You are a financial adviser to a U.S. corporation that expects to receive a payment of 60 million Japanese yen in 180 days for goods exported to Japan. The current spot rate is 100 yen per U.S. dollar. You are concerned that the U.S. dollar is going to appreciate against the yen over the next six months. For all your answers, round to the nearest whole number. a. Assuming the exchange rate remains unchanged, how much does your firm expect to receive in U.S. dollars? $ b. How much would your firm receive, in U.S. dollars, if the dollar appreciated to 110 yen per U.S. dollar? $ c. How could you use an options contract to hedge against the risk of losses associated with the potential appreciation in the U.S. dollar? The firm could buy ¥60 million in call options on dollars, at a rate 110¥ per dollar.

You are a financial adviser to a U.S. corporation that expects to receive a payment of 60 million Japanese yen in 180 days for goods exported to Japan. The current spot rate is 100 yen per U.S. dollar. You are concerned that the U.S. dollar is going to appreciate against the yen over the next six months. For all your answers, round to the nearest whole number. a. Assuming the exchange rate remains unchanged, how much does your firm expect to receive in U.S. dollars? $ b. How much would your firm receive, in U.S. dollars, if the dollar appreciated to 110 yen per U.S. dollar? $ c. How could you use an options contract to hedge against the risk of losses associated with the potential appreciation in the U.S. dollar? The firm could buy ¥60 million in call options on dollars, at a rate 110¥ per dollar.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter11: Foreign Exchange, Trade, And Bubbles

Section: Chapter Questions

Problem 6MC

Related questions

Question

Please see image for question

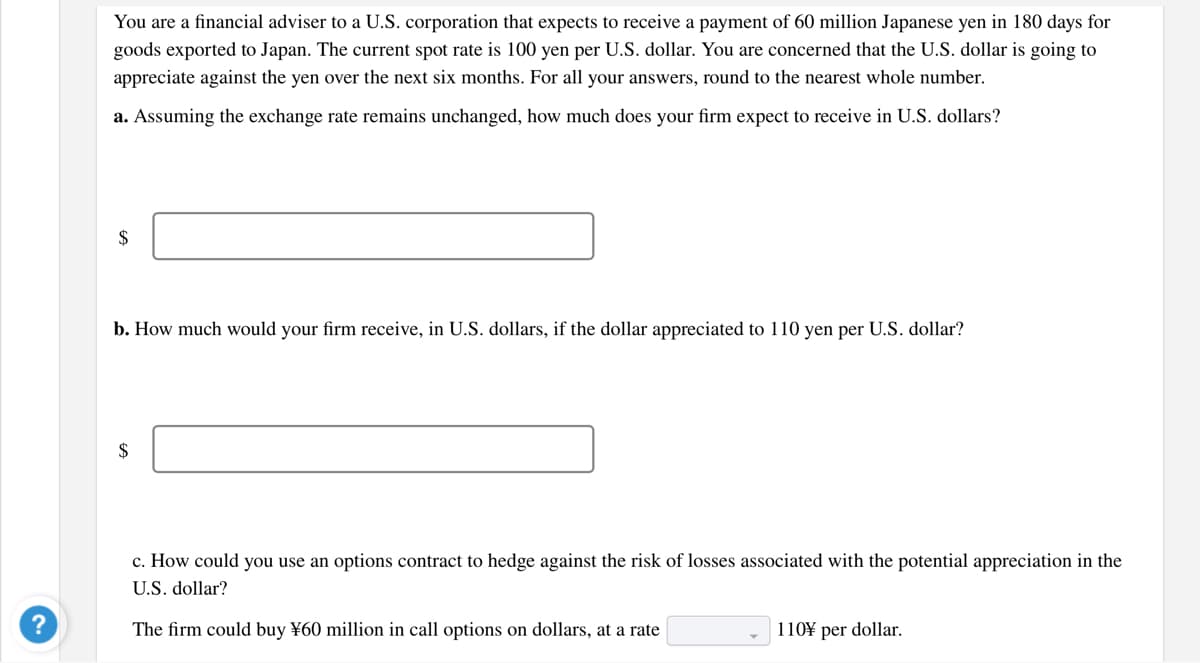

Transcribed Image Text:You are a financial adviser to a U.S. corporation that expects to receive a payment of 60 million Japanese yen in 180 days for

goods exported to Japan. The current spot rate is 100 yen per U.S. dollar. You are concerned that the U.S. dollar is going to

appreciate against the yen over the next six months. For all your answers, round to the nearest whole number.

a. Assuming the exchange rate remains unchanged, how much does your firm expect to receive in U.S. dollars?

$

b. How much would your firm receive, in U.S. dollars, if the dollar appreciated to 110 yen per U.S. dollar?

$

c. How could you use an options contract to hedge against the risk of losses associated with the potential appreciation in the

U.S. dollar?

The firm could buy ¥60 million in call options on dollars, at a rate

110¥ per dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning