Kate is very pleased with the results of the first year of year on a high note, with the company's reputation for producing quality cards leading to more bsi. ness than she can currently manage. Kate is considering expanding and bringing in several emlay- ees. In order to do this, she will need to find a larger location and also purchase more this means additional financing. Kate has asked you to look at her year-end financial statements as if you were a banker considering giving Kate a loan. Comment on your findings and provide calcula- tions to support your comments. equipment. All

Kate is very pleased with the results of the first year of year on a high note, with the company's reputation for producing quality cards leading to more bsi. ness than she can currently manage. Kate is considering expanding and bringing in several emlay- ees. In order to do this, she will need to find a larger location and also purchase more this means additional financing. Kate has asked you to look at her year-end financial statements as if you were a banker considering giving Kate a loan. Comment on your findings and provide calcula- tions to support your comments. equipment. All

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter6: Statistical Inference

Section: Chapter Questions

Problem 29P: Carpetland salespersons average 8,000 per week in sales. Steve Contois, the firms vice president,...

Related questions

Question

Transcribed Image Text:the nearest percent.

Which company has the most seasonal business? Briefly explain.

Which company is Toys "R" Us? The Gillette Company? Briefly explain.

c.

d.

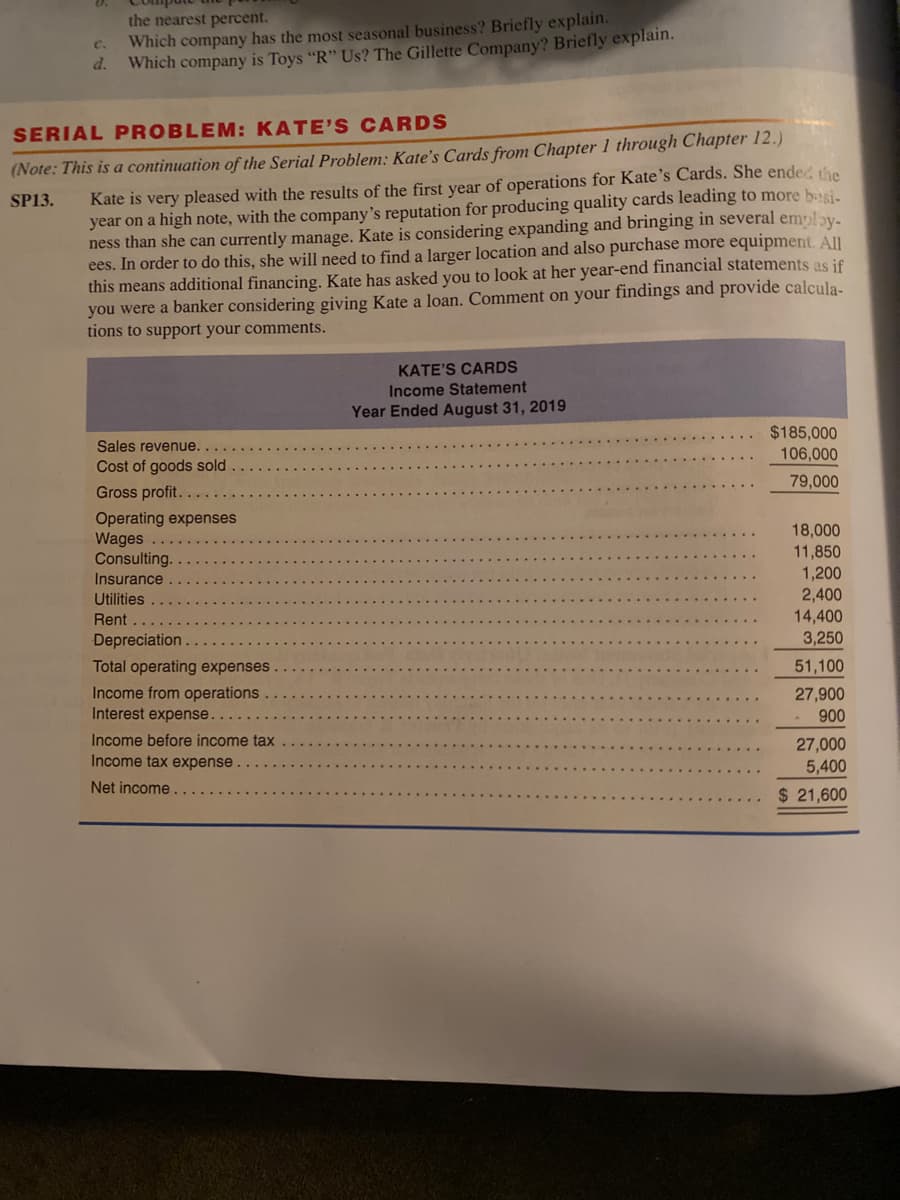

SERIAL PROBLEM:KATE'S CARDS

Kate is very pleased with the results of the first year of operations for Kate's Cards. She ended the

year on a high note, with the company's reputation for producing quality cards leading to more basi-

ness than she can currently manage. Kate is considering expanding and bringing in several employ-

ees. In order to do this, she will need to find a larger location and also purchase more equipment. All

this means additional financing. Kate has asked you to look at her year-end financial statements as if

you were a banker considering giving Kate a loan. Comment on your findings and provide calcula-

tions to support your comments.

(Note: This is a continuation of the Serial Problem: Kate's Cards from Chapter 1 through Chapter 12.)

SP13.

KATE'S CARDS

Income Statement

Year Ended August 31, 2019

$185,000

106,000

Sales revenue.

Cost of goods sold

79,000

Gross profit..

Operating expenses

Wages

Consulting.

18,000

11,850

1,200

2,400

14,400

3,250

Insurance

Utilities ..

Rent....

Depreciation.

Total operating expenses

51,100

Income from operations

Interest expense.

27,900

900

Income before income tax

27,000

5,400

Income tax expense

Net income....

$ 21,600

Transcribed Image Text:Chapter 13 Analysis and Interpretation of Financial Statemonts

679

pss Publishera

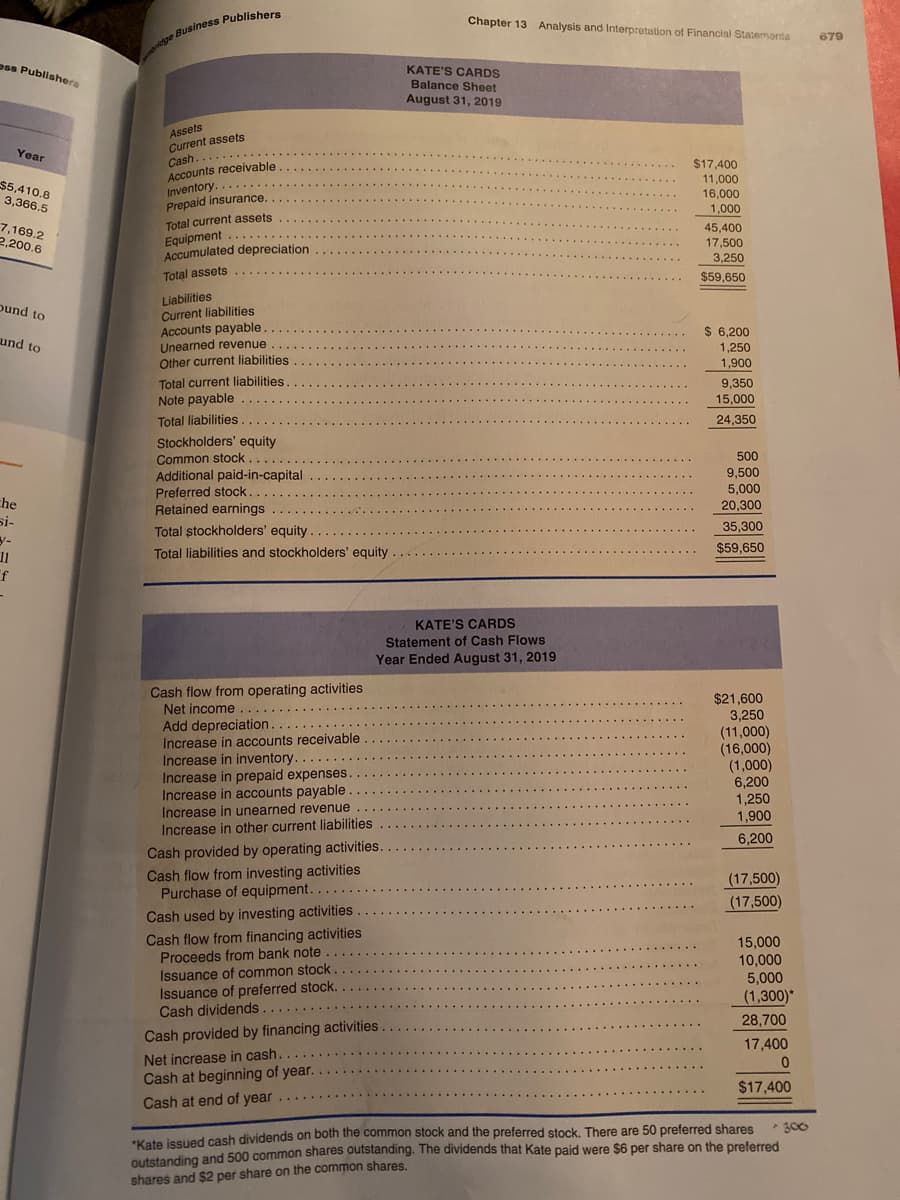

KATE'S CARDS

Balance Sheet

August 31, 2019

Assets

Current assets

Cash.

Accounts receivable

Inventory........

Prepaid insurance.

Year

.....

$17,400

11,000

$5,410.8

3,366.5

16.000

1,000

7,169.2

2,200.6

Total current assets

Equipment

Accumulated depreciation

45,400

17,500

3,250

Total assets

$59,650

Liabilities

Current liabilities

Accounts payable.

Unearned revenue

Other current liabilities

pund to

$ 6,200

und to

1,250

1,900

Total current liabilities

Note payable

9,350

15,000

Total liabilities.

24,350

Stockholders' equity

Common stock

500

Additional paid-in-capital

Preferred stock.

Retained earnings

9,500

5,000

20,300

che

si-

y-

11

Total ștockholders' equity.

35,300

$59,650

Total liabilities and stockholders' equity

KATE'S CARDS

Statement of Cash Flows

Year Ended August 31, 2019

Cash flow from operating activities

Net income.. .

Add depreciation

Increase in accounts receivable

Increase in inventory.

Increase in prepaid expenses.

Increase in accounts payable

Increase in unearned revenue

Increase in other current liabilities

$21,600

3,250

(11,000)

(16,000)

(1,000)

6,200

1,250

1,900

6,200

Cash provided by operating activities.

Cash flow from investing activities

Purchase of equipment.

(17,500)

(17,500)

Cash used by investing activities

Cash flow from financing activities

Proceeds from bank note

Issuance of common stock.

Issuance of preferred stock.

Cash dividends

15,000

10,000

5,000

(1,300)*

......

28,700

Cash provided by financing activities

17,400

Net increase in cash.

Cash at beginning of year.

Cash at end of year

$17,400

*Kate issued cash dividends on both the common stock and the preferred stock. There are 50 preferred shares

outstanding and 500 common shares outstanding. The dividends that Kate paid were $6 per share on the preferred

• 300

shares and $2 per share on the common shares.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning