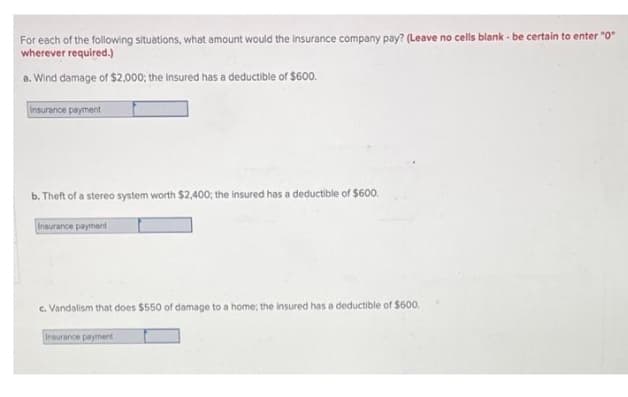

For each of the following situations, what amount would the insurance company pay? (Leave no cells blank - be certain to enter "0" wherever required.) a. Wind damage of $2,000; the Insured has a deductible of $600. Insurance payment b. Theft of a stereo system worth $2,400; the insured has a deductible of $600. Insurance payment c. Vandalism that does $550 of damage to a home; the insured has a deductible of $600. Insurance payment

For each of the following situations, what amount would the insurance company pay? (Leave no cells blank - be certain to enter "0" wherever required.) a. Wind damage of $2,000; the Insured has a deductible of $600. Insurance payment b. Theft of a stereo system worth $2,400; the insured has a deductible of $600. Insurance payment c. Vandalism that does $550 of damage to a home; the insured has a deductible of $600. Insurance payment

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 55P

Related questions

Question

Sh13

Please help me.

Solution

Transcribed Image Text:For each of the following situations, what amount would the insurance company pay? (Leave no cells blank - be certain to enter "0"

wherever required.)

a. Wind damage of $2,000; the insured has a deductible of $600.

Insurance payment

b. Theft of a stereo system worth $2,400; the insured has a deductible of $600.

Insurance payment

c. Vandalism that does $550 of damage to a home; the insured has a deductible of $600.

Insurance payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you