You are considering purchasing a new piece of equipment (7yr MACRS property) for your manufacturing process for $100,000. The equipment has a 6-year useful life and no salvage value. The equipment is expected to generate an additional $40,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate = 35%. Annual inflation = 4%.

You are considering purchasing a new piece of equipment (7yr MACRS property) for your manufacturing process for $100,000. The equipment has a 6-year useful life and no salvage value. The equipment is expected to generate an additional $40,000 of net income before taxes and depreciation each year by using this upgraded system. The combined federal and state income tax rate = 35%. Annual inflation = 4%.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 6MCQ: Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense...

Related questions

Question

100%

Transcribed Image Text:You are considering purchasing a new piece of equipment (7yr MACRS property) for your

manufacturing process for $100,000. The equipment has a 6-year useful life and no salvage

value. The equipment is expected to generate an additional $40,000 of net income before

taxes and depreciation each year by using this upgraded system. The combined federal and

state income tax rate = 35%. Annual inflation = 4%.

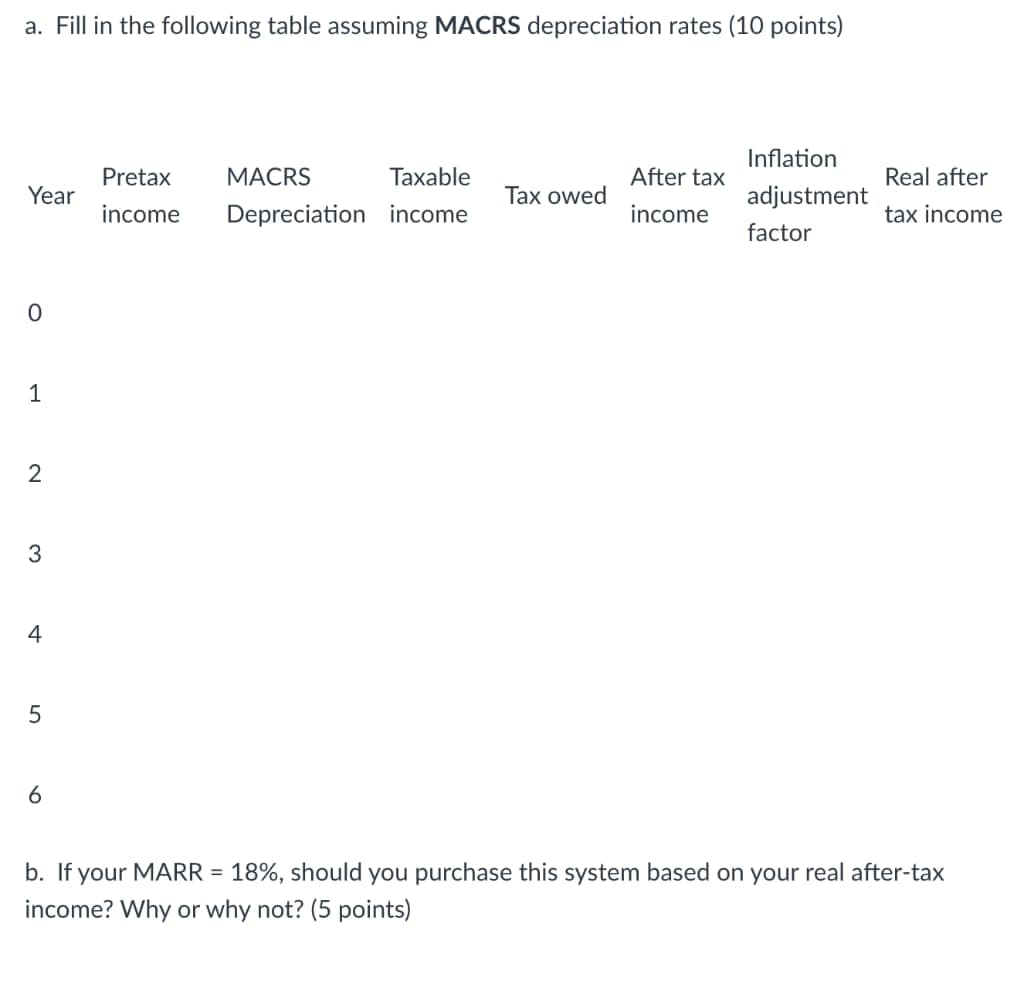

Transcribed Image Text:a. Fill in the following table assuming MACRS depreciation rates (10 points)

Year

0

1

2

3

4

5

6

Pretax

income

MACRS

Taxable

Depreciation income

Tax owed

After tax

income

Inflation

adjustment

factor

Real after

tax income

b. If MARR = 18%, should you purchase this system based on your real after-tax

income? Why or why not? (5 points)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College