You are interested in estimating a beta for Digital Universe Company. Since they are a privately held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC, you will have to work with some comparable firm data. a)Calculate the unlevered betas for each of the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates given.) b) Estimate an equally-weighted and sales-weighted average unlevered betas using the data from your answer above. c) Digital has a target capital structure of 10% debt and 90% equity as well as a 40% marginal tax rate. If you estimated an unlevered beta of 1.30, calculate the levered beta for Digital. d) The current appropriate risk-free rate is 6% and the return on the market is 13.5%. Further assume that you calculated the levered beta above as 1.29. Using the CAPM, estimate DE’s cost of equity. Be sure to state any additional assumptions.

You are interested in estimating a beta for Digital Universe Company. Since they are a privately held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC, you will have to work with some comparable firm data. a)Calculate the unlevered betas for each of the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates given.) b) Estimate an equally-weighted and sales-weighted average unlevered betas using the data from your answer above. c) Digital has a target capital structure of 10% debt and 90% equity as well as a 40% marginal tax rate. If you estimated an unlevered beta of 1.30, calculate the levered beta for Digital. d) The current appropriate risk-free rate is 6% and the return on the market is 13.5%. Further assume that you calculated the levered beta above as 1.29. Using the CAPM, estimate DE’s cost of equity. Be sure to state any additional assumptions.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.1.4MBA

Related questions

Question

100%

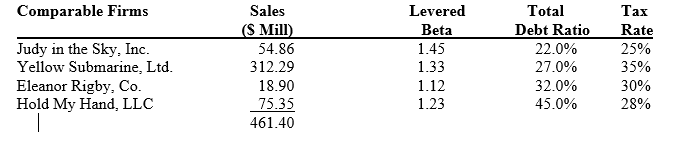

- You are interested in estimating a beta for Digital Universe Company. Since they are a privately held firm, you do not have access to the necessary data. If you want to estimate a beta for DUC, you will have to work with some comparable firm data.

a)Calculate the unlevered betas for each of the four basic comparable firms shown below. (Hint: Be sure to adjust for the respective tax rates given.)

b) Estimate an equally-weighted and sales-weighted average unlevered betas using the data from your answer above.

c) Digital has a target capital structure of 10% debt and 90% equity as well as a 40% marginal tax rate. If you estimated an unlevered beta of 1.30, calculate the levered beta for Digital. d) The current appropriate risk-free rate is 6% and the return on the market is 13.5%. Further assume that you calculated the levered beta above as 1.29. Using theCAPM , estimate DE’scost of equity . Be sure to state any additional assumptions.

Transcribed Image Text:Comparable Firms

Sales

Levered

Total

Таx

(S Mill)

Beta

1.45

Debt Ratio

Rate

Judy in the Sky, Inc.

Yellow Submarine, Ltd.

Eleanor Rigby, Co.

Hold My Hand, LLC

54.86

22.0%

25%

312.29

1.33

27.0%

35%

18.90

1.12

32.0%

30%

75.35

1.23

45.0%

28%

461.40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning