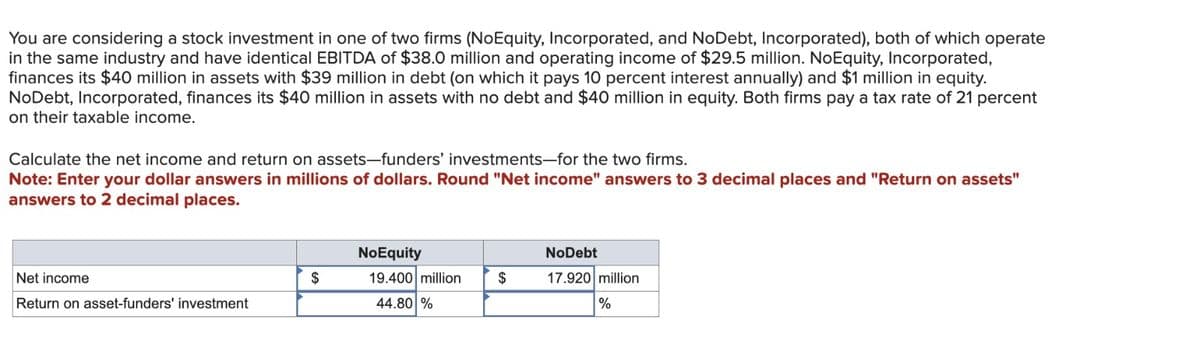

You are considering a stock investment in one of two firms (NoEquity, Incorporated, and NoDebt, Incorporated), both of which operate in the same industry and have identical EBITDA of $38.0 million and operating income of $29.5 million. NoEquity, Incorporated, finances its $40 million in assets with $39 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Incorporated, finances its $40 million in assets with no debt and $40 million in equity. Both firms pay a tax rate of 21 percent on their taxable income. Calculate the net income and return on assets-funders' investments-for the two firms. Note: Enter your dollar answers in millions of dollars. Round "Net income" answers to 3 decimal places and "Return on assets" answers to 2 decimal places. NoEquity Net income $ Return on asset-funders' investment 19.400 million 44.80% $ NoDebt 17.920 million %

You are considering a stock investment in one of two firms (NoEquity, Incorporated, and NoDebt, Incorporated), both of which operate in the same industry and have identical EBITDA of $38.0 million and operating income of $29.5 million. NoEquity, Incorporated, finances its $40 million in assets with $39 million in debt (on which it pays 10 percent interest annually) and $1 million in equity. NoDebt, Incorporated, finances its $40 million in assets with no debt and $40 million in equity. Both firms pay a tax rate of 21 percent on their taxable income. Calculate the net income and return on assets-funders' investments-for the two firms. Note: Enter your dollar answers in millions of dollars. Round "Net income" answers to 3 decimal places and "Return on assets" answers to 2 decimal places. NoEquity Net income $ Return on asset-funders' investment 19.400 million 44.80% $ NoDebt 17.920 million %

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 14P

Related questions

Question

Vijay

Transcribed Image Text:You are considering a stock investment in one of two firms (NoEquity, Incorporated, and NoDebt, Incorporated), both of which operate

in the same industry and have identical EBITDA of $38.0 million and operating income of $29.5 million. NoEquity, Incorporated,

finances its $40 million in assets with $39 million in debt (on which it pays 10 percent interest annually) and $1 million in equity.

NoDebt, Incorporated, finances its $40 million in assets with no debt and $40 million in equity. Both firms pay a tax rate of 21 percent

on their taxable income.

Calculate the net income and return on assets-funders' investments-for the two firms.

Note: Enter your dollar answers in millions of dollars. Round "Net income" answers to 3 decimal places and "Return on assets"

answers to 2 decimal places.

NoEquity

NoDebt

Net income

$

Return on asset-funders' investment

19.400 million

44.80 %

$

17.920 million

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning