a tax rate of 42%. Markum maintains a debt-equity ratio of

0.40.

a. What is the NPV of the new product line (including any tax shields from leverage)?

b. How much debt will Markum initially take on as a result of launching this product line?

c. How much of the product line's value is attributable to the present value of interest tax shields?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning