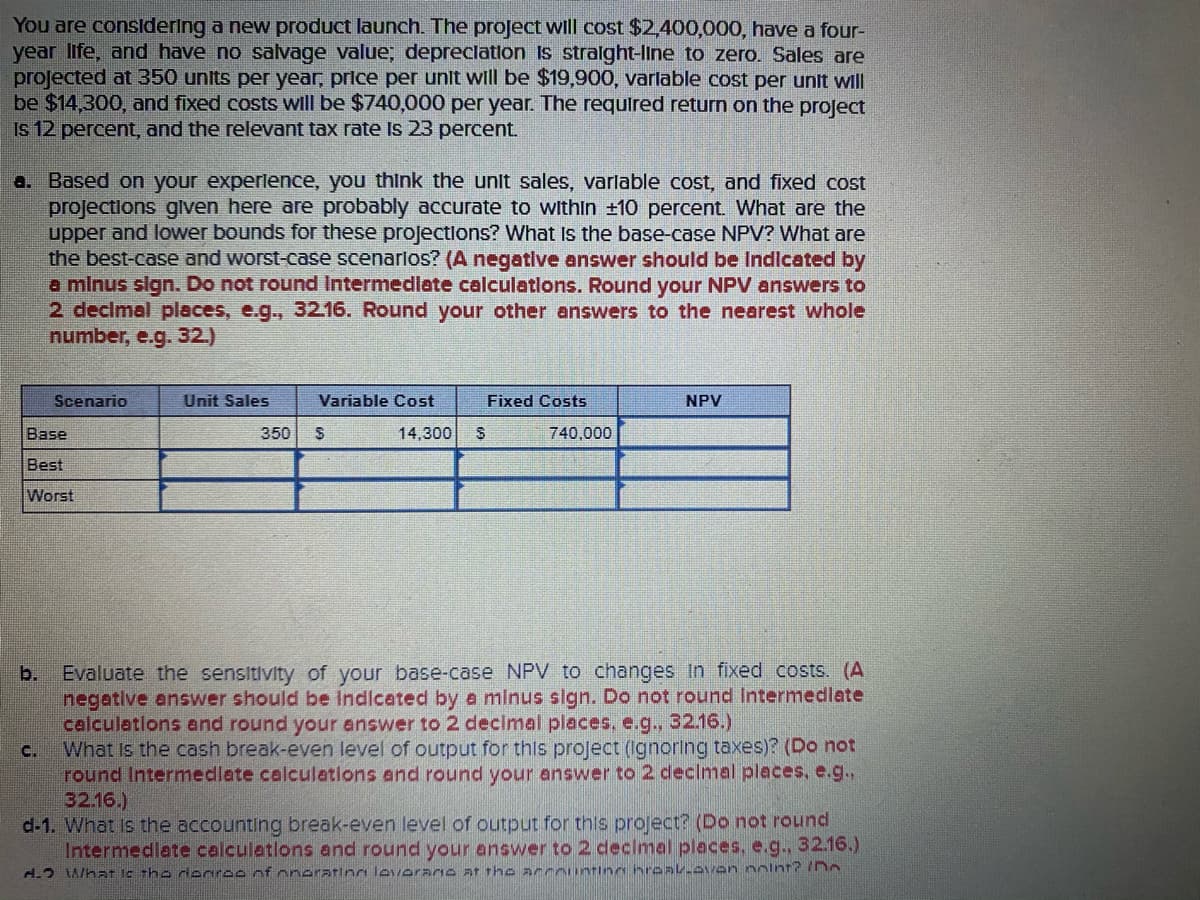

You are consldering a new product launch. The project will cost $2,400,000, have a four- year life, and have no salvage value; depreclation Is stralght-line to zero. Sales are projected at 350 units per year, price per unit will be $19,900, varlable cost per unit will be $14,300, and fixed costs wll be $740,000 per year. The required return on the project Is 12 percent, and the relevant tax rate Is 23 percent. a. Based on your experilence, you think the unit sales, varlable cost, and fixed cost projections glven here are probably accurate to within +10 percent What are the upper and lower bounds for these projections? What Is the base-case NPV? What are the best-case and worst-case scenarlos? (A negative answer should be Indicated by a mlnus slgn. Do not round Intermedlate calculatlons. Round your NPV answers to 2 decimal places, e.g., 32.16. Round your other answers to the nearest whole number, e.g. 32.) Scenario Unit Sales Variable Cost Fixed Costs NPV Base 350 14,300 740,000 Best Worst

You are consldering a new product launch. The project will cost $2,400,000, have a four- year life, and have no salvage value; depreclation Is stralght-line to zero. Sales are projected at 350 units per year, price per unit will be $19,900, varlable cost per unit will be $14,300, and fixed costs wll be $740,000 per year. The required return on the project Is 12 percent, and the relevant tax rate Is 23 percent. a. Based on your experilence, you think the unit sales, varlable cost, and fixed cost projections glven here are probably accurate to within +10 percent What are the upper and lower bounds for these projections? What Is the base-case NPV? What are the best-case and worst-case scenarlos? (A negative answer should be Indicated by a mlnus slgn. Do not round Intermedlate calculatlons. Round your NPV answers to 2 decimal places, e.g., 32.16. Round your other answers to the nearest whole number, e.g. 32.) Scenario Unit Sales Variable Cost Fixed Costs NPV Base 350 14,300 740,000 Best Worst

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

Please show work. Both images are from the same question

Transcribed Image Text:You are consldering a new product launch. The project will cost $2,400,000, have a four-

year life, and have no salvage value, depreclation Is stralght-line to zero. Sales are

projected at 350 units per year, price per unit will be $19,900, varlable cost per unit will

be $14,300, and fixed costs will be $740,000 per year. The required return on the project

Is 12 percent, and the relevant tax rate Is 23 percent.

a. Based on your experlence, you think the unit sales, varlable cost, and fixed cost

projections gven here are probably accurate to within ±10 percent. What are the

upper and lower bounds for these projections? What Is the base-case NPV? What are

the best-case and worst-case scenarlos? (A negatlve answer should be Indlcated by

a mlnus slgn. Do not round Intermedlate calculatlons. Round your NPV answers to

2 decimal places, e.g., 32.16. Round your other answers to the nearest whole

number, e.g. 32.)

Scenario

Unit Sales

Variable Cost

Fixed Costs

NPV

Base

350

14,300

740,000

Best

Worst

Evaluate the sensitivity of your base-case NPV to changes In fixed costs. (A

negative answer should be Indicated by a minus sign. Do not round Intermedlate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

What Is the cash break-even level of output for this project (Ignoring taxes)? (Do not

round Intermedlate calculations and round your answer to 2 decimal pleces, e.g.

32.16.)

d-1. What Is the accounting break-even level

Intermedlate calculations and round your answer to 2 decimal places, e.g., 32.16.)

b.

C.

output for thls project? (Do not round

H.2 What lc tho rdenroe of oneratioc leverane at the accountings hroak.ovan nolnt? iD

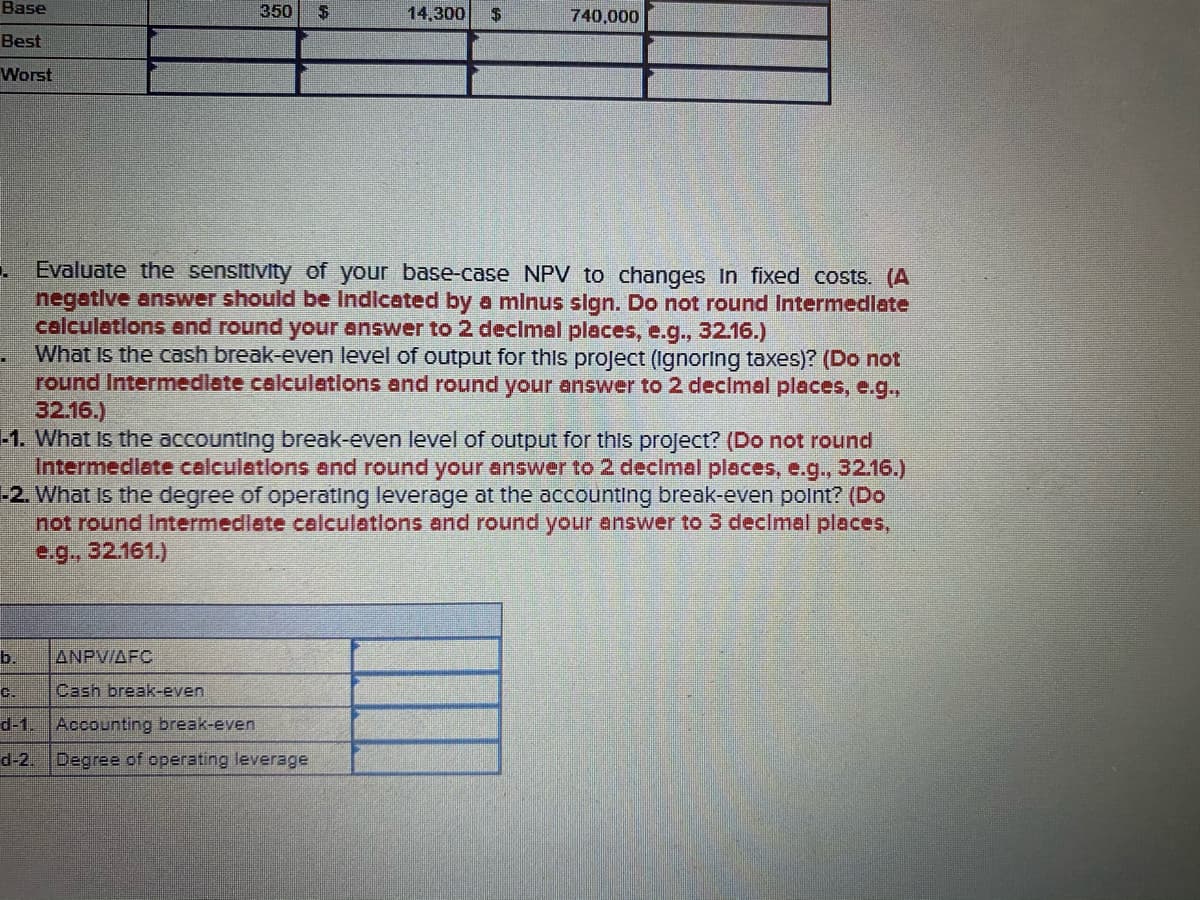

Transcribed Image Text:Base

350

14,300

740,000

Best

Worst

Evaluate the sensitivity of your base-case NPV to changes In fixed costs. (A

negative answer should be Indicated by a mlnus slogn. Do not round Intermedlate

calculatlons and round your answer to 2 declmal places, e.g., 32.16.)

What Is the cash break-even level of output for this project (Ignoring taxes)? (Do not

round Intermedlate calculatlons and round your answer to 2 decimal places, e.g.,

32.16.)

-1. What Is the accounting break-even level of output for this project? (Do not round

Intermedlete calculetlons and round your answer to 2 declmal places, e.g., 32.16.)

-2. What Is the degree of operating leverage at the accounting break-even polnt? (Do

not round Intermediete calculations and round your answer to 3 decimal places,

e.g., 32.161.)

b.

ANPV/AFC

c.

Cash break-even

d-1. Accounting break-even

d-2. Degree of operating leverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning