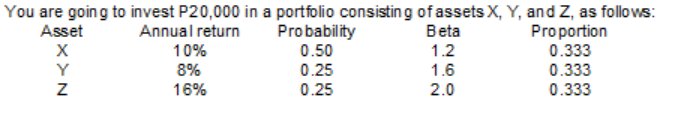

You are going to invest P20,000 in a portfolio consistin g of assets X, Y, and Z, as follows: Probability 0.50 0.25 Annual return Beta Proportion 0.333 0.333 Asset X Y 1.2 1.6 10% 8% 16% 0.25 2.0 0.333

Q: discuss Volkswagen deciding to go for a Foreign Direct Investement with Ghana

A: Volkswagen is the flagship brand of the Volkswagen Group, is a German motor vehicle manufacturer…

Q: You have an opportunity to make an investment that will pay $200 at the end of the first year,…

A: Present value of stream of cash flows can be calculated by discounting each cash flow to the…

Q: E Loan Amount Is $430,000 Loan is a 7/30 Balloon Loan Annual Interest Is 3.75%, with monthly…

A: Given, Loan amount is $430,000 Interest rate is 3.75% Loan is 7/30 balloon loan, which means, after…

Q: What is the net operating profit after taxes (NOPAT) for 2020? Enter your answer in millions. For…

A: NOPAT: Net operating profit after tax is a measure indicating the performance of a company through…

Q: You are interested buying a business and the current owner is asking $180,000 for it. You require a…

A: As per Bartleby guidelines, If multiple questions are posted , only first 1 question will be…

Q: . Ji-Hoon wants to get a $500,000 3% 30-year mortgage in order to buy his first home. How much…

A: Loan amount (PV) = $500,000 Interest rate = 3% Monthly interest rate (r) = 3%/12 = 0.25% Period = 30…

Q: 18. Qualified Small Business Stock. (Obj. 1) Jenson pays $30,000 for Section 1202 qualified business…

A: Given, Small Business Stock Gains Exclusion (Section 1202),It is the Internal Revenue Code (IRC)…

Q: The Seattle Corporation has been presented with an investment yield end of year cash flows of…

A: NPV is calculated as sum of present value of cash inflows less initial investment

Q: Suppose you take out a 30-year mortgage for a house that costs $303,023. Assume the following: The…

A: A mortgage is a loan taken that has to be repaid in equal periodic installments. The monthly amount…

Q: NC Corp. holds three stocks in her portfolio: A, B, and C. The portfolio beta is 1.40. Stock A…

A: The new portfolio beta can be calculated by subtracting the beta contribution of Stock A in the…

Q: QS 24-23 (Algo) Internal rate of return LO P4 Perez Company is considering an investment of $30,490…

A: Internal Rate of Return: Internal Rate of Return (IRR) is the required rate of return at which the…

Q: Project R has annual cash flows of $6,000 for the next 10 years and then $5,000 each year for the…

A: Annual cash flow for 10 years = $6,000 Annual cash flow in following 10 years = $5,000 IRR = 12.92%…

Q: The Shell Corporation has a 34% tax rate and owns a piece of petroleum-drilling equipment that costs…

A: Explanation : NPV is help in decision making if I have Calculate the NPV & it comes to positive…

Q: 5) Determine the present value at time 0 of payments of $1,000 at the start of each month for 5…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: The answer is wrong and I don't know why... can you please help me?

A: Total price is $10 million Maturity is 20 years. The rate of interest is 5%.

Q: For a 10%, $1,000 coupon bond, a longer term bond (say, 15 years) is: less affected by changes in…

A: Solution 5:- Volatility means the change in price of bond when market interest rate changes.

Q: On December 31, 2017, Jackson Company had 100,000 shares of common stock outstanding and 24,000…

A: Answer- Part 1 - Computation of Basic Earnings per share- Income after 7% dividend on cumulative…

Q: a. What is the company’s total book value of debt? (Enter your answer in dollars, not millions of…

A: Cost of debt (yield to maturity) refers to the total return generated by a bond until it matures.…

Q: Consider a 20-year mortgage for $182,892 at an annual interest rate of 5.3%. After 7 years, the…

A: Mortgage is an amount which is borrowed from external sources like a bank for a specific period.…

Q: Company A has issued $2 million (notional principal) in five-year bonds with a floating (variable)…

A: Interest is the amount paid to the lender by the borrower as a fee for the money borrowed. Interest…

Q: templating the purchase of a new $545,000 computer-based order entry system. The system will be…

A: IRR is a rate where present value of cashinfows is equal to present value of cashoutflows.

Q: What are the benefits to a company of maintaining and encouraging high ethical standards?

A: Ethical standards can be defined as the set of ethical principles followed by business organizations…

Q: ve years ago, you acquired a 30-year loàn of $130,750, charging 6.6% annual interest, compounded…

A: Loans are to be paid by the monthly payments that carry the payment of loan amount and also payment…

Q: ROUND ALL ANSWERS TO NEAREST DOLLAR How much will $10,000 grow to in 3 years, assuming an Interest…

A: Note: Since you have specifically used question number 10 to get solved, so we are solving the same…

Q: Consider a stock currently trading at $10, with expected annual return of 15% and annual volatility…

A: Current Stock price is $10 Expected annual return is 15% Annual Volatility is 0.2 To Find:…

Q: How does title insurance work? Why is it not absolute (fool-proof

A: Title insurance is that insurance product that is related to the world of real estate. It is an…

Q: ABC Inc. currently sells P12,000,000 per annum. Its credit period and DSO are both 30 days, and 1.5%…

A: Given, Old sales is P12,000,000 New sales increase by P3,000,000.

Q: +ve risks and -ve risks

A: A risk is an unexpected event that may impact and affect any area of your project says, people,…

Q: Which of the following is true about the WACC? It’s the appropriate discount rate for all new…

A: Solution:- Weighted Average Cost of Capital (WACC) means the minimum rate of return required by the…

Q: what would be the predicted new bond price according to duration?

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: It is desired to determine the present economic value of an old machine by considering of how it…

A: The difference between the present value of cash inflows and outflows over time is known as net…

Q: You are given the following information concerning three portfolios, the market portfolio, and the…

A: Risk and return are two parts of investment. There is a positive relation between the risk and…

Q: You are offered a job that pays $37,000 during the first year with an annual increase of 9% per year…

A: Solution:- When an amount increases by same rate of growth, the amount at nth year can be computed…

Q: A company had 20 000 shares of ordinary shares outstanding on January 1; on May 1, 4 000 shares were…

A: Earnings per share = Net income available to common stockholders/Weighted average number of shares…

Q: a. Calculate the return on investment. (Round your answer to 2 decimal places.) Return on Investment…

A: Return on Investment: It is a measure of performance and profitability that is applied to evaluate…

Q: A) Brock purchases equipment that has a fair value of $50,000. Brock pays $10,000 as a downpayment,…

A: Fair Value of Equipment is $50,000 Downpayment is $10,000 Principal amount of note is $60,000 Annual…

Q: What is an expected rate of return? How would you explain the concept to a child?

A: An investor's expected rate of return is the return on investment that he or she expects to receive.…

Q: If the payments are monthly how would you set up the present value?

A: The concept of present value asserts that a sum of money today is worth more than the same sum in…

Q: What is the criteria to accept a project based on the net present value and the internal rate of…

A: Net present value (NPV) Is the difference between present value of all cash inflows and initial…

Q: are given the following information about Jordan plc: Financial position statement at January 2017…

A: To Find: Weighted Average cost of capital

Q: Project L requires an initial outlay at t = 0 of $56,000, its expected cash inflows are $10,000 per…

A: Initial outlay = $56,000 Annual cash inflow = $10,000 WACC = 14% Period = 10 years

Q: List five types of key investment decisions a financial manager needs to make.

A: Financial management is the part of a business dealing with bookkeeping, selecting sources of…

Q: Weston Industries has a debt–equity ratio of 1.5. Its WACC is 11 percent, and its cost of debt is 7…

A: Weighted average cost of capital (WACC) When a firm has both equity and debt as its sources of…

Q: Last year you bought 100 shares of NC Corp. common stock for P53 per share. During the year you…

A: The rate of return is simply calculated as capital gain yield plus dividend yield

Q: An investor has two bonds in her portfolio, Bond C and Bond Z. Each bond matures in 4 years, has a…

A: Given: Bond C Bond Z Years 4 4 Face value 1000 1000 Yield to maturity 9.40% 9.40%…

Q: Mackenzie Company has a price of $33 and will issue a dividend of $2.00 next year. It has a beta of…

A: Given, (Part a)The cost of capital,=Risk-free rate+Beta×Market (risk) premium…

Q: 12. A company has agreed to pay $4.2 million in 6 years to settle a lawsuit. How much must it invest…

A: Future value required = $4,200,000 Interest rate = 6% Number of compounding per year = 12 Period= 6…

Q: If the market price for an option is lower than what the value is from using the binomial model what…

A: Options are contracts that provide the buyer the right, but not the responsibility, to buy or sell a…

Q: Compute the monthly payments on a 3-year lease for a $28,427 car if the annual rate of depreciation…

A: Lease can be defined as the agreement between lessor and lessee where lessor gives lessee the right…

Q: 21. Aluminum maker Alcoa has a beta of about 1.9, whereas Hormel Foods has a beta of 0.37. If the…

A: First, we will calculate the Cost of Equity by applying the required formula for both companies and…

The beta of the portfolio containing assets X, Y, and Z, is

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- You are going to invest $20,000 in a portfolio consisting of assets X, Y, and Z, as follows: Asset Annual Return Probability Beta Proportion X 10% 0.50 1.2 0.333 Y 8% 0.25 1.6 0.333 Z 16% 0.25 2.0 0.333 Given the information in Table 5.2, The beta of the portfolio in Table 8.2, containing assets X, Y, and Z is ________. Select one: a. 1.6 b. 2.0 c. 1.5 d. 2.4What is the expected return of the following portfolio of investments, Investment r Amount Invested DEF 4% $30,000 JKL 24 25,000 TUV 14 45,000The investor has R60,000 to invest. R15,000 will be invested into the market portfolio, R10,000 into asset A and R25,000 into asset B. The balance will be invested into the risk-free asset. The beta for asset A and asset B is 0.90 and 1.2 respectively. What is the portfolio beta? A. 0.09 B. 0.90 C. 0.91 D. 0.92

- Suppose you have the following investments: Security Amount Invested Expected Return Beta A $2,000 5% .80 B $4,000 10% .95 C $6,000 15% 1.10 D $8,000 18% 1.40 What is the expected return on this portfolio? Select one:The investor has R60,000 to invest. R15,000 will be invested into the market portfolio, R10,000 into asset A and R25,000 into asset B. The balance will be invested into the risk-free asset. The beta for asset A and asset B is 0.90 and 1.2 respectively. What is the portfolio beta? What is the correct answer? A. 0.09 B. 0.90 C. 0.91 D. 0.92What is the expected return for the following portfolio? (State your answer in percent with two decimal places.) Stock Expected returns Investment AAA 35% $500,000 BBB 29% $1,300,000 CCC 18% $1,200,000 DDD 7% $1,500,000 O.17.13% O.19.40% O.21.01% O.22.21% O.23.88%

- The investor has R50,000 to invest A, B and C. R12,000 will be invested into asset A. The beta for asset A and asset B is 0.90 and 1.2 respectively. Asset C represents the risk-free asset. If the investor envisages a portfolio equally as risky as the market, how much should be invested into asset B? A. 32677 B. 32676 C. 32667 D. 32678Assume that the CAPM is true, ?F = 5%, ?M = 15% ??? ?M = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that a. it would be possible for the investor to obtain a return of 17% on portfolio Q. b. if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then ρQM = 1, βQ = 1.2 and σQ = 0.12. c. to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio. d. all of the above are true. e. only (a) and (b) above are true.You have invested in the following portfolio: an amount of cash USD 111 earning 0.04 percent return. An amount of treasury bills USD 171, earning 0.07 percent return, an amount of bonds USD 150 earning 0.07 percent return. And an amount of stock USD 219 earning -0.11 percent return. Calculate the investment portfolio return..

- You have invested 0.21 percent of your overall money in risk free treasury bills, and the rest of your money equally between stock A that has beta of 1.37 and stock B has beta of 0.04 calculate the risk free of your overall portfolio with risk free and risky asset, give your answer in 0.000.You invest R100 in a risky asset with an expected rate of return of 15% and a standard deviation of 20% and a T-bill with a rate of return of 4%. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 9%. What is the percentage invested in risky asset ?What is the percentage invested in risk-free asset ?Suppose you have the following investments: Security Amount Invested Expected Return Beta A $2,000 5% .80 B $4,000 10% .95 C $6,000 15% 1.10 D $8,000 18% 1.40 What is the beta of the portfolio? Select one: a. 1.16 b. 0.59 c. 1.34 d. 1.20