Q: You can buy a carton of three 32-ounce bottles of shower cleaner on sale for $5.00. The 64-ounce "re...

A: Price of a carton of three 32-ounce bottles of shower cleaner = $ 5.00Price of 64-ounce "refill" siz...

Q: no preferred stock. The yield to at the company's WACCs 12.60% What is Pearson's cost of common equi...

A: Weighted average cost of capital is the cost o capital considering the weight of the different compo...

Q: re in 20 years. She opens up a retirement account with an APR of 5.25% compounded monthly. She will ...

A: There is need of proper planning for the retirement and if there is proper planning on time better p...

Q: Pearce's Cricket Farm issued o 15-year, 10% semiannual bond 4 years ago. The bond currently sells fo...

A: Book value of primary debt = $60 million Book value of secondary debt = $35 million Market value of ...

Q: A stock is expected to pay dividends of $1.45 per share in Year 1 and $1.68 per share in Year 2. Aft...

A: Shares are the company’s securities which are issued by the company to raise the funds. Value of sha...

Q: A corporation decides to deposit fixed payment per account earning 9% interest per year in order to ...

A: Compound interest is the interest that is charged on the principal amount as well as interest amount...

Q: The market compensates investors for accepting which type(s) of risk? O None of the listed selection...

A: Risk refers to the level of uncertainty in returns that an investor expects while making investments...

Q: The minimum required return by Cross-Ocean’s debtholders. 2. The minimum required return by Cro...

A: Minimum Required Return: It represents the minimum return expected by the investors for investing i...

Q: You recently went to work for Allied Components Company, a supplier of auto repair parts used in the...

A: Here, Discount rate = 10% To Find: IRR of each project =? Payback Period =?

Q: Big Industries has the following market-value balance sheet. The stock currently sells for $20 a sha...

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first t...

Q: Mye has a 15-year mortgage loan at a compounded annual interest rate of 9.3%. After making annual pa...

A: Given that: Annual Cash flow=P11600 N=7 Years=7*12=84 Months r=9.3% annually= 0.93/12 Monthly =0.775...

Q: The parents of a newborn have decided to make deposits into an investment account on each of their s...

A: Formula Present value = P*[1-(1+g)n*(1+r)-n]/(r-g) Where P - First payment i.e. $2500 g - Annual gro...

Q: Often, through government-supported programs, students may obtain "bargain" interest rates such a...

A: Installment payment has two components as first interest amount and second principal amount utilized...

Q: The estimated capitalized cost is $

A: A stream of equal cash flows paid or received periodically is termed as annuity. Annuity is either r...

Q: Everest Inc. is presently enjoying relatively high growth because of a surge in the demand for its n...

A: Dividend $ 0.85 Growth Rate for 2 years 32% Growth Rate for 2 years 22.9...

Q: Calculate the bank's excess reserves if the legal reserve requirement is 25% based on the informatio...

A: Excess reserve refers to the fund (reserves) held by the bank or financial institutions and the amou...

Q: Please show the solution 1. What is the present worth of 4100 deposited at the end of every three mo...

A: Hai There! Thank you for the question. Post has multiple sub parts, as per company authoring guideli...

Q: your required return is 7.32% how would adding ETFS with average annual returns that are expected to...

A: Meaning of ETFs( Exchange traded funds) This is a bunch of securities which is responsible for the ...

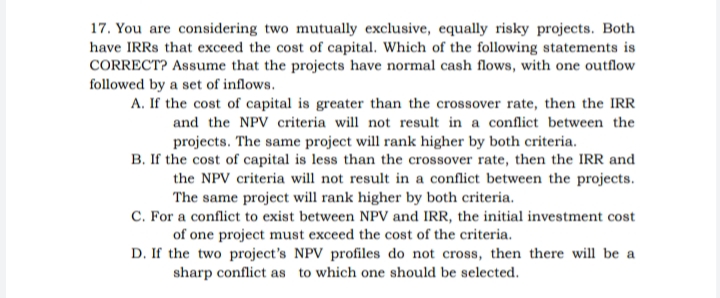

Q: 17. You are considering two mutually exclusive, equally risky projects. Both have IRRS that exceed t...

A: Before investing in a new project or assets, profitability of the project is evaluated by using vari...

Q: Calculate the Black-Scholes price of a Call option where: S = $50 %3D K = $45 %3D T-t=.25 O = .20 r ...

A: Here we have; Spot price S is $50 Strike Price K is $45 Standard deviation is 20% Risk free rate is ...

Q: Tn real estate question

A: An affiliate broker is a person who is licensed and works as an agent but not working in his or her ...

Q: Determine which one of these three portfolios dominates another. Name the dominated portfolio and th...

A: Solution : i) As compared to return under three investment which was under Portfolio option Blue, Ye...

Q: Assume that Riverside Corp. from the United States will receive 400,000 pounds in 180 days. The foll...

A: Solution : Money Market Hedge help a domestic company in reducing the exchange rate and currency ri...

Q: Answer the following probiems: 1. The buyer of a car pays P 169,000 cash and P 12,000 every month fo...

A: Solution:- Cash price means the amount payable in today’s terms. So, cash price = Down payment + Pre...

Q: Mr. Hernandez wants to provide a series of 18 yearly allowance for his 1 yr old daughter starting at...

A: Year Annual payment 1 to 7 50000 8 to 12 85000 13 to 18 200000 Interest rate = 17%

Q: Consider a European put option and a European call option on a $100 non-dividend-paying stock. Both ...

A: Strike Price $ 100.00 Spot price $ 100.00 Time Period 6 Months Risk Free rate 5%

Q: Compute the rate of return.

A: The rate of return refers to the amount earned on the investment made by the investor. It is helpful...

Q: What are Critical success factors of the investment sector or banking sector?

A: Banking is the ultimate expression of using other people's money to generate profit. Banks use depos...

Q: A fund is to provide an annual scholarship at P4,000.00 for the first 5 years; P6,000.00 for the nex...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently bein...

A: NPV It provides the net present value or worth of an investment. If NPV is calculated considering al...

Q: Calculate the cash payback period and net present value of the proposed investment

A: Payback Period: It represents the period in which the project's initial cost is recovered. A projec...

Q: distributed cash dividends of $0.60 and capital gains of $1.40 per share. If the net asset value of ...

A: Return on Investment: It is a measure of performance applied to evaluate the profitability of an in...

Q: What is the relevance of personal financial planning in a daily life of a student? And what is the s...

A: Financial planning is a systematic approach to achieving one's life goals. As you travel through lif...

Q: etermine the amount of money he ne

A: Present value refers to the value of assets present today of the value at some future date. It def...

Q: 2. You invested $39,000 in Yug Industries at an annual interest rate of 5% compounded continuously. ...

A: Formula Future value = PV*ert Where PV - Investment amount i.e. $39000 e - Euler's number i.e. 2.718...

Q: Machine M Machine N $ 25,000 5 years $3,000 $10,000 $3,500 Initial Cost $25,000 4 years $4,000 $11,0...

A: Present worth is the present value of all cost and revenue and cash flow from the machine considerin...

Q: The maintenance cost of a new equipment is projected to start at the end of the 2nd year at an amoun...

A: Annual Equivalent cost is the annual amount of expenditure incurred each year resulting in total pre...

Q: What is the net asset value of an investment company with $9,600,000 in assets, $610,000 in current ...

A: The difference between the assets and liabilities is known as the net assets, net worth, or capital ...

Q: Assume Merck (MRK) just finished paying an annual dividend of $2.1 (for 2019). You look up their bet...

A: GivenRisk free rate = rf =1.96%Beta=B=0.34Dividend=D=$2.1Market risk premium= rm-rf =9.9%Stock price...

Q: I need help explaining the graphs, below please.

A: Cash flow from financing activities: It shows the cash inflow and outflow from a company's financing...

Q: who are still dependent. He received a $150,000 lump-sum retirement bonus and will receive $2,800 pe...

A: Prices increase each year by the rate of inflation and may grow to double from existing levels over ...

Q: An FSA can be used to pay for over-the-counter as well as prescription medications. Kendra bought th...

A: FSA or Flexible spending account is an employer sponsored healthcare benefit. This account allows t...

Q: If P500.00 is invested at the end of each year for 6 years at an annual interest rate of 7%, what is...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: Lamar is taking out a mortgage for $146,000 to buy a new house and is deciding between the offers fr...

A: The present value of loan is equal to the sum of the present value of all its future monthly install...

Q: From the firm’s perspective, how are dividends different from interest payments?

A: Even though interest and dividend are two distinct ideas, both are critical components of a corporat...

Q: Suppose that P400 is deposited each year into a bank account that pays 8% interest annually. If 12 p...

A: Annual deposit (A) = P 400 n = 12 payments r = 8% Let the accumulated value = X

Q: To help buy his new townhome, Bill is taking out a s163,000 mortgage loan for 30 years at 3.4% annua...

A: Here, Loan amount = $163,000 Rate of interest = 3.4% Number of year = 30 years Monthly payment of lo...

Q: Based on the table below, you invested 40% on Stock A and B and 20% on Stock Calculate the expected ...

A: Expected return The expected return refers to the profit or loss that is anticipated by an investor ...

Q: You want to buy a $226,000 home. You plan to pay 5% as a down payment, and take out a 30-year loan a...

A: Price = $226000 Down payment = 5% Interest rate = 6.55% Monthly interest rate (r) = 6.55%/12 = 0.545...

Q: 3.Using Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (...

A: Principal (P) = 5500 Period = 4 Years Quarterly periods (n) = 4*4 = 16 Interest rate = 8% Quarterly ...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 8. Which of the following statements is CORRECT? Group of answer choices If two projects are mutually exclusive, then they are likely to have multiple IRRs. For a project to have more than one IRR, then both IRRs must be greater than the WACC. If a project is independent, then it cannot have multiple IRRs. Multiple IRRs can only occur if the signs of the cash flows change more than once. If a project has two IRRs, then the smaller one is the one that is most relevant, and it should be accepted and relied upon.Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.Sexton Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used. WACC: 12.75% 0 1 2 3 4 CFs -$2050 $750 $760 $770 $780 CF L -$4300 $1500 $1518 $1536 $1554 Options: $24.80 $30.25 $22.32 $28.52 $22.57

- Which of the following is CORRECT? Select one: a. If the NPV of a project is negative, the IRR for the project must also be negative. b. A project's MIRR can never exceed its IRR. c. If a project with normal cash flows has an IRR less than WACC, the project must have a positive NPV. d. If Project 1's IRR exceeds Project 2's IRR, then 1 must have a higher NPV than 2. e. If a project with normal cash flows has an IRR greater than WACC, the project must have a positive NPV. You purchase a house for $250,000. After you make your down payment of $50,000, you are financing $200,000 for 30 years at an annual percentage rate of 5.4%. How much are your monthly payments? Select one: a. Less than $1,000 b. Between $1,000 and $1,050 c. Between $1,050 and $1,100 d. Between $1,100 and $1,150 e. Greater than $1,200Which of the following statements is CORRECT? a. If a project with normal cash flows has an IRR greater than the cost of capital, the project must also have a positive NPV. b. If a project with normal cash flows has an IRR less than the cost of capital, the project must have a positive NPV. c. If the NPV is negative, the IRR must also be negative. d. A project's MIRR can never exceed its IRR. e. If Project A's IRR exceeds Project B's, then A must have the higher NPV.Yonan Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WACC: 10.25% 0 1 2 3 4 CFS -$800 $650 $350 $0 $0 CFL -$1,900 $550 $600 $600 $840 Please explain and show calculations.

- Yonan Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. WACC: 14.25% 0 1 2 3 4 CFS -$950 $500 $800 $0 $0 CFL -$2,100 $400 $800 $800 $1,000 G $93.62 $95.90 $127.87 $0.00 $116.46A firm is considering two mutually exclusive projects, X and Y, with the following cash flows: 0 1 2 3 4 Project X -$1,000 $90 $320 $430 $700 Project Y -$1,000 $1,000 $100 $45 $55 The projects are equally risky, and their WACC is 10%. What is the MIRR, Payback Period or Discount Payback Period of project X and project Y. Note: DO NOT SOLVE ON EXCELA tire manufacturing firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. What is the cost of capital at which the decision to take project L (or S) based on NPV will contradict the decision based on IRR method? Hint: Calculate the crossover rate and explain how the crossover rate would influence your decision to take project L or project S based on NPV vs. IRR? Show your excel work and thoroughly explain your answer. See cash flows below: Year 0 1 2 3 4 Project L: CFL -$2,050 $770 $780 $790 $795 Project S: CFS -$4,300 $1,300 $1,510 $1,520 $1,530

- If two mutually exclusive projects were being compared, would a high cost of capital favor the longer-term or the shorter-term project? Why? If the cost of capital declined, would that lead firms to invest more in longer-term projects or shorter-term projects? Would a decline (or an increase) in the WACC cause changes in the IRR ranking of mutually exclusive projects?Note: DONOT GIVE BREIF ANSWER USE SHORT CONCEPTUAL ANSWERKosovski Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost. WACC: 10.75% 0 1 2 3 4 CFS -$775 $560 $535 CFL -$775 $315 $315 $315 $315 Please explain the process and provide calculations.Which of the following statements is most correct? If a project’s internal rate of return (IRR) exceeds the cost of capital, then the project’s profitability index must be positive. If Project A has a higher IRR than Project B, then Project A must also have a higher NPV. The IRR calculation implicitly assumes that all cash flows are reinvested at a rate of return equal to the IRR. Group of answer choices Only statements I and II are incorrect. None of the statements above is incorrect. Only statement II is correct. Only statement I is correct. Only statement III is incorrect.