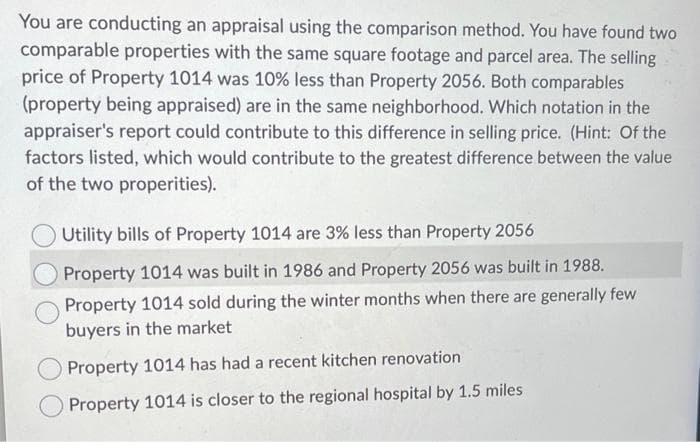

You are conducting an appraisal using the comparison method. You have found two comparable properties with the same square footage and parcel area. The selling price of Property 1014 was 10% less than Property 2056. Both comparables (property being appraised) are in the same neighborhood. Which notation in the appraiser's report could contribute to this difference in selling price. (Hint: Of the factors listed, which would contribute to the greatest difference between the value of the two properities). Utility bills of Property 1014 are 3% less than Property 2056 Property 1014 was built in 1986 and Property 2056 was built in 1988. Property 1014 sold during the winter months when there are generally few buyers in the market Property 1014 has had a recent kitchen renovation Property 1014 is closer to the regional hospital by 1.5 miles.

You are conducting an appraisal using the comparison method. You have found two comparable properties with the same square footage and parcel area. The selling price of Property 1014 was 10% less than Property 2056. Both comparables (property being appraised) are in the same neighborhood. Which notation in the appraiser's report could contribute to this difference in selling price. (Hint: Of the factors listed, which would contribute to the greatest difference between the value of the two properities). Utility bills of Property 1014 are 3% less than Property 2056 Property 1014 was built in 1986 and Property 2056 was built in 1988. Property 1014 sold during the winter months when there are generally few buyers in the market Property 1014 has had a recent kitchen renovation Property 1014 is closer to the regional hospital by 1.5 miles.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:You are conducting an appraisal using the comparison method. You have found two

comparable properties with the same square footage and parcel area. The selling

price of Property 1014 was 10% less than Property 2056. Both comparables

(property being appraised) are in the same neighborhood. Which notation in the

appraiser's report could contribute to this difference in selling price. (Hint: Of the

factors listed, which would contribute to the greatest difference between the value

of the two properities).

Utility bills of Property 1014 are 3% less than Property 2056

Property 1014 was built in 1986 and Property 2056 was built in 1988.

Property 1014 sold during the winter months when there are generally few

buyers in the market

Property 1014 has had a recent kitchen renovation

Property 1014 is closer to the regional hospital by 1.5 miles

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College