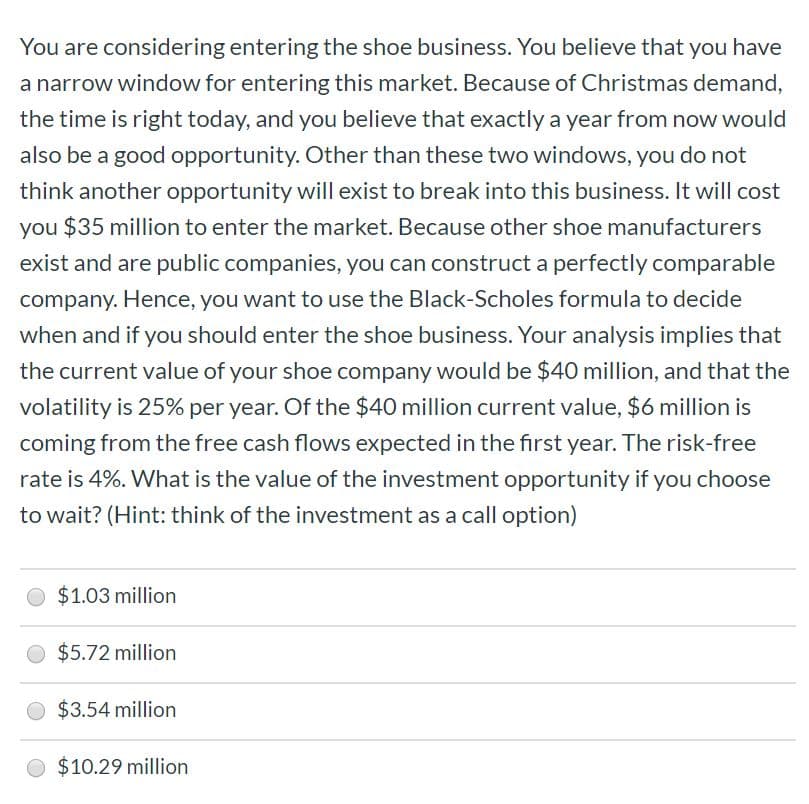

You are considering entering the shoe business. You believe that you have a narrow window for entering this market. Because of Christmas demand, the time is right today, and you believe that exactly a year from now would also be a good opportunity. Other than these two windows, you do not think another opportunity will exist to break into this business. It will cost you $35 million to enter the market. Because other shoe manufacturers exist and are public companies, you can construct a perfectly comparable company. Hence, you want to use the Black-Scholes formula to decide when and if you should enter the shoe business. Your analysis implies that the current value of your shoe company would be $40 million, and that the volatility is 25% per year. Of the $40 million current value, $6 million is coming from the free cash flows expected in the first year. The risk-free rate is 4%. What is the value of the investment opportunity if you choose to wait? (Hint: think of the investment as a call option) $1.03 million $5.72 million $3.54 million $10.29 million

You are considering entering the shoe business. You believe that you have a narrow window for entering this market. Because of Christmas demand, the time is right today, and you believe that exactly a year from now would also be a good opportunity. Other than these two windows, you do not think another opportunity will exist to break into this business. It will cost you $35 million to enter the market. Because other shoe manufacturers exist and are public companies, you can construct a perfectly comparable company. Hence, you want to use the Black-Scholes formula to decide when and if you should enter the shoe business. Your analysis implies that the current value of your shoe company would be $40 million, and that the volatility is 25% per year. Of the $40 million current value, $6 million is coming from the free cash flows expected in the first year. The risk-free rate is 4%. What is the value of the investment opportunity if you choose to wait? (Hint: think of the investment as a call option) $1.03 million $5.72 million $3.54 million $10.29 million

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 8EB: Shonda & Shonda is a company that does land surveys and engineering consulting. They have an...

Related questions

Question

Transcribed Image Text:You are considering entering the shoe business. You believe that you have

a narrow window for entering this market. Because of Christmas demand,

the time is right today, and you believe that exactly a year from now would

also be a good opportunity. Other than these two windows, you do not

think another opportunity will exist to break into this business. It will cost

you $35 million to enter the market. Because other shoe manufacturers

exist and are public companies, you can construct a perfectly comparable

company. Hence, you want to use the Black-Scholes formula to decide

when and if you should enter the shoe business. Your analysis implies that

the current value of your shoe company would be $40 million, and that the

volatility is 25% per year. Of the $40 million current value, $6 million is

coming from the free cash flows expected in the first year. The risk-free

rate is 4%. What is the value of the investment opportunity if you choose

to wait? (Hint: think of the investment as a call option)

$1.03 million

$5.72 million

$3.54 million

$10.29 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College